The Government Should Borrow More Money Because It Gets A Really Good Teaser Rate On Its Credit Card

In one of the most irresponsible suggestions I have seen in a while, Ezra Klein writes: (via Kevin Drum)

The Financial Times reports that there was record demand for 10-year Treasurys this week. “The $21 [billion] sale of 10-year paper sold at a yield of 1.459 per cent, the lowest ever in an auction.” William O’Donnell, a strategist at RBS Securities, told the FT that “we were expecting good auction results but this one has left me speechless.”...

But that 1.459 percent doesn’t account for inflation. And so when you do account for inflation, it’s not “almost nothing.” It’s “less than nothing.”...

The market will literally pay us a small premium to take their money and keep it safe for them for five, seven or 10 years. We could use that money to rebuild our roads and water filtration systems. We could use that money to cut taxes for any business that adds to its payrolls. We could use that to hire back the 600,000 state and local workers we’ve laid off in the last few years.

Or, as Larry Summers has written, we could simply accelerate payments we know we’ll need to make anyway. We could move up maintenance projects, replace our military equipment or buy space we’re currently leasing. All of that would leave the government in a better fiscal position going forward, not to mention help the economy.

The fact that we’re not doing any of this isn’t just a lost opportunity. It’s financial mismanagement on an epic scale.

This is wrong on so many levels that it makes my head spin. However, I will begin with four:

- The US never pays down debt. Except for a short period in the 1990's when we paid a tiny chunk off, all we do is roll over the old debt and pile more on top. We are still rolling over most of the debt we incurred in World War II. So any new debt we take on will likely still be around fifty years from now. As a result, taking on debt based on current low rates is exactly equivalent to a cash-strapped family taking on more debt because they got a low teaser rate on a new credit card. Eventually the rates go back up on the debt.

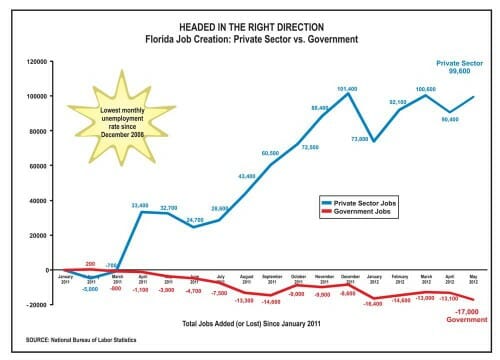

- Just because interest rates are low does not mean that somehow the spending is free. In the private sector, companies take on debt in expectation of growing revenues enough to pay the debt back. How is hiring 600,000 state bureaucrats going to help pay off the new debt in 10 years?

- The implication here is that all current government spending is so awesome that when we drew the line to mark the budget, additional totally awesome spending got left out, so if we just had more money, there are still lots of great projects available to spend the money on. Really? Where was all the catch-up road maintenance and water filtration systems in the last trillion dollar stimulus debt-binge? Seriously, the Left had their trillion dollar opportunity to prove out some value here and coughed up a hairball. So now they want a do-over? This is yet another great bait-and-switch: They say its for water filtration and roads, but it ends up just being to maintain do-nothing government jobs with above market pay and benefits, largely in exchange for these folks voting Democrat.

- Here is the ultimate irony -- certain countries are getting negative interest rates (Switzerland comes to mind right now) in government bond auctions because they are considered safe in comparison to a number of countries that are floundering. They are considered safe because investors think they are less likely to do fiscally stupid stuff like what is done in Greece in Spain -- say, for example, borrowing a bunch of money when the country is already deeply in debt to rehire at above market salaries 600,000 unneeded government workers. Klein is saying, basically, since interest rates are low, lets go indulge ourselves in all the actions that tend to drive interest rates for government way up.