Douthat, Brennan, even McArdle Making 3 Mistakes in Looking at Exchange Subsidy Numbers

Ross Douthat in the NYT quoting Patrick Brennan

About one-fourth of the people who have entered their income information on their applications were deemed eligible for subsidies on the exchanges (about 900,000 out of about 3.6 million), which is lower than the number we saw in October alone and remains really far from what was projected. The CBO projected that just 1 million out of the 7 million people to enroll in the exchanges in the first year would be ineligible for subsidies, so the ratio is way off from what was expected (15–75 vs. 75–25). I had some thoughts on that surprising fact a month ago, and I’ll add a couple now: Unsubsidized customers (basically, those above the national median income) are generally savvier and more likely to have the resources to enroll and make their payments ahead of time, so maybe this is understandable and doesn’t say anything about who will eventually enroll. On the other hand, it may demonstrate that the people to whom insurance was supposed to be expanded — the uninsured, who tend to be low-income and not well educated — aren’t getting to the exchanges at all, and covering them will be a much longer term project.

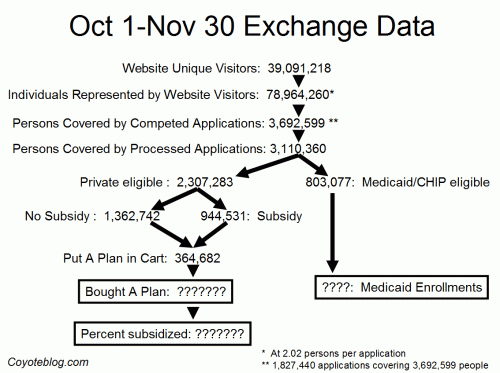

There is a huge, enormous analytical problem with this-- they are looking at entirely the wrong numbers. Incredibly, Meghan McArdle makes this same mistake, and I generally respect her analysis of things. I am going to pull out my summary chart of the Exchange numbers to try to make things clear (click to enlarge):

There are 3 major mistakes, each worse than the one before.

MISTAKE 1: The 3.6 million total applicants number is in line 3 (3,692,599). This is the wrong number. The number he should use is line 4, the number of people who have had their eligibility processed. So the denominator should be 3.1 million, not 3.6 million.

MISTAKE 2: He leaves out the Medicaid piece. Seriously, if we looking at numbers that are partially subsidized, why leave out numbers (Medicaid and CHIP) that are entirely subsidized? This means the applicants eligible for subsidy are 803,077 + 944,531 or 1,747,608 which is 56% of the processed applicant pool. The subsidy number may be lower than expected but I get the sense that the Medicaid percentage is higher than expected.

MISTAKE 3: They are looking at the application pool, not the sign-up or enrollment pool. That is understandable, because the Administration refuses to give the subsidy percentage breakdown of those who have selected a plan (a number which they certainly must have). My guess is that people are putting in applications just to see if they are eligible for subsidies. If not, they quit the exchange process and go back to their broker. That is what I will probably do (out of curiosity, I would never accept taxpayer money for something I am willing to pay for myself). The people who actually sign up for coverage are almost certainly going to skew more towards subsidized than does the applicant pool.

Making reasonable assumptions about the mix of subsidies in the "selected a plan" group, one actually gets numbers of 80-90% Medicare and CHIP and subsidies in the enrollment pool.

I do think McArdle is correct in saying that the uninsured numbers were both exaggerated and mis-characterized. I have been saying that for years.