A few weeks ago, Kevin Drum had a post on shale oil development, quoting from a speech by Congressman Ken Salazar. It is hard to really excerpt the piece well, but my take on their argument against shale oil leasing is:

- Shale oil technology is unproven

- The government is leasing the shale oil rights too cheap

- There is already plenty of shale oil land for development, so new leases won't increase development

- This is just being done by the Bush Administration to enrich the oil companies

- The administration is rushing so fast that Congress has not had the chance to put a regulatory regime in place

In many ways, the arguments are surprisingly similar to those against new offshore and Alaskan oil leasing. Through it all, there is this sort of cognitive dissonance where half the arguments are that the oil won't be developed, and the other half seem to be based on an assumption that a lot of oil will be developed. For example, how can the leases be "a fire sale" if shale oil technology is unproven and development is not likely to occur? I would say that if these assumptions were true, then any money the government gets for a worthless lease is found money.

Similarly, how are oil companies going to enrich themselves by paying for leases if the technology is not going to work and no development is going to occur? This same bizarre argument became Nancy Pelosi's talking point on offshore oil leasing, by saying that oil companies were somehow already cheating us by not drilling in leases they already have. Only the most twisted of logic could somehow come to the conclusion that oil companies were enriching themselves by paying for leases were they found no developable oil.

From the standpoint of Democratic Party goals, there is absolutely nothing bad that happens if the government leases land for oil shale or oil drilling and oil companies are unable to develop these leases (there is some small danger of royalty loss if leases are not developed when they could be economically, but most private royalty agreements are written with sunset periods giving the lease-holder a fixed amount of time to develop the lease or lose it -- I don't know how the government does it). The net result of "no drilling" or "oil shale technology turns out not to work" is that the government gets money for nothing.

Here is the problem that smart Democrats like Drum face, and the reason behind this confusing logic: They have adopted environmental goals, particularly the drastic reduction of CO2 in relatively short time frames, that they KNOW, like they know the sun rises in the east, will require fuel and energy prices substantially higher than they are today. They know these goals require substantially increased pain and lifestyle dislocation from consumers who are already fed up with fuel-cost-related pain. This is not because the Democrats are necessarily cruel, but because they are making the [faulty] assumption that the pain and dislocation some day from CO2-driven global warming outweighs the pain from higher priced, scarcer energy.

So, knowing that their policy goal is to have less oil at higher prices, and knowing that the average consumer would castrate them for espousing such a goal, smart Democrats like Drum find themselves twisted into pretzels when they oppose oil development. They end up opposing oil development projects because in their hearts they want less oil around at higher prices, but (at least until their guy gets elected in November) they justify it with this bizarre logic that they oppose the plan because it would not get us oil fast enough. The same folks who have criticized capitalism for years for being too short-term focused are now opposing plans that don't have a payoff for a decade or so.

At the end of the day, most Democrats do not want more oil developed, and they know that much higher prices will be necessary to meet their climate goals. It sure would be refreshing to hear someone just say this. As I wrote at Climate Skeptic, the honest Democrat would say:

Yeah, I know that $4 gas is painful. But do you know what? Gas

prices are going to have to go a LOT higher for us to achieve the CO2

abatement targets I am proposing, so suck it up. Just to give you a

sense of scale, the Europeans pay nearly twice as much as we do for

gas, and even at those levels, they are orders of magnitude short of

the CO2 abatement I have committed us to achieve. Since late 2006, gas

prices in this country have doubled, and demand has fallen by perhaps

5%. That will probably improve over time as people buy new cars and

change behaviors, but it may well require gasoline prices north of $20

a gallon before we meet the CO2 goal I have adopted. So get ready.

Postscript: By the way, oil companies have been trying to develop shale oil since the 1970s. Their plans went on hold for several decades, with sustained lower oil prices, but the call by the industry to the government for a clarified regulatory regime has been there for thirty years. The brief allusion in Salazar's speech to water availability is a valid one. I saw some studies at Exxon 20+ years ago for their Labarge development that saw water availability as the #1 issue in making shale oil work.

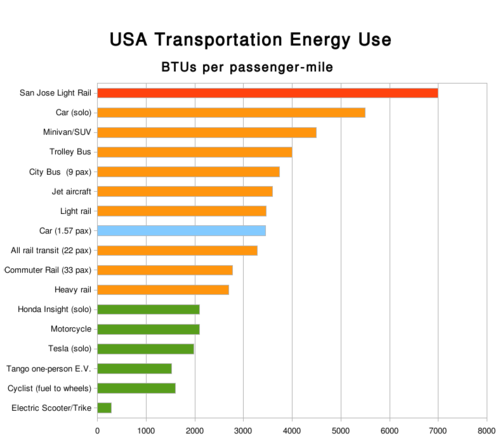

PPS: I mention above that the pain of fuel prices not only hits the wallet, but hits in term of painful lifestyle changes. One of the things the media crows about as "good news" is the switch to mass transit from driving by a number of people due to higher oil prices. This is kind of funny, since I would venture to guess that about zero of those people who actually switched and gave up their car for the bus consider it good news from their own personal life-perspective. Further, most of the reduction in driving has been the elimination of trips altogether, and not via a switch to mass transit. Yes, transit trips are up, but on a small base. 95%+ of reduced driving trips are just an elimination of the trip. Which is another form of lifestyle pain, as presumably there was some good reason to make the trip before.

Update: Updated on Canadian Oil Sands production here. Funny quote:

Fourth, and potentially most important, the U.S. "green" lobby is

pushing legislation that could limit purchases of oil sands products by

U.S. government agencies based on its GHG footprint. It would be well

beyond stupid for Congress to prohibit our buying oil from Canada while

we increase buying it from countries that threaten our security. But

just because something is stupid certainly does not mean Congress may

not do it.