Generally, in any discussion of taxes, I focus on the foundations of

property rights, to argue that taxation is no different than

stealing. Most of us agree that grabbing someone else's money at

gunpoint is immoral. I do not hold to a theory of government that says

that this immoral action is suddenly moral if 51% of my neighbors

sanction it.

Anyway, I am going to leave behind the moral basis (or lack thereof)

for taxes and focus instead on five practical problems that a

well-crafted tax system should be able to avoid.

1. Complexity and Preparation Time

I probably don't need to go into great depth on this one to convince you that taxes and tax returns are ridiculously complex. We all know how complicated even the individual 1040 has become, so much so that using tax preparation software is nearly de riguer for most middle class taxpayers. Last year, our federal and state income tax returns for the company were over 400 pages long.

For a small business, the tax preparation burden goes much further. For example, the burden of payroll tax preparation, not to mention staying on top of compliance issues, is so high that no sane business person does payroll in house any more. Quarterly state and federal unemployment and withholding tax returns must be filed, with salary detail to the last penny for every single employee. As a result, everyone uses a service like ADP, and though this solves the workload problem, it still costs money - about $12,000 a year in our case. That's not the tax bill, just the cost to keep up with the government paperwork.

But with payroll taken care of, businesses still must file sales tax returns, excise tax returns, detailed property tax returns, census data requests, labor and commerce department surveys, and of course income tax returns. Each of these typically have to be done at the state level and in many cases separately for every single county and city where we do business. Each in and of itself is horribly time consuming - see this example for property taxes, this one for sales taxes, and this one for government surveys.

In Kentucky, for example, we have to file quarterly state withholding tax returns, quarterly payroll withholding returns in each county we operate in, a quarterly state unemployment return, an annual property tax return in each county, and annual income tax return at the state level, an annual income tax return in each county, a monthly sales tax return, a monthly survey for the US Department of Labor about Kentucky headcount levels, an annual foreign corporation renewal, a new hire report whenever we hire a new employee, and a monthly report to the workers comp state fund

2. Disguising the Tax Load

Quick, how much total do you pay in taxes? Perhaps the greatest innovation of statists in the 20th century was the tax load shell game - the clever balkanization of the tax load that makes it nearly impossible for the average person to truly know how much they pay in taxes to the government.

Start with income taxes. OK, April 15 has just passed, but even so, how many people know how much they paid in income taxes last year? For many people, this is the single largest expense they have, but the total amount is disguised by the fact that most income taxes are taken out as direct payroll deduction. Statists and leftists everywhere in the US should get up in the morning and give thanks for direct payroll deduction -- without it, if every American had to write a single check once a year for the sum total of their annual income taxes, there would have long since been a revolution.

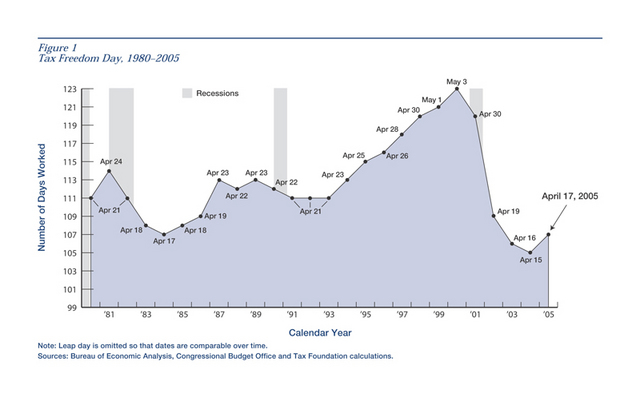

OK, so you don't know how much you paid in federal, state and local income taxes. But in addition to that, how much did you pay in social security and medicare (typically about 8% of salary)? Property taxes (typically 1-2% of your home value)? How about sales taxes (typically 6-9% of your purchases)? What about vehicle licensing fees and special taxes on hotels and airfare and rent cars? If you add all these up, the average American pays about 30% of his/her salary in taxes. The Tax Foundation has a great chart summarizing this shell game, with relative burdens expressed as days of work each year required to pay the tax. Note that on average, your federal income tax is only 1/3 of the total of what you are paying:

So those are the direct ones, but how much are you also paying in higher prices due to government import duties? What about the 8% FICA and medicare that employers pay on your behalf - how much higher might your salary be if they did not have to pay these? What about corporate taxes - you may not pay them directly, but they certainly get passed on to you in the form of higher prices and lower dividends. What else? - try this list on for size.

3. Taxes on Wealth and Savings

Most taxes are on income or sales, and so they are at least marginally calibrated with an individual's cash flows. The exceptions to this are property taxes and inheritance taxes. These two taxes both go after an individual's savings -- property taxes mainly on the home, the primary savings vehicle for most Americans, and inheritance taxes on everything you've saved when you die.

Lets take property taxes first. Many people complain that modern life has become a treadmill, forcing families to work harder and harder to keep up their lifestyle. To a large extent, I think this is a myth - people may be working harder but their effective standard of living is way, way higher than say 30 years ago. But one of the things that definitely creates a treadmill are property taxes.

Many people have worked hard to pay off their mortgage, thinking they could settle down into their retirement in a paid off house. Unfortunately, they may find that their home has increased in value so much that their property taxes at retirement are actually much higher than their original payment on the house. Take the case of a couple who bought their house in an urban area for $25,000 and find its now worth $375,000 forty years later (this is an average urban price increase over the last 40 years). For simplicity, we will assume the effective tax rate has stayed at $1.50 per $100 for these forty years (though its more likely to have gone up). In 1965, they paid $375 a year in taxes. Today, they have to pay $5,625. In other words, their property taxes today are over 22.5% a year of the original price they paid for the house. Now, this is all fine if the couple strove to work up the corporate ladder and get promotions and grow their income proportionately. But what if they didn't want to? What if they just wanted to buy that house, pay it off, and live modestly selling driftwood sculptures at farmers markets, or whatever. The answer is, because of property taxes, they can't. Likely they will have to sell this house, give up the urban life they wanted, and either move to an urban dump they can afford the property taxes on, or they move out to the country. Here is an example, via Reason, of this process of property taxes forcing out urban residents living small in favor of yuppies living the dream. It is ironic that a tax initially invented for populist reasons to cut back on wealth accumulation hurts the lower income brackets and those trying to step off of the capitalist treadmill the most. In fact, it was the poor in the Great Depression who typically lobbied for laws to put moratoriums on property tax collections.

The estate tax has many of the same origins and issues. The biggest downside of the estate tax is that it tends to force premature sales of productive business assets to pay the tax. Rather than leaving small businesses in the family, who have the experience and passion to make them work, they typically must be sold to third parties outside the family to pay the estate taxes. Again, the law of unintended consequences crops up - estate taxes and the sales they force have done more to contribute to merger and acquisition activity, which in turn drives consolidation of economic assets into fewer and fewer corporations. The tax meant to stifle wealth accumulation among individuals has in fact spurred wealth accumulation among corporations. While used for many purposes today, LBO's, that bogeyman of the left, were invented to manage this estate tax forced sale problem.

Asymmetrical Information has a thoughtful series of posts going on estate taxes.

4. Picking Favorites for Special Treatment

One of the defining characteristics of statist politicians of both the left and the right is that they think they are smarter and more moral than the average American, and certainly than the average American businessman. Statists and technocrats distrust markets and assume that they can succeed in managing the economy in general and individual decision-making in particular where markets have "failed" to reach whatever end-state politicians would prefer.

Therefore politicians insist on using tax policy to reinforce (or discourage) certain behaviors or to influence certain outcomes or to frankly enrich some favored group. Examples are all around us, but include:

5. Class Warfare and Punishing Success

Many of the taxes we pay - income, property, estate - have strong class warfare origins. Heck, the income tax and the Constitutional Amendment that made it possible because Americans were told that only the richest 1% or so would ever have to pay it. Today, tax debate is littered with class warfare arguments.

Today, the richest 1% of Americans pay about a third of the total individual taxes, and the richest 10% pay two-thirds. The richest 50% of Americans pay 100% of the taxes (in the other half, some pay a bit, and some get a bit back in EITC, but the net is zero). So, a small percentage of Americans pay for the services and government

cash subsidies enjoyed by the majority. So how do we treat these

people? As heroes, or benefactors, or as the most productive? No we treat them as evil parasites who are not

doing their fair share.

By the way, These shares paid by the rich actually went up after the Bush tax cuts (yes, that's not a typo). The very fact that this statement might seem unbelievable points to how much ridiculous class warfare demagoguery permeated the last election. By the way, these numbers are for income taxes. The numbers for total taxes, including the regressive payroll taxes, yields slightly different numbers but the same results, as outlined in TaxProfBlog today.

The fact is that most "progressive" taxes are in fact punishing the successful and most productive. The Left loves to wave Paris Hilton around as an example of the useless and unproductive rich who presumably should be taxed into poverty. They want to obscure the fact that 99% of the rich got to be rich honestly, through hard work, and via the uncoerced interaction with others. Because saying that your government rewards success with its highest tax rates and confiscates the vast majority of its operating funds from the people who would employ this money the most productively, um, doesn't sound very good.

UPDATE: I have more here, including a rebuttal of Kevin Drum.