Two Lessons From the Last Five Years

I propose two lessons learned from the last five years:

- There is no such thing as a risk-free return

- There is no such thing as a perfect hedge

Dispatches from District 48

Posts tagged ‘debt’

I propose two lessons learned from the last five years:

Perhaps I do not give Sarah Palin enough credit, because this is a really good passage, from one of her recent speeches (emphasis added by Mickey Kaus)

We sent a new class of leaders to D.C., but immediately the permanent political class tried to co-opt them – because the reality is we are governed by a permanent political class, until we change that. They talk endlessly about cutting government spending, and yet they keep spending more. They talk about massive unsustainable debt, and yet they keep incurring more. They spend, they print, they borrow, they spend more, and then they stick us with the bill. Then they pat their own backs, and they claim that they faced and “solved” the debt crisis that they got us in, but when we were humiliated in front of the world with our country’s first credit downgrade, they promptly went on vacation.

No, they don’t feel the same urgency that we do. But why should they? For them business is good; business is very good. Seven of the ten wealthiest counties are suburbs of Washington, D.C. Polls there actually – and usually I say polls, eh, they’re for strippers and cross country skiers – but polls in those parts show that some people there believe that the economy has actually improved. See, there may not be a recession in Georgetown, but there is in the rest of America.

Yeah, the permanent political class – they’re doing just fine. Ever notice how so many of them arrive in Washington, D.C. of modest means and then miraculously throughout the years they end up becoming very, very wealthy? Well, it’s because they derive power and their wealth from their access to our money – to taxpayer dollars. They use it to bail out their friends on Wall Street and their corporate cronies, and to reward campaign contributors, and to buy votes via earmarks. There is so much waste. And there is a name for this: It’s called corporate crony capitalism. This is not the capitalism of free men and free markets, of innovation and hard work and ethics, of sacrifice and of risk. No, this is the capitalism of connections and government bailouts and handouts, of waste and influence peddling and corporate welfare. This is the crony capitalism that destroyed Europe’s economies. It’s the collusion of big government and big business and big finance to the detriment of all the rest – to the little guys. It’s a slap in the face to our small business owners – the true entrepreneurs, the job creators accounting for 70% of the jobs in America, it’s you who own these small businesses, you’re the economic engine, but you don’t grease the wheels of government power.

So, do you want to know why the permanent political class doesn’t really want to cut any spending? Do you want to know why nothing ever really gets done? It’s because there’s nothing in it for them. They’ve got a lot of mouths to feed – a lot of corporate lobbyists and a lot of special interests that are counting on them to keep the good times and the money rolling along.

I find the Left's opinions on Greece to be fascinating. After all, Greece is essentially the logical end result of all of their love for deficit spending, so what kind of cognitive dissonance is necessary to write about Greece on the Left? This kind:

OK, but they're spending too much money. Surely they know they have to cut back?

Sure, but the deals on offer are pretty unattractive. Europe wants to forgive half of Greece's debt and put them on a brutal austerity plan. The problem is that this is unrealistic. Greece would be broke even if all its debt were forgiven, and if their economy tanks they'll be even broker.

But that's the prospect they're being offered: a little bit of debt forgiveness and a lot of austerity.

Well, them's the breaks.

But it puts Greece into a death spiral. They can't pay their debts, so they cut back, which hurts their economy, which makes them even broker, so they cut back some more, rinse and repeat. There's virtually no hope that they'll recover anytime in the near future. It's just endless pain. What they need is total debt forgiveness and lots of aid going forward.

I certainly agree that Greece is now in a death spiral, but this analysis is just amazing. The only way for other countries to avoid sharing Greece's fate is to, very simply, spend within their means. If they do, problem avoided. If they don't, and get hooked on deficit spending, then Greece is their future, the only question is when.

So what does Drum do? He calls the spending withing their means strategy "unrealistic" and "brutal austerity." So he occupies a long post lamenting what a totally SNAFU'd situation Greece is in, but takes off the table the only possible approach for other counties to avoid the same fate. And in fact advocates a strategy that will push a few others over the cliff sooner, or even cause a few to jump on their own (after all, if the punishment for spending your way into financial disaster is to get, as Drum recommends, all your debt forgiven and years of aid payments, why the hell would anyone want to be fiscally responsible?)

And it is amazing to me that he calls forgiving half their debt, the equivalent in the US of our creditors erasing about $7 trillion, as "a little bit of debt forgiveness" while cutting government spending a few percent of GDP is "a lot of austerity."

His solution, of course, is not for Greece to face up to its problems but to transfer the costs of its irresponsibility to others and then remain nearly perpetually on the dole.

His mistake is to assume Greece faces endless pain. It does not. History has shown that countries that are willing to rip off the bandage quickly rather than over a few decades can recover remarkably quickly if sensible policies are put in place. Heck, the Weimar Republic, which had inflation so bad people got paid 3 times a day so their family could buy something before the money became worthless a few hours later, got its house in order in a matter of months.

I am not at all a financial or Wall Street guy, but I had a few thoughts

When sharing our kneejerk reaction to yesterday's latest European resolution, we pointed out the obvious: "Portugal, Ireland, Spain and Italy will promptly commence sabotaging their economies (just like Greece) simply to get the same debt Blue Light special as Greece." Sure enough, 6 hours later Bloomberg is out with the appropriately titled: "Irish Spy Reward Opportunity in Greece’s Debt Hole." Bloomberg notes that Ireland has not even waited for the ink to be dry before sending out feelers on just what the possible "rewards" may be: "Greece’s failure to cut spending and boost revenue by enough to meet targets set by the European Union and International Monetary Fund prompted bondholders to accept a 50 percent loss on its debt. While Ireland won’t seek debt discounts, the government might pursue other relief given to Greece, including cheaper interest payments on aid and longer to repay it, according to a person familiar with the matter who declined to be identified as no final decision has been taken."

A key reason why a preponderance of the population is fascinated with the student loan market is that as USA Today reported in a landmark piece last year, it is now bigger than ever the credit card market. And as the monthly consumer debt update from the Fed reminds us, the primary source of funding is none other than the US government. To many, this market has become the biggest credit bubble in America. Why do we make a big deal out of this? Because as Bloomberg reported last night, we now have prima facie evidence that the student loan market is not only an epic bubble, but it is also the next subprime! To wit: "Vince Sampson, president, Education Finance Council, said during a panel at the IMN ABS East Conference in Miami Monday that lenders are no longer pushing loans to people who can’t afford them." Re-read the last sentence as many times as necessary for it to sink in. Yes: just like before lenders were "pushing loans to people who can't afford them" which became the reason for the subprime bubble which has since spread to prime, but was missing the actual confirmation from authorities of just this action, this time around we have actual confirmation that student loans are being actually peddled to people who can not afford them. And with the government a primary source of lending, we will be lucky if tears is all this ends in.

When you mess with pricing signals and resource allocation, you get bubbles. And one could easily argue that OWS is as much about the student loan bubble bursting as about Wall Street.

I must say that I never had a ton of sympathy for home buyers who were supposedly "lured" into taking on loans they could not afford. The ultimate cost for most of them was the loss of a home that, if the credit had not been extended, they would never have had anyway. US law protects our other assets from home purchase failures, and while we have to sit in the credit penalty box for a while after mortgage default or bankruptcy, most people are able to recover in a few years.

Student loans are entirely different. In large part because the government is the largest lender via Sallie Mae, student loans cannot be discharged via bankruptcy. You can be 80 years old and still have your social security checks garnished to pay back your student loans. You can more easily discharge credit card debt run up buying lap dances in topless bars than you can student loans. There is absolutely no way to escape a mistake, which is all the more draconian given that most folks who are borrowing are in their early twenties or even their teens.

I can see it now, the pious folks in power trying to foist this bubble off on some nameless loan originators. Well, this is a problem we all caused. The government, as a long-standing policy, has pushed college and student lending. Private lenders have marketed these loans aggressively. Colleges have jacked costs up into the stratosphere, in large part because student loans disconnected consumers from the immediate true costs. And nearly everyone in any leadership position have pushed kids to go to college, irregardless of whether their course of study made even a lick of sense vis a vis their ability to earn back the costs later in the job market.

Public service note: Their are, to my knowledge, five colleges that will provide up to 100% financial aid in the form of grants, such that a student can graduate debt free: Princeton, Harvard, Yale, Stanford, Amherst. These are obviously really hard schools to get into. I don't think a single one has a double digit percentage admissions rate. But these are the top schools that hopefully establish trends.

I am thrilled my alma mater is on the list. For years I have argued that they were approach severe diminishing returns from spending tens of millions of dollars to improve educational quality another 0.25%. If an institution is really going to live by the liberal arts college philosophy -- that a liberal arts education makes one a better human being irregardless of whether the course of study is easily monetized after graduation -- then it better have a way for students who want to join the Peace Corp or run for the state legislature to graduate without a debt load than only a Wall Street job can pay off.

By the way, my other proposal for Princeton has been this: rather than increasing the educational quality 1% more to the existing students, why not bring Ivy League education to 3x as many students. I have always wondered why a school like Princeton doesn't buy a bunch of cheap land in Arizona and build a western campus for another 10,000 kids.

My son and I spent the last year touring colleges. One common denominator of all the good and great private colleges: they are all over 100 years old. Rice was probably the newest, when a rich guy toured the great colleges of the world and thought he could do as well, and started Rice (Stanford is older but has a sort of similar origin story). Where are the new schools? The number of kids with the qualifications and desire to go to a top private college have skyrocketed, and tuition have risen far more than inflation, but there is no new supply coming on the market. Why is that?

I am amazed that the US equity market can fall for the same load of BS over and over again

Stocks finished with strong gains amid optimism about plans to recapitalize euro-zone banks.

Two thoughts

Countries are going to start to default in Europe, and I don't see any way around it. The Euro isn't toast but its going to have a lot fewer members in 3 years. And speaking of bad news, I don't see any way to avoid a massive Chinese bubble burst in the next 3 years either.

That is the sound of the printing presses running 24/7. Because that appears to be how we are funding all of Obama's spending right now (source)

When folks say they are not worried about the deficit, because folks still seem eager to buy our debt (as evidenced by the low interest rates) note that the general public has been a net seller of US debt the first 2 quarters of 2011. In fact, the only buyer has been Uncle Sam himself, buying up the debt with newly minted cash (or electrons, really).

One other interesting issue, the Fed seems to have been soaking up the money supply in the early days of the recession, before the high-profile business and financial failures really got things moving downward.

If I asked you what three major American consumer products saw the largest steady price rises in the last decade (as opposed to price volatility, as we see in commodities like gasoline) one might well answer "housing, medical care, and college tuition."

Two or more of each of these share a number of features in common

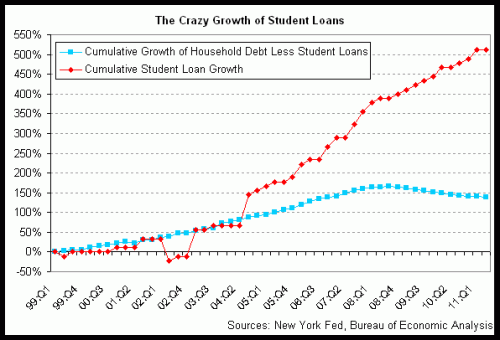

The housing bubble has of course burst. Obamacare, by further disconnecting individual use from the true costs of the services, will likely push health care costs ever higher. And then there is the college bubble. I am a bit late on this, but this is truly a remarkable chart:

I have already heard the leftish talking point on this, which is that this increase in debt is the fault of (surprise!) private lenders and loan originators. This is a similar argument to the one made in the mortgage bubble, arguing that all the bad loans are the results of unscrupulous private originators and securities packagers.

And certainly there were many private companies originating awful mortgages and selling them to Fannie and Freddie. But what we forget in hindsight is that the government was begging for them to do so. Fannie and Freddie had active programs where they were encouraging mortgages with Loan-to-value of 97% or more. This kind of leverage is absurd, particularly for American-style no-recourse home mortgages. Sure, it was crazy to write them, but they were getting written only because the government was asking for them to be written and buying them all up.

In fact, in student loans, almost all of this loan growth is eagerly being underwritten by the Feds, not by private lenders. Note the only consumer credit line really growing below is the "federal government" line (in red), which is primarily being driven by federally backed student loans.

One might argue that this is once again due to private originators going crazy. But the Feds took over origination of all federal student loans in 2010. You can see that much of the growth has occurred after the Feds took over origination. In fact, I think most of us can understand that when the origination decision is shifted from being a business decision to a political decision, student lending standards are certainly not going to get tougher. We can see that in home lending, where Fannie and Freddie have already returned to most of their worst pre-crash origination standards (here is an example of government promotion of these low down payment programs).

The other day my mother-in-law argued that the student lending business (particularly private lenders) needed reform because some students were being charged exorbitant rates. Having not been in the market for student loans lately, I wondered if this were the case. But the first thing that caught my eye was this stat: The 2-year default rate (not lifetime, but just in the first 2 years) of student loans was 8.8% last year, and 12% if one looks at the first 3 years. Compare that to credit card default rates which are around 6%. And recognized that these are apples and oranges, the student loan numbers actually understate lifetime default rates.

Based on that, the interest rate on student loans should be in the twenties. Against this backdrop, the rates I see online seem like a screaming deal. Probably too good of a deal. Which is why so many people are piling into these loans on the explicit promise society has made to them that their college degree will pay off, no matter what the cost.

Beyond the absurd price increases in both public and private education, here is the 900 pound gorilla in the room -- some majors are simply more valuable than others. A computer programming grad is going to have a lot more earning potential than the average poetry or gender studies major.

What we really need is tiered lending standards based on a student's major. Banks don't treat the earning potential of a dog-grooming business and a steel mill the same, why treat a mechanical engineering degree the same as a sociology degree? But, of course, this is never, ever going to happen.

Years ago I had these thoughts along this line, in response to a Michelle Obama rant about the cost of education

This analogy comes to mind: Let’s say Fred needs to buy a piece of earth-moving equipment. He has the choice of the $20,000 front-end loader that is more than sufficient to most every day tasks, or the $200,000 behemoth, which might be useful if one were opening a strip mine or building a new Panama Canal but is an overkill for many applications. Fred may lust after the huge monster earth mover, but if he is going to buy it, he better damn well have a big, profitable application for it or he is going to go bankrupt trying to buy it.

So Michelle Obama has a choice of the $20,000 state school undergrad and law degree, which is perfectly serviceable for most applications, or the Princeton/Harvard $200,000 combo, which I can attest will, in the right applications, move a hell of a lot of dirt. She chooses the $200,000 tool, and then later asks for sympathy because all she ever did with it was some backyard gardening and she wonders why she has trouble paying all her debt. Duh. I think the problem here is perfectly obvious to most of us, but instead Obama seeks to blame her problem on some structural flaw in the economy, rather than a poor choice on her part in matching the tool to the job. In fact, today, she spends a lot of her time going to others who have bought similar $200,000 educations and urging them not to use those tools productively, just like she did not.

Postscript: Kids who find they cannot pay their student debts and think bank home foreclosures are the worst thing in the world are in for a rude surprise -- home mortgage default consequences are positively light in this country. The worst that happens is that you lose the home and take a ding on your credit record. Student debt follows you for life, with wage garnishments and asset losses. People walk away from home debt all the time, the same is not true of student debt.

via Kevin Drum, personal debt in the US:

One of the problems with the stimulus, in my mind, is that it was aimed at interrupting this process.

Kevin Drum argues that Conservatives have vastly over-estimated the effects of capital gains tax changes on investment.

I can't agree with parts of the article that seem to argue that all taxes have limited effects on behavior (this is easily disproved, just look at what the tax code does for preferences of issuing debt vs. equity, or even look at the mortgage market). But I have always suspected that the political focus on the capital gains tax represents another piece of evidence that financial players (Wall Street, banks) dominate much of economic regulation.

All things being equal, a low capital gains tax is fine. If I sell some stock, its nice to pay a lower tax on the profits, particularly since at some level those profits have already been taxed once at the corporate level. Financial players who buy and sell securities live and die by the capital gains tax, and I suppose for businesses there is some advantage in that it perhaps reduces the cost of debt and equity.

But as a business person with my own company, that capital gains tax is largely irrelevant to my investment decisions. That is because all my investments are made to generate cash flow, and thus the regular tax rate is the ordinary income tax rate. Perhaps one time in my life, if ever, the capital gains tax will be hugely relevant when I sell my business, but that is at some time in the future so nebulous that it does not affect my behavior. Other than the double taxation argument, I have never understood why those who take their investment gains in asset value appreciation rather than in income should get different tax treatments.

Most of those who read the online libertarian rags have seen this, but its awesome enough to require repitition

What makes me libertarian is what makes me an atheist -- I don't know. If I don't know, I don't believe. I don't know exactly how we got here, and I don't think anyone else does, either. We have some of the pieces of the puzzle and we'll get more, but I'm not going to use faith to fill in the gaps. I'm not going to believe things that TV hosts state without proof. I'll wait for real evidence and then I'll believe.

And I don't think anyone really knows how to help everyone. I don't even know what's best for me. Take my uncertainty about what's best for me and multiply that by every combination of the over 300 million people in the United States and I have no idea what the government should do.

President Obama sure looks and acts way smarter than me, but no one is 2 to the 300 millionth power times smarter than me. No one is even 2 to the 300 millionth times smarter than a squirrel. I sure don't know what to do about an AA+ rating and if we should live beyond our means and about compromise and sacrifice. I have no idea. I'm scared to death of being in debt. I was a street juggler and carny trash -- I couldn't get my debt limit raised, I couldn't even get a debt limit -- my only choice was to live within my means. That's all I understand from my experience, and that's not much.

It's amazing to me how many people think that voting to have the government give poor people money is compassion. Helping poor and suffering people is compassion. Voting for our government to use guns to give money to help poor and suffering people is immoral self-righteous bullying laziness.

People need to be fed, medicated, educated, clothed, and sheltered, and if we're compassionate we'll help them, but you get no moral credit for forcing other people to do what you think is right. There is great joy in helping people, but no joy in doing it at gunpoint.

Who is at the other end of the spectrum? Well, how about Brad Delong arguing for a return to technocratic rule by our betters

America's best hope for sane technocratic governance required the elimination of the Republican Party from our political system as rapidly as possible.

Technocratic utopia is of course a mirage, a supreme act of hubris, that any group of people could have the incentives or information required to manage the world top-down for us. If I told an environmentalists that I wanted ten of the smartest biologists in the world to manage the Amazon top-down and start changing the ratios of species and courses of rivers and such in order to better optimize the rain forest, they would say I was mad. Any such attempt would lead to disaster (just see what smart management has done for our US forests). But the same folks will blithely advocate for top-down control of human economic activity. The same folks who reject top-down creationism in favor of the emergent order of evolution reject the emergent order of markets and human uncoerced interaction in favor of top-down command and control.

When it comes to high speed rail, the Left tends to have a Santa Clause mentality. They want the rail, but refuse to even discuss its costs vs. benefits, as if it is going to be dropped in place by Santa Clause.

I have actually had pro-high-speed rail writers call me a dinosaur for taking a cost-benefit approach. After a reasoned article on why our rail system, with its focus on freight, makes more sense than China and Europe's focus on high speed passenger rail, Joel Epstein wrote me that I should get out of the country more, as if I am some backwoods rube that would just swoon if I saw a nifty bullet train. For the record, my actual experience on a high-speed rail train in Europe confirmed that it was a nice experience (I knew it would be) and that it was a financial mess, as my son and I were the only passengers in my car. I would be all for HSR if Santa Clause dropped in down from the North Pole, but it costs a lot of real money.

How much money? Well take the system in China that Friedman and Epstein and many others have begged the US to emulate:

The rail ministry that builds and operates the trains has an incredible 2.1 million employees, more than the number of civilians employed by the entire U.S. government. Moreover, the ministry is in debt to the tune of 2.1 trillion yuan ($326 billion), about 5 percent of the country’s GDP.

Does anyone else find it funny that after being the butt of Congressional and Administration demagoguery, trying to lay blame for the financial crisis on them for applying AAA ratings to risky debt, that S&P's first visible step to correct such overly-optimistic ratings is to downgrade US debt -- based mainly on the fiscal management failures of Congress and the Administration.

By the way, many observers seem to be declaring this a punishment for not raising taxes. The lack of accountability inherent in the government's spending like a drunken sailor, and then using such reckless and profligate spending as an excuse to raise taxes, just makes me want to scream.

My column in Forbes is up. Here is how it starts. Hit the link to see it all.

We Americans are all being held hostage. The ransom demand: Trillions of dollars in new taxes. The threat: the shut down of any number of economic activities, from retirement payments to mortgage lending.

Megan McArdle, blogging at the Atlantic Monthly, posted a hypothetical list of what government activities would have to cease if we bumped up against the debt ceiling and 40% of government activity (ie the amount currently funded by deficit spending) had to cease immediately. Here are two examples from her article:

The market for guaranteed student loans plunges into chaos. Hope your kid wasn’t going to college this year!

The mortgage market evaporates. Hope you didn’t need to buy or sell a house!

Terrorists have tried for years to find some way to threaten the whole of America and have, with the exception of 9/11, never really succeeded. Who knew that all they really needed was not to buy guns and bombs, but to get elected to Congress. How did we ever get in this position, where a handful of men and women in Washington had the power to hold the entire economy hostage?

Megan McArdle posted a hypothetical list of what would have to stop if the government shrunk 40%, which is grabbed gleefully by folks likeKevin Drum to support the continued fiat power of government officials to demand that the public sector be as large as they, not we, want it.

Here are two examples:

The market for guaranteed student loans plunges into chaos. Hope your kid wasn't going to college this year!

The mortgage market evaporates. Hope you didn't need to buy or sell a house!

Wow - this is a great example of how statists defend their power. Here is the basic process:

Step 1: Take over a traditionally private offering and move it into the public domain. Mortgage lending is a good example. Wipe out the private sector either by fiat, or by subsidizing the government offering.

Step 2: Once the traditionally private offering has been made a public good, use its loss as a threat against any decrease in government size or power.

Just because the government does not provide the offering does not mean it won't exist. Private mortgages and private student loans without government guarantees existed for years and can again.

Yes, it would be a mess if done overnight, but this just demonstrates that the government has gone past government service to hostage-taking. If you threaten us and our power, we will bring everything crashing down. It is obscene, and all the more reason, when the near term budget problems are sorted out, we need to start moving all these activities back to the private sector.

By the way, this is a great demonstration of how, while the private sector can screw up, giving the public sector power to supposedly tame the private sector just creates a worse problem. Sure, some private mortgage lenders screwed up and contributed to the bubble. Some even committed fraud. But none of them had the power to shut down the entire market, as in the implied threat here.

McArdle's list may be a good reason not to let the debt limit expire, but it is an even better reason to get these activities out of the Federal government so that a few politicians can no longer hold us hostage.

Several blogs have pointed out this February editorial in the USA Today by Jacob Lew, head of Obama's OMB. In February he told us, no, in true Obama Administration fashion, he lectured us like little kids that:

Social Security benefits are entirely self-financing. They are paid for with payroll taxes collected from workers and their employers throughout their careers. These taxes are placed in a trust fund dedicated to paying benefits owed to current and future beneficiaries.

When more taxes are collected than are needed to pay benefits, funds are converted to Treasury bonds — backed with the full faith and credit of the U.S. government — and are held in reserve for when revenue collected is not enough to pay the benefits due. We have just as much obligation to pay back those bonds with interest as we do to any other bondholders. The trust fund is the backbone of an important compact: that a lifetime of work will ensure dignity in retirement.

According to the most recent report of the independent Social Security Trustees, the trust fund is currently in surplus and growing. Even though Social Security began collecting less in taxes than it paid in benefits in 2010, the trust fund will continue to accrue interest and grow until 2025, and will have adequate resources to pay full benefits for the next 26 years.

As many have pointed out this week, if this is the case, why does the debt limit even affect the ability to pay or not pay Social Security to grandma? Because Lew was spouting complete BS. Social Security has generated surpluses in the past, but these have been spent and replaced with IOU's. And we are finding out right now how much those IOU's are worth - zero.

Brad DeLong and Arnold Kling have been going back and forth on Fannie Mae and its culpability, or lack thereof, for worsening the recent bubble and financial crisis. DeLong originally argued, if I remember right, that the default rate for Fannie Mae conforming loans were not worse than those being bought by other groups. Kling argued that even their based default rate of 7% was awful (How do you make money on a pool of debt paying 5% if there is a 7% default rate). DeLong countered

Arnold Kling's response is simply not good. It is silly enough to make me think he has not thought the issues through. a 7% delinquency rate on a mortgage portfolio is horrible in normal times, but is actually very good if you are in a depression--ever our Lesser Depression. For an investment with a 15-year duration that's a cost of less than 50 basis points in a "black swan" near worst case scenario. A portfolio that does that well under such conditions is a solid gold one.

I may not be thinking about this right, but I think DeLong is making a mistake in this analysis. In the comments I wrote

First, I have no clue what a "reasonable" default rate is in a black swan event, and my guess is that, almost by definition, no one else does either.

However, it strikes me that DeLong's argument is a bit off. If mortgage default rates went up in an economic crisis that was wholly unrelated to mortgages, ie due to an oil shock or something, that would be one thing. But in this case, the black swan is in large part due to the mortgages issued. I guess it is sort of a chicken and egg problem, but the mortgages started defaulting before the depression, not the other way around, and helped precipitate the depression.

Remember, we are not talking about how well a portfolio survived the economic downturn. We are talking about if a portfolio contributed to the economic downturn.

When the framers of the Constitution designed its separation of powers features, they presumed that members of each of the three branches would try to protect their own turf. In other words, grabs of power by one branch would be met by hard pushback from other branches.

What they did not anticipate was that Congress would simply give away power to the Executive. It seems like Congressman only want their job titles, and maybe the ability to pass a few earmarks for the home district now and then, and would really like not to be bothered by that whole legislation thing. After all, your election opponents can't critique you for votes that were never taken.

This has been occuring for years, with the accretion of regulatory authorities (like the EPA) whose rules-making effectively usurps traditional Congressional regulatory authority.

More recently, the Democrats in Congress gave away immense power in Obamacare by creating an independent cost cutting board. Cost cutting suggestions of this board become law automatically unless Congress votes to override the changes, and even then they cannot override without passing cost cuts of similar magnitude on their own. The whole point was to take legislation of things like the doc fix, which just gets everyone riled up, out of the sphere of Congressional accountability.

Now the Senate Republicans are proposing what appears to me to be exactly the same bullsh*t vis a vis the debt limit. The debt limit is in fact a poor name. In fact, it should be called the debt authorization. Issuance of government debt can only by Constitutionally authorized by Congress, but instead of giving the Administration a blank check, it authorizes the Treasury to issue debt up to some limit, kind of like the limit on a credit card and serving much the same purpose. While Democrats talk about the debt limit as if it is some useless device, sort of like an appendix, it is in fact central to the excercise of power by both branches as set up in the Constitution.

Senate Republicans, though, want to change all that by giving the Executive Branch what amounts to a credit card with no limit. Why? Again, Congress is just dead tired of being so accountable for so many difficult decisions, and it would rather turn the President in to an Emperor than have to face difficult questions at reelection time. This is so gutless I could scream:

The debt limit now works as an only if proposition: the debt limit is increased only if Congress votes affirmatively to authorize an increase. Increasing the debt limit therefore requires a majority of the House and Senate to cast a difficult aye vote, plus a Presidential signature. The McConnell proposal would invert this into an unless proposition: the debt limit would automatically be increased unlessCongress voted to stop it. And by changing the key vote to a veto override, you would need only 1/3 of either the House or Senate to take a tough vote to allow the debt limit to increase.

In exchange for this significant increase in Presidential authority, the President would take most of the political heat for the debt limit increase, and he would be required to propose difficult spending cuts of an equal or greater amount.

Congresspersons of both parties don't give a cr*p about the Constitution or fiscal responsibility. They just want to avoid accountability.

Fortunately, I can see the House buying this at all. The House has a special role in spending and taxation, and I see them far more loath to accept this kind of deal.

Every person considering student loans should make sure they understand what is in this post from Megan McArdle. Americans are spoiled, to some extent, by non-recourse home loans (ie, unlike in the rest of the world, they can't come after assets to pay the loan beyond the house itself) and pretty generous terms for escaping credit card debt. These cause us to forget that most other types of lenders out there are pretty hard-ass about actually, you know, getting paid back.

I never held any student debt, so I was not aware of many of the facts she provides, but my guess is that many people who do have student debts aren't that aware either. Here is the most important part:

I don't know why Mystal thought I was only talking about federally guaranteed loans, or that I didn't understand that his debt had been sold to a collector, but there you are. If I had thought that he was talking only about federally guaranteed loans, I would simply have said "Mystal is dangerously deluded and needs to issue a correction immediately before someone gets a very harmful idea from his post." Federal loans don't settle. Period....

Private lenders have more incentive to settle, but not a great deal more. Most unsecured debt, like credit card balances, personal loans, and medical bills, can and will be settled for pennies on the dollar--as low as ten cents in some cases (though this usually means that they don't have any verification of the debt, so I wouldn't take a settlement this low.) It's not unheard of for a credit card collector to take 25 cents on the dollar on a valid debt, and 50 cents on the dollar is eminently achievable for many people.

But my understanding is that student loans are the great exception to this rule. Why? Student loans are not bankruptable, not even private ones. A collector for normal sorts of unsecured debt is always working with the threat of bankruptcy in the background; if you try to hold out for full repayment, the debtor can always file Chapter 7. In most cases, that means that unsecured creditors get nothing.

But that's not the case with student loans. There are only two ways to erase the debt: prove you're permanently disabled and will never again earn more than a pittance; or die

It is folks like this who continue to want to score the stimulus solely based on employment created by stimulus projects, without considering the fact that someone was using the money for some productive purpose before the government took or borrowed it.

David Brin at the Daily Kos via the South Bend Seven

There is nothing on Earth like the US tax code. It is an extremely complex system that nobody understands well. But it is unique among all the complex things in the world, in that it's complexity is perfectly replicated by the MATHEMATICAL MODEL of the system. Because the mathematical model is the system.

Hence, one could put the entire US tax code into a spare computer somewhere, try a myriad inputs, outputs... and tweak every parameter to see how outputs change. There are agencies who already do this, daily, in response to congressional queries. Alterations of the model must be tested under a wide range of boundary conditions (sample taxpayers.) But if you are thorough, the results of the model will be the results of the system.

Now. I'm told (by some people who know about such things) that it should be easy enough to create a program that will take the tax code and cybernetically experiment with zeroing-out dozens, hundreds of provisions while sliding others upward and then showing, on a spreadsheet, how these simplifications would affect, say, one-hundred representative types of taxpayers.

South Bend Seven have a number of pointed comments, but I will just offer the obvious: Only half of the tax calculation is rates and formulas. The other half is the underlying economic activity (such as income) to which the taxes are applied. Brin's thesis falls apart for the simple reason that economic activity, and particularly income, are not variables independent of the tax code. In fact, economic activity can be extremely sensitive to changes in the tax code.

The examples are all around us -- the 1990 luxury tax tanked high end boat sales. The leveraged buyout craze of the 80's and housing bubble of the 00's are both arguably fed in part by the tax code's preference for debt. The entire existence of employer-paid (rather than individual-paid) health insurance is likely a result of the tax code. And of course there are all the supply-side and incentives effects that Kos readers likely don't accept but exist none-the-less.

U.S. Treasury Secretary Timothy Geithner told Congress he would start tapping into federal pension funds on Monday to free up borrowing capacity as the nation hits the $14.294 trillion legal limit on its debt.

The U.S. Treasury will issue $72 billion in bonds and notes on Monday, pushing the nation right up against its borrowing cap at some point during the day, according to a Treasury official.

Geithner said he would suspend investments in two government retirement funds, which will give the U.S. Treasury $147 billion in additional borrowing capacity.

"I will be unable to invest fully" in the civil service retirement and disability fund and the government securities investment fund, he said in a letter to congressional leaders

Why does this surprise anyone? Up to this point, government workers have enjoyed a special privilege. All other Americans have had their retirement accounts in the Social Security system raided and replaced with IOU's, such that $0 actually still exists in these accounts. All this does is subject government worker's pensions to the same treatment. It is in fact telling that government employees have been a protected class on this dimension for so long.

I am sure these funds will be quickly replaced. No such luck for folks counting on Social Security for their retirement.

Hayekians would argue that both the Japanese lost decade and the recent US housing crash were both caused by massive mis-allocations of capital driven by a variety of government interventions and corrupted price signals (particularly on interest rates). This may be an early signal of a lulu of a bust coming to China, in an story on the high speed rail system in China

With the latest revelations, the shining new emblem of China’s modernization looks more like an example of many of the country’s interlinking problems: top-level corruption, concerns about construction quality and a lack of public input into the planning of large-scale projects.

Questions have also arisen about whether costs and public needs are too often overlooked as the leadership pursues grandiose projects, which some critics say are for vanity or to engender national pride but which are also seen as an effort to pump up growth through massive public works spending.

The Finance Ministry said last week that the Railways Ministry continued to lose money in the first quarter of this year. The ministry’s debt stands at $276 billion, almost all borrowed from Chinese banks.

“They’ve taken on a massive amount of debt to build it,” said Patrick Chovanec, who teaches at Tsinghua University. He said China accelerated construction of the high-speed rail network — including 295 sleek glass-and-marble train stations — as part of the country’s stimulus spending in response to the 2008 global financial crisis.

Zhao Jian, a professor at Beijing Jiaotong University and a longtime critic of high-speed rail, said he worries that the cost of the project might have created a hidden debt bomb that threatens China’s banking system.

“In China, we will have a debt crisis — a high-speed rail debt crisis,” he said. “I think it is more serious than your subprime mortgage crisis. You can always leave a house or use it. The rail system is there. It’s a burden. You must operate the rail system, and when you operate it, the cost is very high.”

It should be noted that this is the system that has been lauded by folks from Thomas Friedman to Barack Obama as something we should emulate in the US. By the way, this problem identified in China is in fact endemic to the US -- the cost overruns in every rail system. In the US, this probably has less to do with outright individual corruption (i.e. the stealing of money for personal gain) but more common political corruption, in the form of purposefully underestimating costs to get public approval, knowing that when inevitable overruns appear, it will be too late to stop the project.

Part of the cost problem has been that each segment of the system has been far more expensive to build than initially estimated, which many trace directly to the alleged corruption being uncovered, including a flawed bidding process.

I wrote earlier on high speed rail as triumphalism rather than real investment here. Why the US actually has the best rail network in the world is here (hint: from an energy, pollution, and congestion standpoint, the best thing to put on rails is freight rather than passengers, and the US does that better than China or Europe, by far)

Called a “debt failsafe trigger,” Obama’s scheme would automatically raise taxes if politicians spend too much. According to the talking points distributed by the White House, the automatic tax increase would take effect “if, by 2014, the projected ratio of debt-to-GDP is not stabilized and declining toward the end of the decade.”

Pretty good evidence that the default mentality in Washington is that "all your money are belong to us" and whatever is leftover that the government does not happen to spend, you are welcome to use for yourself.

My column this week in Forbes is a response to yesterday's Presidential budget speech. An excerpt:

President Obama is working from the assumption that the political leader who suggests painful but necessary budget cuts first, loses. He had every opportunity to propose and pass a budget when he had Democratic majorities in Congress. But Democrats feared that showing leadership on the hard budget choices they faced would hurt them in the November election, so they punted.

Even when Obama did produce a budget, it was the closest thing to a non-entity as could be imagined. A budget that doubles government debt over 10 years and raises interest costs (under optimistic assumptions) to a trillion dollars a year would likely be controversial in any year, but is a non-starter given fresh memories of debt crises in Greece, Ireland and a number of other countries.

Of course there is an 800-lb gorilla in the room that no one wants to acknowledge: Three programs — Social Security, Medicare, and Medicaid — grow in the next 10 years under current rules to at least $2.7 trillion dollars a year. Recognize that this figure excludes all the other so-called non-discretionary payments (unemployment, food stamps, etc.) as well as everything else the government does including the military and Obamacare. The 2021 spending on just those three programs is 25% higher than the total revenue of the federal government from all sources in 2011.

Later in the article, I suggest ten principles that should be the foundation of a budget deal.

In the eight days preceding the $38.5 billion deficit reduction deal, the national debt of the United Statesincreased $54 billion.