The Anti-Responsibility Law

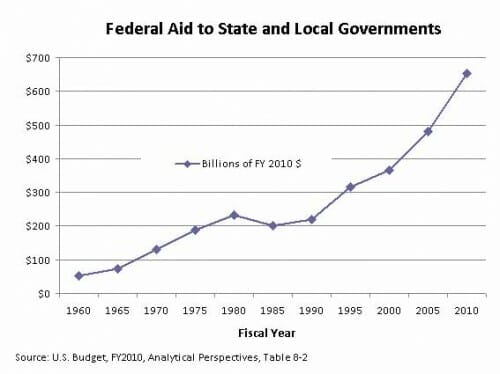

Congress just passed a new $26 billion payoff to state governments, easing the pressure on states to institute some sort of fiscal responsibility. The follows on the heals of last year's tens of billions of dollars in direct aid to state budgets in the original stimulus bill.

Taking the pressure off states for real fiscal reform is bad enough, but this is worse:

Maintaining the salaries and generous benefit plans for members of teachers unions is indeed a top Democratic priority. That's why $10 billion of the bill's funding is allocated to education, and the money comes with strings that will multiply the benefits for this core Obama constituency.Specifically, the bill stipulates that federal funds must supplement, not replace, state spending on education. Also, in each state, next year's spending on elementary and secondary education as a percentage of total state revenues must be equal to or greater than the previous year's level.

This is roughly equivalent to the government telling mortgage holders that took on too much debt that the government will bail them out, a clear moral hazard. But then it goes further to force the mortgage-holder to promise to take on a bigger mortgage next year. Unbelievable.

In a move right out of Atlas Shrugged, Texas is singled out for special penalties in the law because, well, it seems to be doing better than all the other states economically and is one of the few that seem comitted to fiscal responsibility

For Texas, and only Texas, this funding rule will be in place through 2013 [rather than 2011]. This is a form of punishment because the Beltway crowd believes the Lone Star State didn't spend enough of its 2009 stimulus money.

So much for equal protection. This Congress sure has set an incredible record for itself in choosing to reward and punish individual states (remember Nebraska and Louisiana) in its legislation.

The WSJ thinks perhaps a different kind of multiplier, other than the Keynesian one, is behind this legislation.

Keep in mind that this teacher bailout also amounts to a huge contribution by Democrats to their own election campaigns. The National Right to Work Committee estimates that two of every three teachers belong to unions. The average union dues payment varies, but a reasonable estimate is that between 1% and 1.5% of teacher salaries goes to dues. The National Education Association and other unions will thus get as much as $100 million in additional dues from this bill, much of which will flow immediately to endangered Democratic candidates in competitive House and Senate races this year.