Welcome to the Tesla Earnings Presenta... Squirrel!

Several years ago I was pretty active in the online community that was deeply skeptical of Tesla. When I backed away from blogging for several years, the Tesla fanboi community immediately decided that I was scared off by Tesla's success, as measured by a stock price that went through the roof for several years. I still get DM's on X from time to time taunting me for all sorts of past heresies, when in fact I was just exhausted with blogging, and remained certain that Tesla stock had become a sort of Bitcoin-equivalent, without any underlying value except for a community belief that it had value.

In fact, I was so embarrassed about my past criticism of Tesla that one of my first posts back here was... a criticism of Tesla.

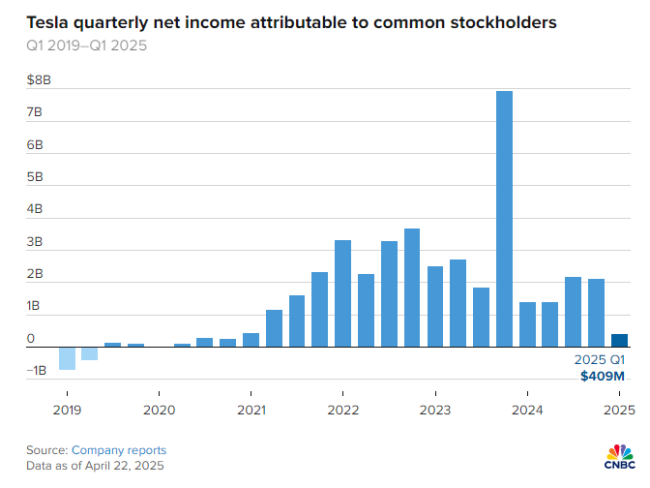

I was distracted a month or two ago when Tesla first quarter financials came out, but they are worth looking at because they were a disaster (of course, for anyone who knows the history of Tesla stock fandom, the stock price was up the next day after the release). But I want to get into it now because it is pretty stunning.

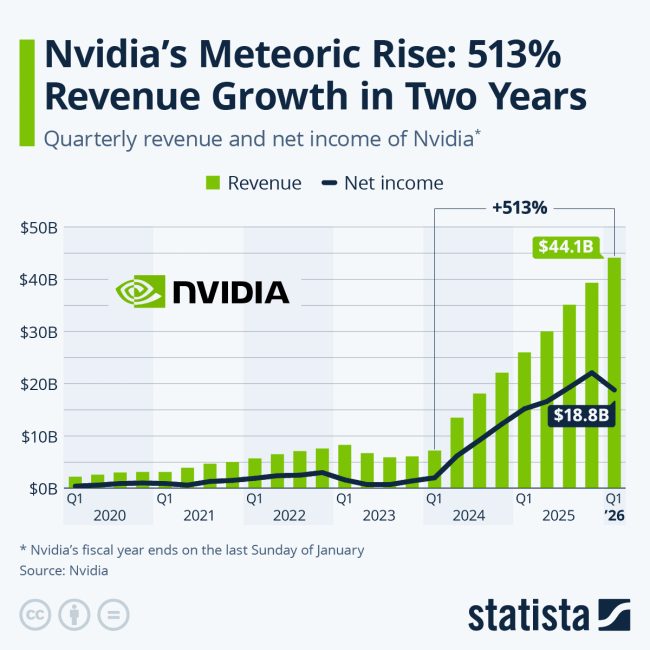

Before I get to the earnings number, note that Tesla stock closed today with a trailing PE ratio of 174. This sort of PE (except in turnaround situations) is only granted to astronomically-high-growth companies. For comparison, AI darling and the superstar growth stock of the last year or so Nvidia, has a PE just under 53. To justify a 53, Nvidia has demonstrated this sort of revenue and earnings growth the last several years:

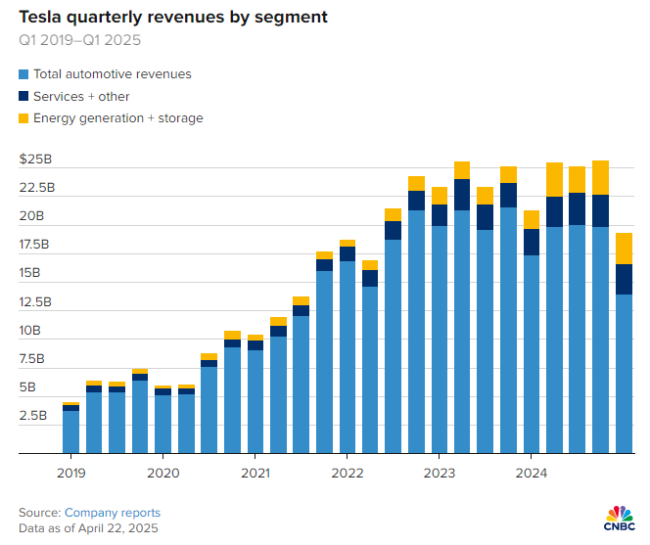

So, one would expect Tesla to have demonstrated something even more spectacular to justify a PE of 174. Drumroll please:

Tesla has 13 quarters, or over 3 years, of essentially zero revenue growth and an even longer period of zero net income growth. Freaking General Motors has seen more revenue growth over the same period and they have a PE south of 8. A PE of 8 seems about right for Tesla as a car company, meaning it is 20x overvalued. This would lead to a value of $50 billion vs. its approximate $1 trillion market cap.

So what is driving the other $950 billion in market cap? Whatever this $950 billion business is -- and we know it is not cars -- it constitutes the 10th largest company in America. So here is the answer for you ... squirrel!

Tesla and Musk are very very very good at getting their fanbase to buy into the fact that they are more than whatever the company actually is at the moment (ie anything but a US automaker with an 8 PE). We are a solar company... until Solar City crashed and burned. We are a solar roof company ... until that business was shown to be all flim flam and no substance. We are a battery change innovator ... until that was shown to be a stunt. We are an electric truck company ... until they never made more than the prototype. We are a battery storage company .. until that growth stalled. We are a leader in the huge Chinese market... until we weren't. We are the leader in full self driving ... until, after selling the product for years, we still have never delivered to those who bought it. One squirrel after another.

Today, it is the same game with only the exact future promise changing. Every chance they get today, Tesla and its supporters will tell you that they are not a car company. Go to Seeking Alpha and look at the Tesla buy recommendations, they say things like this:

- Tesla's current valuation isn't justified by traditional metrics, but its potential as an AI, robotics, and energy company is unmatched.

- The robotaxi and autonomous vehicle market could drive Tesla's valuation to $900B alone, thanks to its vertically integrated stack and cost advantages.

- Optimus robotics and other moonshot projects could add $300B+ in value, with further upside from energy, insurance, and software businesses.

- Tesla's valuation is now primarily driven by its robotaxi and humanoid robotics ambitions, not near-term automotive delivery growth/decline.

- Despite recent deliveries disappointment and renewed political fallout with Trump, investor sentiment has remained remarkably robust.

- The market is starting to price in significant operating income potential from robotaxi deployment, with a medium-term outlook in the next five years.

- Tesla investors are starting to take its AI ambitions (robotics and autonomy) very seriously, suggesting automotive hiccups could become less market-moving going ahead.

As I am writing this, enjoying the latest movie snark from the fabulous Critical Drinker on my iPad, I even got an ad for this crazy Tesla-pump video with the same basic message.

So apparently buyers and holders of this stock believe that Tesla's robotaxi business and AI/robotics business is worth at least $950 billion (as a comparison Uber is worth less than $200 billion). So let's think about that.

I am a frequent user of Waymo driverless taxis and have been in a number of friends' Teslas (totally white-knuckle nervous) in whatever passes for self-driving in Tesla models. And they do not even compare. Waymo is top to bottom a superior, better thought out product and way more reliable in its driving. We have hundreds of these things on our streets around my house in Phoenix such that I cannot even drive to the grocery store without one driving through the same roads and intersections. Yesterday I saw them stopped 3-wide at a nearby intersection. And I have never seen a Waymo -- whether I am inside it or driving next to it -- do anything that makes me nervous. They are incredibly well-driven and safe vehicles (not to mention always clean and comfortable). I have seen them navigate situations, like left-turns in complicated intersections, that might confuse me as a driver. Tesla continues to double down on Musk's early mistake of eschewing Lidar (Musk claiming good AI can work with cameras only) and I am convinced Tesla is thus in a technology dead end. Part of the proof of this is that Tesla has actually been selling full-self driving for years and years and still have not delivered that product to the people who paid for it.

But forget all that for now, and assume I know nothing about self-driving (partially true) and nothing about AI (totally true). Tesla made hay in its early growth phases by competing on technology and particularly electronics and automation with auto companies who are not really leaders in this stuff. I had a Mercedes for a while and those Germans build a nice car but damn their electronics such as their entertainment system always suck. I remember someone lauding the US military for being capable and the response to that was that the US military only appears capable and advanced because it competes with other militaries. Same for Tesla cars -- they brought fresh technology into an industry that is basically the special needs kid of innovation and software.

Now, though, consider Robotaxis and AI. With Robotaxis Tesla is competing with Google. In AI it is competing with Microsoft, Google, and Meta. Musk has made formidable investments in that space, but he is no longer running up the score against Appalachia State but has to take on the first teams of Alabama, Georgia, and Texas. Not impossible, but $950 billion is a ridiculous valuation to put on what to date is simply arm-waying and talk, particularly given how much of past Tesla talk and arm-waving has turned out to be total bullsh*t.

It has got to be a bad idea to invest in a 22-year old company on the proposition that 95% of their value is in new things you haven't really seen yet. This sort of shift almost never happens, and tends to be the equivalent of a company like Gamestop trying to keep investors excited in a no-growth low-margin business by announcing they are really a bitcoin company. A tiny tiny few companies have pulled this off -- I think of Amazon with cloud computing eclipsing their retail business. But even in this case the shift was something that was only really recognized and drove valuations after Amazon made it real.

Postscript: "But SpaceX" is not an adequate retort. I love SpaceX, and give Musk a lot of credit for being the founder and visionary behind it. But SpaceX just performs in its original business, without all the shifting promises and BS. And for every SpaceX, I can say "But SolarCity" of another Musk business that ended up in the toilet after tons of hype.

Warning: Please don't take this as a recommendation to go short Tesla. I am sometimes short Tesla and I can assure you that Tesla fanbois can keep the stock overvalued much longer than you can endure the pain. Always short with caution. Remember, Tesla stock is up over 25% since the day in April that it announced the terrible results above. If you had reasonably shorted the stock during the abysmal last earnings call you would be getting margin calls.

Update: I forgot to link the source for the Tesla earnings charts. It is here.