For years now I have lampooned the crazy money Glendale, AZ has thrown at the Phoenix ice hockey team in a desperate attempt to trade taxpayer money for prestige. Let me bring you up to date:

Years ago a town of about 250,000 people committed about $200 million in taxpayer money to build a stadium for a professional ice hockey team, to attract it away from Scottsdale or downtown Phoenix to what is frankly the ass-end of the metropolitan area (I have no problems with the west side of town, but from a geographic, demographic, and economic logic standpoint this was roughly equivalent to moving the LA Lakers to Riverside or San Bernardino).

For some weird reason, moving an ice hockey team to the desert with no base of hockey fans and locating it a good 45 minutes from the wealthier parts of town caused the team to go bankrupt. Lots of people were willing to pay good money to haul the team back to Canada where there are, you know, ice hockey fans, but few wanted to pay good money to keep it on the west side of Phoenix.

So enter the NHL, which took the team over. The NHL commissioner promised the other owners that it would not lose money on the deal, so it set the price of the team not at the market price (which appears to be around $100 million based on the Atlanta sale) but based on its costs, which were about $200 million. It has agreed to try to keep the team in Glendale, but only if the city covers its operating losses of $25 million each year, which incredibly, the city has done for two years (note this is $100 a year for every man, woman, and child in the city to subsidize a hockey team).

The team may be worth $200 million in Canada, but it is only worth $100 million in Glendale (at most) so it does not sell. The city agreed to make up the $100 million difference with a bond issue (and throw another $90+ million in to boot), which almost closed the deal with one buyer until the Goldwater Institute pointed out that this kind of subsidy was illegal under the AZ constitution. And so the situation sits. The asking price is still $200 million, which no one will pay if they have to keep the team in Glendale. And the city keeps forking over $25 million a year to the NHL to keep the team running.

OK, so that is the background. Here is the new news.

The league, which purchased the Phoenix Coyotes at a bankruptcy court auction in 2009, has been managing the team and city-owned arena until an owner willing to keep the team in Glendale can be found. The city paid $25 million to the NHL during the 2010-11 season and pledged another $25 million for the current season, which is expected to come due in May.

To fulfill that pledge, the city put $20 million in escrow and still needs to come up with $5 million.

The hefty payouts have nearly drained the city's reserves, leading to a recent drop in the city's bond rating.

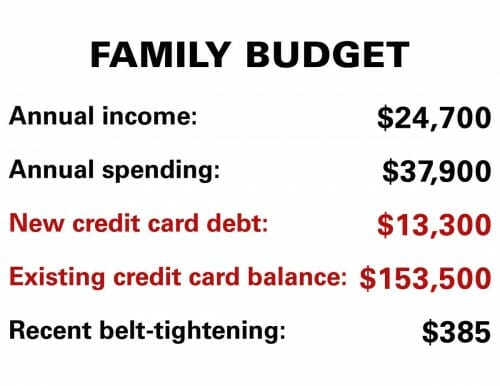

And the city is looking at a deficit next fiscal year that one councilwoman has estimated could reach $30 million. A possible sales-tax hike, furloughs and program cuts are on the table to close the spending gap....

During Tuesday's budget talks, [Glendale Mayor] Scruggs asked council members to join her in signing a letter to NHL Commissioner Gary Bettman to "release us from that $20 million in escrow and let us pay over time."

None of the councilmembers responded to her request. Councilman Manny Martinez later told The Republic he would "have to think about it in light of what is going on."

Scruggs said if the city can get back the $20 million from escrow and pay the NHL an initial $5 million, "our problems and everything our employees are fearful of would pretty much go away."

Translation: Dear NHL, we are idiots and committed a bunch of money to a stupid purpose that we can't really afford. Would you pretty please let us out of our commitment? Hilarious and pathetic. The chickens are coming home to roost by the millions.

Even funnier, the Glendale mayor is trying to blame the NHL for bad faith

The mayor said she and four others councilmembers pledged the second payout last May because city staff and NHL Deputy Commissioner Bill Daly said a deal with a team owner was nearly complete and that "we should never have to pay that $25 million."

Scruggs said the city was told the money was just a place holder so that the NHL wouldn't move the team out of Glendale.

"Given the stress that our budget is under, there should be a payment plan developed," Scruggs said. "They have no right to that money. They held us hostage for a year."

She said the NHL never intended to do business with Chicago businessman Matt Hulsizer, who wanted to buy the team but walked away from the negotiation table in frustration just weeks after the council pledged the second payment to the NHL....

Scruggs said the NHL last spring "misled us and they can't do this to our city."

In fact, the NHL was totally serious about the Hulsizer deal. That deal fell through not because the NHL screwed up, but because Glendale did. The deal fell through because Glendale had committed to a subsidy of the deal which may not have been Constitutional, and even if it had proved legal, became impossible when Glendale's bond ratings started tanking and they realized they could not move the paper. Glendale officials have been amateurish and dishonest through this entire process.

By the way, several years ago, Jim Balsillie offered a deal worth over $200 million for the team, PLUS he offered to pay off something like $150 million of Glendale's stadium debt. Glendale opposed the deal, because they would have been left with an empty stadium and tens of millions in debt (given the crash in RIM's fortunes, the offer is unlikely to be renewed).

Glendale is likely going to wish they had taken the first offer. There is a very good chance that Glendale will lose the team without any sort of payment on their debt and after paying $25 million a year to the NHL. Glendale will end up with hundreds of millions in debt, an empty stadium, a junk-level bond rating and a busted budget.

There is a saying in the investment world - your first loss is your best loss. Glendale is about to learn this very expensive lesson.