I find the Left's opinions on Greece to be fascinating. After all, Greece is essentially the logical end result of all of their love for deficit spending, so what kind of cognitive dissonance is necessary to write about Greece on the Left? This kind:

OK, but they're spending too much money. Surely they know they have to cut back?

Sure, but the deals on offer are pretty unattractive. Europe wants to forgive half of Greece's debt and put them on a brutal austerity plan. The problem is that this is unrealistic. Greece would be broke even if all its debt were forgiven, and if their economy tanks they'll be even broker.

But that's the prospect they're being offered: a little bit of debt forgiveness and a lot of austerity.

Well, them's the breaks.

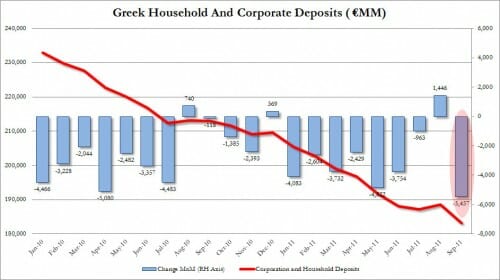

But it puts Greece into a death spiral. They can't pay their debts, so they cut back, which hurts their economy, which makes them even broker, so they cut back some more, rinse and repeat. There's virtually no hope that they'll recover anytime in the near future. It's just endless pain. What they need is total debt forgiveness and lots of aid going forward.

I certainly agree that Greece is now in a death spiral, but this analysis is just amazing. The only way for other countries to avoid sharing Greece's fate is to, very simply, spend within their means. If they do, problem avoided. If they don't, and get hooked on deficit spending, then Greece is their future, the only question is when.

So what does Drum do? He calls the spending withing their means strategy "unrealistic" and "brutal austerity." So he occupies a long post lamenting what a totally SNAFU'd situation Greece is in, but takes off the table the only possible approach for other counties to avoid the same fate. And in fact advocates a strategy that will push a few others over the cliff sooner, or even cause a few to jump on their own (after all, if the punishment for spending your way into financial disaster is to get, as Drum recommends, all your debt forgiven and years of aid payments, why the hell would anyone want to be fiscally responsible?)

And it is amazing to me that he calls forgiving half their debt, the equivalent in the US of our creditors erasing about $7 trillion, as "a little bit of debt forgiveness" while cutting government spending a few percent of GDP is "a lot of austerity."

His solution, of course, is not for Greece to face up to its problems but to transfer the costs of its irresponsibility to others and then remain nearly perpetually on the dole.

His mistake is to assume Greece faces endless pain. It does not. History has shown that countries that are willing to rip off the bandage quickly rather than over a few decades can recover remarkably quickly if sensible policies are put in place. Heck, the Weimar Republic, which had inflation so bad people got paid 3 times a day so their family could buy something before the money became worthless a few hours later, got its house in order in a matter of months.