Do Reporters Even Look At Their Own Charts?

A Wall Street Journal article today looks at problems at Sears in their critical appliance business. I have no problem believing that Sears is in trouble, and at various times over the past decade (full disclosure here) have held small short positions in Sears. The author argues that the Sears appliance business has had a number of missteps, and is contributing to Sears growing losses, propositions with which I cannot argue, in part because there is no data provided to confirm or deny the connection between problems in the appliance business and Sears' profitability woes.

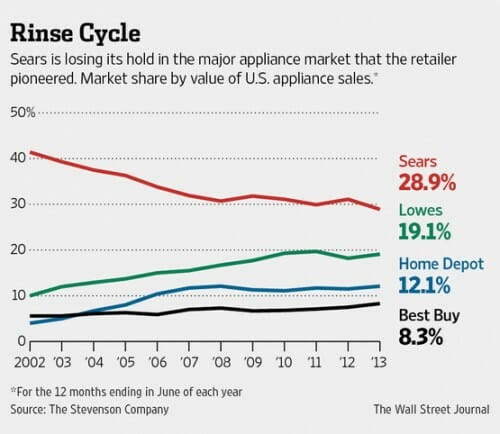

The other theme of the article is that recent missteps in the appliance business, particularly the 2009 switch from Whirlpool to Samsung and LG to manufacture its in-house Kenmore brand, is hurting its market share in the retail appliance business, and leading the the growth in market share at Home Depot and Loews. But the author's own data belie this conclusion. Here is the market share chart she includes:

While Sears may have lost a couple of points of market share since 2008, and 2013 does not look like a particularly good year so far, the vast majority of its market share loss occurred from 2002-2008, long before most of the recent problems profiled in the article. In fact, its more likely that the loss coincided with Sears reorganization with Kmart a decade ago, events referred to only briefly in the article.

Look, I have no insider knowledge here, just a pet peeve that trends referenced in an article should match trends in the data. But Sears is a tired old retailer. Many of its peers from the same era are dying or dead. People are shifting their shopping away from the malls where Sears is located. Lowes and Home Depot were both juggernauts during this period. I would have said that a story could equally well have been written that despite all the confusion in their business, they have done a pretty descent job arresting the decline in their market share over the last five years. Of course they are likely dead in the long run.

Postscript: Oddly, I witnessed a similar Sears private label fracas when I worked for Emerson Electric over a decade ago. For years and years, Emerson (not the folks who make the cheap radios and TVs) manufactured many of the Sears Craftsman hand tools and power tools. Sears got tough one year, and negotiated a better deal of some sort with someone else, and an entire division of Emerson saw its sales basically going to zero. So Emerson bought a bunch of orange paint and plastic, went to Home Depot, and cut a deal for a private label tool line at Home Depot (Emerson separately owns the Rigid tool company, so a lot of the items were branded Rigid). Emerson ended up in potentially better shape (I did not stay long enough to see how it turned out), partnered with a growing rather than a declining franchise.