After giving tens of billions of dollars of our money to the auto makers, Obama has now figured out what I and many others knew years ago:

Obama, responding to a question during an online town hall meeting, said the current business model for U.S. carmakers was unsustainable and the Big Three would need to change their ways.

From the article, however, it is still clear that Obama has no intention of allowing GM to go into chapter 11, as they should have 6 months ago. There is a good political reason for this -- remember what I explained before. Obama is working to equate chapter 11 with the disappearance of the American auto industry, clearly an untrue and facile proposition. Many large companies, from airlines to energy companies to equipment manufacturers, have gone bankrupt over the last several decades and continued operations or at least had their productive assets taken over by other companies. GM's assets are not just going to go poof.

However, there is a clear set of winners and losers in a bankruptcy -- and there is enough case law on it that all the players at GM know it and they know into which category they fall. Those who are lower down the food chain are hoping that putting the restructuring in Obama's hands rather than those of the bankruptcy process will improve their outcomes. And, to get those higher on the food chain (ie senior debt holders) to accept this they need the government to bring taxpayer money to the table. The whole point of an Obama-led restructuring, then, is not to somehow preserve the US auto industry but to improve the financial position of certain GM stakeholders at the expense of US taxpayers (and probably consumers, and some sort of protectionism is likely to be part of this deal).

But here is the most interesting point that was really hammered into me in reading this article. If you were to rank Obama as to where he stood vis a vis all American adults in terms of his knowledge of business and what it takes for a company to be successful, where would you rank him? I don't think very many would put him in the top half. In fact, given that he has never, to my knowledge, had any real job in business of any sort (not even a high school job at McDonald's or something similar), I am not sure I would put him above the 10th percentile. Anyway, put your own number to this question, and then read these quotes from the linked article

The president said he planned to announce decisions on the future of the industry in the coming days.

"But my job is to measure the costs of allowing these auto companies just to collapse versus us figuring out - can they come up with a viable plan?" he said.

White House spokesman Robert Gibbs said Obama will announce his strategy for the auto industry before he leaves for Europe on Tuesday.

Seriously, would you hand over your business or your stock portfolio for Obama to manage? I didn't think so. It takes years of experience to be able to read a business plan skeptically. And even people who are experienced at it fail a lot.

By the way, for those who suspect that decisions will not be based on actual market realities but satisfaction of pet political goals, you are probably correct:

The president said even as the economy bounces back, Detroit can't focus on "trying to build more and more SUVs and counting on gas prices being low."...

Gibbs said Obama still thinks U.S. automakers build cars that Americans want to buy. Both he and the president own Ford Escape hybrids. "It's a nice car," Gibbs said. "It really is."

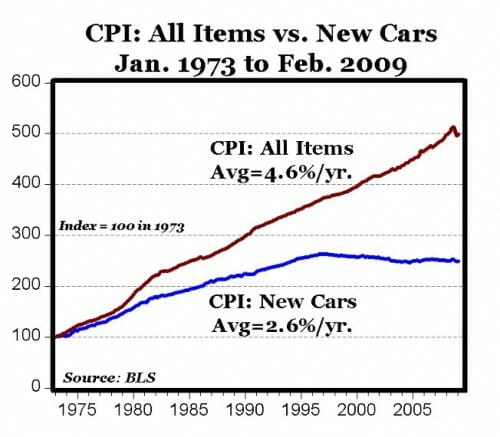

So, for example, one can assume its likely the Obama strategy for GM success will include lots of hybrids. Of course, the market reality is this:

the slowdown has been particularly brutal for hybrids, which use electricity and gasoline as power sources. They were the industry's darling just last summer, but sales have collapsed as consumers refuse to pay a premium for a fuel-efficient vehicle now that the average price of a gallon of gasoline nationally has slipped below $2.

"When gas prices came down, the priority of buying a hybrid fell off quite quickly," said Wes Brown, a partner at Los Angeles-based market research firm Iceology.

I personally believe that a meer restructuring of GM is unlikely to create a turnaround, as I discussed here.

Postscript- It is a bit apples and oranges for me to say that Obama is evaluating business plans here. In fact, he is not. Though he calls them that, if the Chrysler retructuring plan they put on the web is any guide, these are political plans, not business plans. No real business plan, for example, seeking to attract private capital would prioritize the goals "Commitment to Energy Security and Environmental Sustainability", "Compliance with Fuel Economy Regulations," and "Compliance with Emissions Regulations" ahead of "Achieving a Competitive Product Mix and Cost Structure." In fact, the section about costs and competitive products comes dead last in the Chrysler plan, almost as an afterthought.

Update: This sad story about athletes and their difficulty in managing their money seems relevent. These guys, who have spent their whole life getting really good at one thing, don't even have the basic financial vocabulary to understand money management, and absolutely no ability to parse a business plan:

It began in the winter of 1991 when he sank $300,000 into the Rock N' Roll Café, a theme restaurant in New England designed to ride the wave of the Hard Rock Cafe and Planet Hollywood franchises. One of his advisers pitched the idea as "fail-proof, with no downsides," Ismail recalls. He never recouped his money and has no idea what became of the restaurant.

Lesson learned? If only. After that Ismail squandered a fortune funding not only that inspirational movie but also the music label COZ Records ("The guy was a real good talker," says Rocket); a cosmetics procedure whereby oxygen was absorbed into the skin ("We were not prepared for the sharks in the beauty industry"); a plan to create nationwide phone-card dispensers ("When I was in college, phone cards were a big deal"); and, recently, three shops dubbed It's in the Name, where tourists could buy framed calligraphy of names or proverbs of their choice ("The main store opened up in New Orleans, but doggone Hurricane Katrina came two months later"). The shops no longer exist.

You might say Ismail had a run of terrible luck, but the odds were never close to being in his favor. Industry experts estimate that only one in 30 of the highest-caliber private investment deals works out as advertised. "Chronic overallocation into real estate and bad private equity is the Number 1 problem [for athletes] in terms of a financial meltdown," Butowsky says. "And I've never seen more people come to me about raising money for those kinds of deals than athletes."

Doesn't this sound like the current administration in microcosm? Does Obama have any better chance with his GM investment?