Ezra Klein writes:

For a long time, I took questions about stifling innovation very seriously. So did a lot of liberals. But then I realized that the people making those arguments wanted to do things like means-test Medicare, or increase cost-sharing across the system, and generally reduce costs in this or that way, which would cut innovation in exactly the same way that single-payer would hypothetically cut innovation: by reducing profits.

I also found that I couldn't get an answer to a very simple question: What level of spending on health care was optimal for innovation? Should we double spending? Triple it? Cut it by 10 percent? Simply give a larger portion of it to drug and device manufacturers? I'd be interested in a proposal meant to maximize medical innovation. I've not yet seen one.

The reason he could not get an answer to this very simple question is that it is stupid. It is a non-sequitur. It is, as Ayn Rand used to warn, a statist trying to force the argument to conform to his statist assumptions.

Let's take a different example, because medicine is so screwed up by government intervention that it can be confusing. Let's imagine ourselves in the computer market in 1974. The market is dominated by IBM mainframes, and innovation at the time was considered to be the penetration of mini computers (not to be confused with PCs, these were really just smaller mainframes) by DEC and HP.

Let's say that for some reason the US government decides it is fed up with the IBM "monopoly" and the high cost of mainframe computing and it wants to take over. It feels like there is a lot of waste in mainframes as some people are using them for frivolous reasons while other companies who really need them can't afford them. They might have created review boards to make sure that they thought each dollar spent on computing hardware and software was "worth it."

So, how much spending is needed to maintain innovation? We know in hindsight that the PC revolution is looming in the next few years. And in that context, Klein's question is absurd. The answer is that spending per se, and even profits, in the mainframe computing market were irrelevant to the coming series of innovations. The necessary preconditions were that entrepreneurs saw that new technology provided potential new value to consumers, and were allowed the freedom to launch these new products in hopes that the value these new products provided would be sufficiently high that consumers would pay enough for them to return their cost of manufacture and development and return them a profit. Some succeeded, and some failed, but entrepreneurs were allowed to try, despite most "experts" predicting the PC was a silly toy.

Note that computer innovators were not required to trundle into some government computing board to justify the PC and its price, to justify how much, as Klein would say, needed to be spent on PC's. If in fact they were forced to do so, if Jobs and Wozniak had to fly to Washington to justify the Apple I to the Computing Spending Decisions Board, they would have almost certainly been shot down. Or told they could sell it but only for $200 and not their initial price of $2000. We would have never had a PC revolution in a government single payer computing world, no matter how much, as Klein asks, was "spent" by the government. It is possible that the government might eventually have greenlighted a PC (years later) just as the increasingly bureaucratic IBM did, but can you imagine how frail the PC revolution would would be if only IBM had ever sold PCs, without the slew of competitors that emerged, and if every innovation had to pass the scrutiny of a government review board before it could be launched? Only a tiny percentage of PC innovation and of what we think of as a PC today, mostly in the basic architecture, ever came from IBM.

The very problem is that when government runs computers or health care, innovation is seen as a cost. Klein, by asking the question in this way, is betraying exactly what is fundamentally wrong with a single-payer system. The single-payer tends to think in terms of trying to deliver the current value proposition (ie the 2009 level of health care technology) as cheaply as possible. The problem is that in 2039, it will still be focused on delivering the 2009 level of health care technology. For the government -- a new drug, a new procedure, a new test -- these are all incremental costs, to be avoided. Klein just wants a number he can plug into budget projections to say, "see, innovation is covered." Its like Wesley Mouch asking John Galt near the end of Atlas Shrugged to tell him what orders to give.

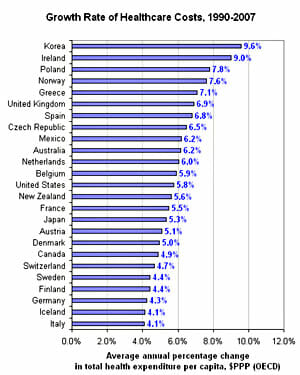

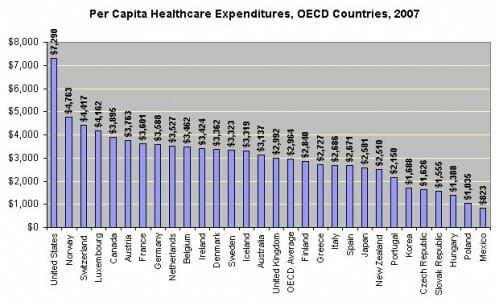

I wrote about it just the other day. You can see it in everything the Left writes -- increased spending is equated with increased costs which are therefore bad. They all say that America's health care spending is rising and our per capita spending is higher than other nations and that this rising spending is somehow a problem to be fixed. But there is a value side of the equation. What are we getting from the spending? When you leave out things the health care system can't do anything about (homicides and fatal accidents) Americans have the longest life expectancy in the world. We are getting something for that extra money. It is not just "cost" to be contained. Is a year of life worth an extra $100,000 spending? Everyone has a different answer, which is why we typically let each individual make these tradeoffs, and why people are uncomfortable having someone in the Post Office make the tradeoff for them.

But, the left will say, we will put really smart people on this board, who are angels of public service, who will make perfect decisions on the price-value tradeoffs of innovation (have you noticed that all their programs seem dependent on this assumption?) Back to our computer example, these guys, they would argue, would have been smart enough to have given Jobs and Wozniak the green light. This is a fantasy. It never happens. No matter how good the people, every such government entity is driven by its incentives, and this group's incentives will be to cut spending. Innovations that result in a net total increase in spending are not going to be well-received.

Further, these boards get politicized, always. Companies will quickly learn they have a better chance, say, of getting a new breast cancer treatment rather than a new prostrate cancer treatment past the board because the current administration is closely tied to women's groups. Just look at current government R&D spending, this already happens. AIDS was under-funded given its mortality because Conservative administrations thought it a disease mainly of groups it found distasteful; today, women's cancers get far more funding than men's due to the strong political activism of women's groups and the success of the pink ribbon campaign. Drug companies will learn that the quickest way to board approval may not be winning over the board, but getting certain interest groups to lobby the board, or maybe lobby Congress to override the board. Just look at the promise not to politicize ownership of GM -- that lasted about 2 days before Congress was passing legislation reversing internal GM decisions and GM was making plant closures based on political rather than economic concerns.

But even beyond these problems, there are Hayekian ones as well. In the mid-seventies, there might have been only a few thousand people who were excited enough to buy an early microcomputer and see its potential. What are the odds that one of those folks would be on the government review board, particularly since few of them were in the mainstream establishment of the computing field (heck, few of them were over 19 years old). And even if one were on the board, would they have approved a technology with only a few initial adherents? The fact is innovation often requires adoption of bleeding edge risk-takers who are willing to try a new technology and iron out its kinks before the mainstream catches on. The iPod was not the first music player -- a few of us struggled for years before the iPod with large and sometimes hard to use early mp3 players -- but if these early MP3 players had not existed, the iPod would not exist.

Perhaps most importantly, everyone makes different tradeoffs. It may make perfect sense for some person in Washington that a biopsy is not required for certain kind of positive cancer test results. This may make perfect price-value sense to the beauracrat, but I know a number of people who would lose months or years of their life to worry -- worry that could be short-circuited with an inexpensive biopsy. Or consider a new cancer treatment -- is a year of life worth an extra $100,000 spending? Would I prefer to extend my life through chemo or increase the quality of life of the time I have left by avoiding chemo? Everyone has a different answer, which is why we typically let each individual make these tradeoffs, and why people are uncomfortable having someone in the Post Office make the decision for them.

One could say that all of this does not answer Klein's question. That is because his question, built on the wrong premise, is unanswerable. I suspect he knows this and is, as Brad Warbiany posited in the link above, just setting up a straw man. All I can do is try to give a feel what what innovation does require, and help folks to understand that it has little if anything to do with Klein's question.

So, if I had to come up with a pithy one sentence answer, here it would be:

Klein: What level of spending on health care is optimal for innovation?

Me: The very fact that you intend to control spending centrally, at any level high or low, is what kills innovation.

Postscript: For a totally different reason, I was reading this article on the Russian T-34 tank, probably the best all-around tank for its time ever made when considering its production volume (the Panther was theoretically a better tank but volume production of the scale of the T-34, not to mention mechanical reliability, eluded the Germans). Apropos of government boards and innovation was this:

The L-11 gun did not live up to expectations, so the Grabin design bureau at Gorky Factory No. 92 designed a superior F-34 76.2 mm gun. No bureaucrat would approve production, but Gorky and KhPZ started producing the gun anyway; official permission only came from Stalin's State Defense Committee after troops in the field sent back praise for the gun's performance.