Government Regulatory Template: Subsidize Demand, Restrict Supply

The government does it in health care, education, and housing. Usually in the name of increasing access to or usage of something, they will subsidize demand. But then at the same time they will restrict supply, giving lie to this stated justification of increasing access, making the whole exercise a crony enrichment of a small number of incumbent producers or asset owners. The government creates low income housing programs and subsidized mortgages but limits the ability to construct new homes, thus having the primary effect not of increasing housing access but of driving up home prices for current incumbent home owners. In health care the government subsidizes access to care in any number of ways but then restricts supply through certificates of need, onerous licencing programs, and drug manufacturing restrictions.

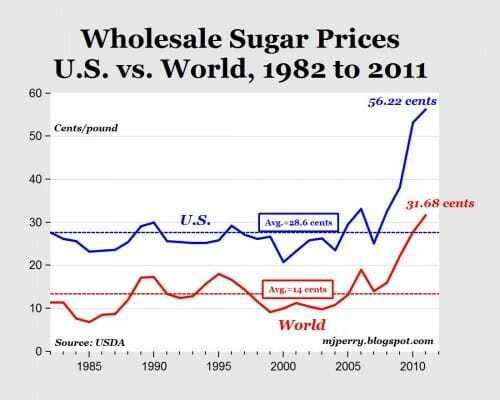

Now, consider solar panels. The government has many programs to subsidize the purchase of solar panels. Often, one can get local, state, and federal rebates and tax breaks for buying solar panels. But at the same time:

President Donald Trump’s pledge to offer American companies more aggressive protection from foreign competition got fresh ammunition Friday, when a government board cleared the way for him to deploy a long-dormant legal weapon to restrict solar panel imports....

In the solar panel case, filed by Georgia-based Suniva Inc. and joined by Oregon-based SolarWorld Americas Inc., the ITC commissioners will now consider specific policy recommendations and submit those to the White House by Nov. 13. Mr. Trump then has two months to decide whether to impose solar trade barriers....

“We brought this action because the U.S. solar manufacturing industry finds itself at the precipice of extinction at the hands of foreign market overcapacity,” Suniva said. The firm filed for bankruptcy protection earlier this year.

This really is utter madness, even from a domestic employment standpoint. I would be willing to be that the solar panel installation industry, which will be hurt by rising costs of solar panels, employs way more people than the US panel manufacturing industry. The solar industry's trade association seems to agree:

“Analysts say Suniva’s remedy proposal will double the price of solar, destroy two-thirds of demand, erode billions of dollars in investment and unnecessarily force 88,000 Americans to lose their jobs in 2018,” said the Solar Energy Industries Association, which promotes solar use.

For Progressives who are suspicious of public choice theory, this is they sort of prediction public choice theory makes and should be an area where Progressives and libertarians could make common cause. But traditionally Progressives have always been trade restrictionists, which seems crazy to me.