Posts tagged ‘Mark Perry’

Some Thoughts About Income Growth and Mobility Part 2: Hours of Work Matter More Than Wage Rates

In part 1, we discussed different ways of measuring income mobility and income growth for the poor, and discovered that many traditional measurement approaches are overly pessimistic -- when one focuses on actual individuals, instead of income quintiles, income for the poor has improved substantially.

Unlike some libertarians, I don't have a problem with intelligently structured income transfer and safety net programs to help the very poor. In fact, I believe that such income transfer programs can be far less distortive and economically inefficient that many other anti-poverty programs. One of the latter I will focus on in this article is the minimum wage.

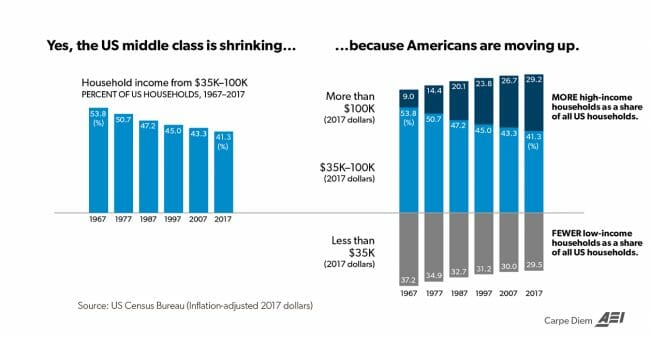

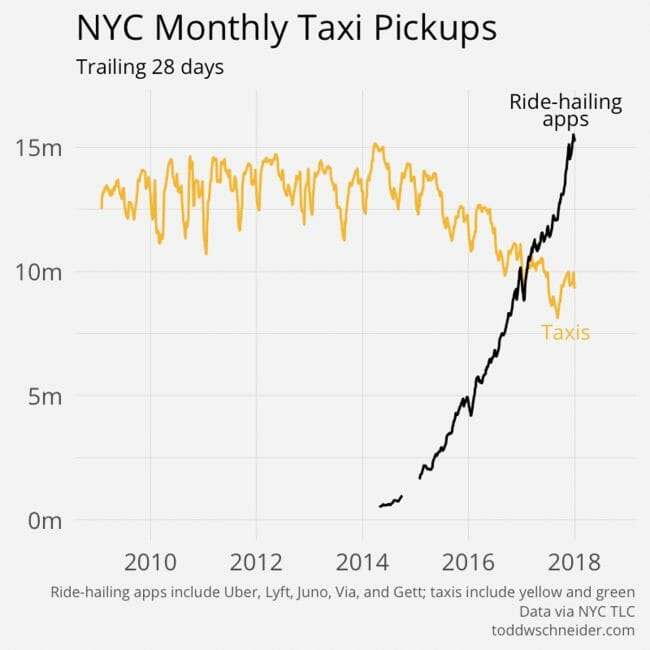

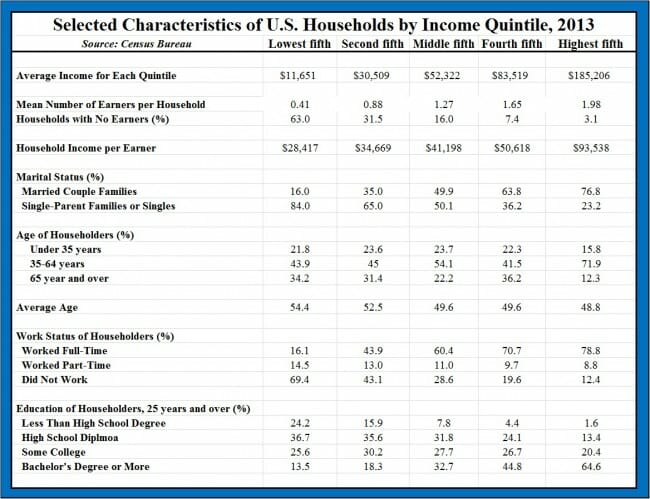

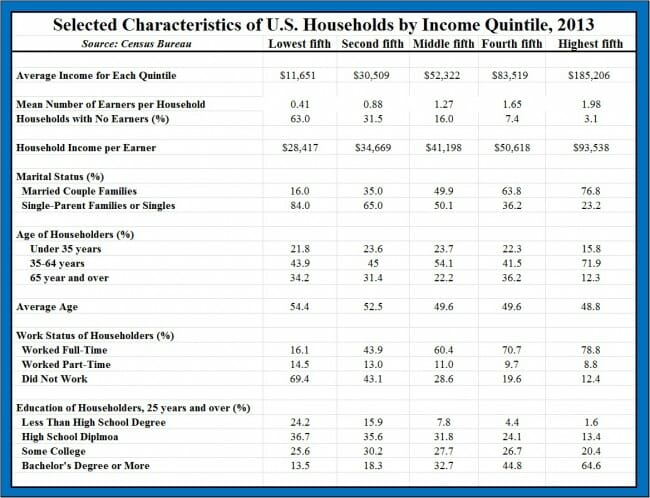

Each year, Mark Perry puts together an awesome demographic snapshot of how various income quintiles differ from each other. Here is his latest:

I want to first call your attention to the figures at the top for mean number of earners per household and household income per earner. Much of anti-poverty policy seems to be based on the assumption that poor people, because they lack bargaining power, get hosed on wages and other work rules. Public policy thus tends to focus on minimum wage and overtime rules and a myriad of other workplace interventions.

But in fact, if we compare the lowest quintile with the middle quintile in the chart above, we see something very different. What we see is the main difference is hours worked, not the relative wage rates. Let's consider two scenarios

- We keep the amount of work done the same, but raise the wage rates of the poorest quintile to the middle quintile. In this case, their average income would go up by about 50% from $12,319 to $18,654 (calculated as 0.41 mean earners times middle income per earner of $45,497).

- We keep wage rates the same but raise the amount of work done in the poorest quintile household to that of the middle quintile. In this case, their average income more than triples from $12,319 to $41,163 (calculated as 1.37 middle income earners times poor income per earner of $30,046)

So in this example, increasing the poor's wage rates to middle class levels yields $6,335 a year while increasing the poor's amount of work done to middle class levels yields $28,844 a year. Public policy that focuses on increasing work hours for the poor has 4.5 times the effect of public policy focused on wage rates. A corollary to this is that any public intervention on wage rates for the poor that has negative employment effects is likely to have little net effect on poverty.

But in fact this understates the relative benefits of approach #2. Look at the education levels in the poorest quintile vs. the middle. The poorest quintile has 2.5 times as many people without even a high school degree as in the middle. For these folks to progress, the only way they can develop skills is on a job and they can't do this without a job. Or said another way, another advantage of approach #2 and getting them more hours of work is that they gain more skills to overcome their starting disadvantage in education.

I wrote about this in the summer issue of Regulation magazine, in a article entitled "How Labor Regulation Harms Unskilled Labor." I argued that while likely intended to help the very poor, most labor regulation may be harming the poor, particularly those without skills or much experience, by making it harder and harder for them to find work. This not only impoverishes them, but makes it harder for them to progress to better jobs and higher income levels.

In my business,which staffs and operates public campgrounds, I employ about 350 people in unskilled labor positions, most at wages close to the minimum wage. I had perhaps 40 job openings last year and over 25,000 applications for those jobs. I am flooded with people begging to work and I have many people asking for our services. But I have turned away customers and cut back on operations in certain states like California. Why? Because labor regulation is making it almost impossible to run a profitable, innovative business based on unskilled labor.

Why is this important? Why can’t everyone just go to college and be a programmer at Google? Higher education has indeed been one path by which people gain skills and opportunity, but until recently it has never been the most common. Most skilled workers started as unskilled workers and gained their skills through work. But this work-based learning and advancement path is broken without that initial unskilled job. For people unwilling, unable, or unsuited to college, the loss of unskilled work removes the only route to prosperity.

...the mass of government labor regulation is making it harder and harder to create profitable business models that employ unskilled labor. For those without the interest or ability to get a college degree, the avoidance of the unskilled by employers is undermining those workers’ bridge to future success, both in this generation and the next.

Public policy could best help the poor by lowering the regulatory barriers to hiring unskilled labor and promoting economic growth that will help keep us close to full employment.

Part 1 of this series was here.

Postscript: This update on the Seattle minimum wage study is interesting. Note that this study is occuring near peak employment, a time when one would expect the minimum employment impact from a minimum wage increase. However, I do think the findings are roughly consistent with the discussion above:

In their latest paper, which has not been formally peer reviewed, Mr. Vigdor and his colleagues considered how the minimum-wage increases affected three broad groups: People in low-wage jobs who worked the most during the nine months leading up to and including the quarter in which the increase took effect (more than about 600 or 700 hours, depending on the year); people who worked less during that nine-month period (fewer than 600 or 700 hours); and people who didn’t work at all and hadn’t during several previous years, but might later work. The latter were potential “new entrants” to the ranks of the employed, in the authors’ words.

The workers who worked the most ahead of the minimum-wage increase appeared to do the best. They saw a significant increase in their wages and only a small percentage decrease in their hours, leading to a healthy bump in overall pay — an average of $84 a month for the nine months that followed the 2016 minimum-wage increase.

The workers who worked less in the months before the minimum-wage increase saw almost no improvement in overall pay — $4 a month on average over the same period, although the result was not statistically significant. While their hourly wage increased, their hours fell substantially. (That doesn’t mean they were no better off, however. Earning roughly the same wage while working fewer hours is a trade most workers would accept.)

It’s the final group of workers — the potential new entrants who were not employed at the time of the first minimum-wage increase — that Mr. Vigdor and his colleagues believe fared the worst. They note that, at the time of the first increase, the growth rate in new workers in Seattle making less than $15 an hour flattened out and was lagging behind the growth rate in new workers making less than $15 outside Seattle’s county. This suggests that the minimum wage had priced some workers out of the labor market, according to the authors.

“For folks trying to get a job with no prior experience, it might have been worth hiring and training them when the going rate for them was $10 an hour,” Mr. Vigdor speculated, but perhaps not at $13 an hour.

I would add as an aside that I think the NYT is being a bit arrogant an narrowly focused on money (vs. other benefits of employment) when they added the parenthetical phrase at the end of the third paragraph.

Failing at Fairness: Getting the Story 180 Degrees Backwards

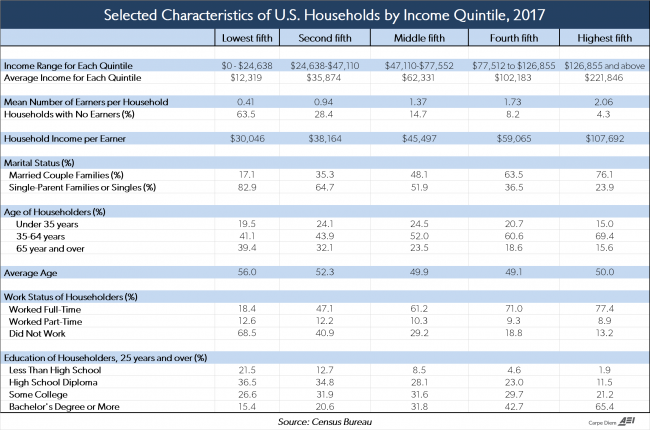

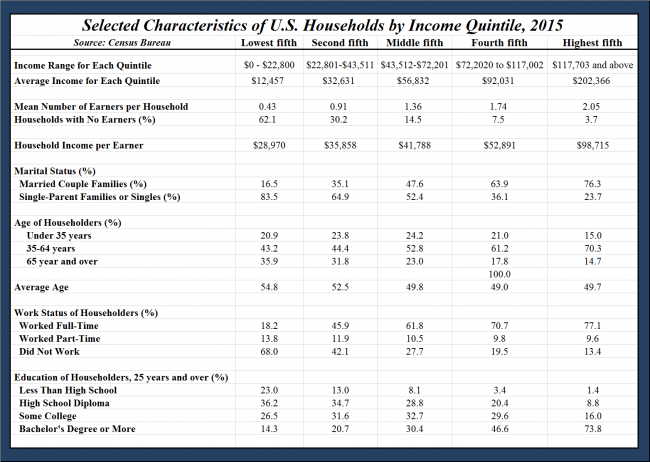

The other day the indispensable Mark Perry wrote:

....women have earned a majority of bachelor’s degrees for the last 36 years starting in 1982. Not shown here, but women previously earned a majority of associate’s degrees starting in 1978 and a majority of master’s degrees starting in 1981. By 2006, women earned a majority of doctoral degrees and the “takeover” of higher education by women was complete for degrees at all levels! But instead of declaring “victory” and moving on, many women are still claiming “victim status” in higher education with the need for special gender preferences in the form of funding, scholarships, centers, commissions, fellowships, awards, programs, and initiatives that are only available for women, or are primarily for women.

I have annotated his chart (shown below) to amplify his last sentence.

One of the seminal books on the topic of girls in education was "Failing at Fairness" by Myra P Sadker and published in 1994. The Google Books summary of the book is as follows:

Failing at Fairness, the result of two decades of research, shows how gender bias makes it impossible for girls to receive an education equal to that given to boys.

- Girls' learning problems are not identified as often as boys' are

- Boys receive more of their teachers' attention

- Girls start school testing higher in every academic subject, yet graduate from high school scoring 50 points lower than boys on the SAT

The book was very influential. I know it sat on my feminist wife's night table for quite a while. But note the publication date on Mark Perry's chart above. For kids in high school when that book was published, a fair median date for their college graduation would be 6 years later, or around the year 2000. It's fair to estimate that girls in high school at the time Sadker was writing were going to be 33% more likely to get a college degree than the boys in the same classes. Anyone who had read that book alone and nothing else on the topic would have called you a liar for predicting that.

Look, I have no doubt that one could easily put together a book about all the ways the public education system fails girls because I think the public education system in many parts of this country fails EVERYONE. But we seem to keep obsessively questioning whether we are doing enough for girls in education when the problem seems to be boys.

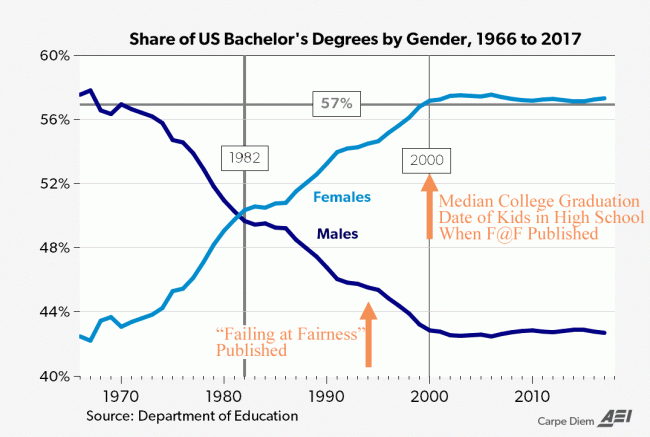

The New York Times actually talked about boys falling behind in education a few years ago, and had this telling chart about ways in which boys lagged in education. The article forced on poor boys, but note that boys of all socioeconomic classes lagged.

And this is before we even get to the most disturbing metrics about boys and girls, such as youth crime. While girls have closed the gender gap in crime somewhat, boys are still 10 times more likely than girls to be arrested for a homicide, and boys are more than twice as likely to be arrested for any sort of crime than girls (source). Remember that last mass shooter who was female? Neither do I.

I am not an expert on why this is. Shifting success norms from competition to cooperation, elimination of historic outlets for non-academic males like vocational programs, and huge amounts of money and counseling resources all dedicated to girls probably play a part. But the frustrating thing is you almost never see a discussion of this topic. Anyone who does try to address it is immediately pigeon-holed as some alt-right male rights extremist and defenestrated from the Overton Window.

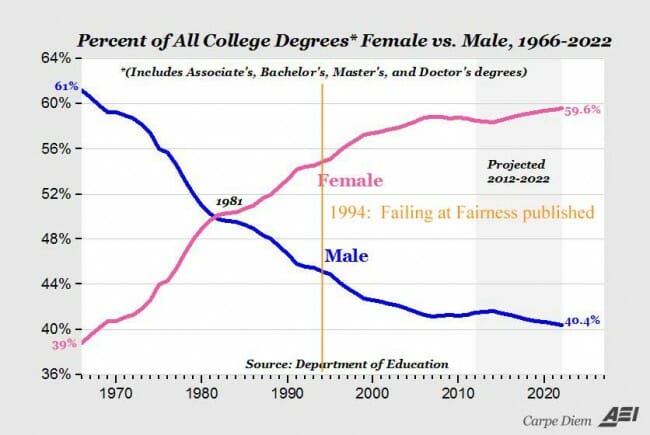

The Best New Technologies Don't Just Unseat Incumbents, They Grow the Market

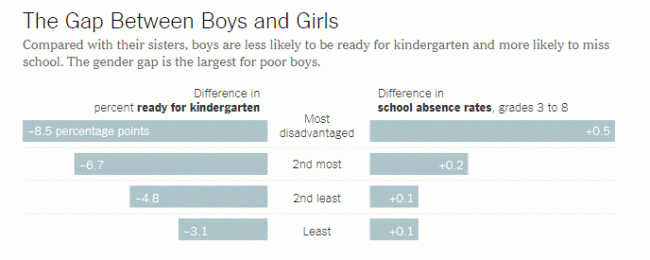

I love Mark Perry's blog but I think he missed an opportunity to point out something awesome in this chart:

We spend a lot of time discussing how Uber and its app-based peers are upending the traditional taxi monopoly. And no one enjoys seeing a government enforced crony monopoly overturned more than I. But let's not miss the other story here, which is the tremendous increase in customer well-being and mobility. Forget the mix for a second and add the two lines. Monthly passenger rides, which were stuck in the 12-13 million a month range for years, have almost overnight doubled to about 25 million rides with the advent of ride-hailing and the entry of many ordinary folks without taxi medallions into the drive-for-hire business. This is amazing!

Addressing the Pro-Tariff Arguments

Don Boudreaux and and Mark Perry have been doing a great job making the case against Trump's trade sanctions. But it is always a danger only to learn about opposing views from those who disagree with you, so in the spirit of Bryan Caplan's "Ideological Touring Test" I wanted to address directly some of the arguments in support of Trump's sanctions.

I followed several links to this article by Spencer Morrison. After reading the whole thing, I fear I have made the intellectual error of choosing a poor representative of the opposing side's argument, but I am committed now, so here goes.

Consider that China steals more than half a trillion dollars in American intellectual property every single year. This is one of the reasons America’s trade deficit with China is so massive. For example, in 2010 Chinese companies stole high-speed rail designs from American firms, thereby depriving them of hundreds of billions in potential revenues. Such theft occurs in nearly every industry, whether it’s software programs or branded consumer goods. And the worst part? We let it happen.

I find the author's figure absurd, and likely untrustworthy given his example. Following his high-speed rail design "theft" link one quickly finds that 1) Americans were not involved at all, which is not surprising since we really don't have high-speed rail manufacturing industry or expertise in this country; 2) the technology seems to have been acquired or copied legally; and 3) the real competitive issue for non-Chinese companies seems to be that the Chinese have extended and improved the technology.

This one paragraph essentially summarized the theme of the article, that technology is the key to increased well-being and that the US is poorer when they cannot monopolize the best technology. The first is true, the second is dead wrong and flies in the face of 200 years of history.

I won't spend time on the mass of the article where describes the economy in very production-based terms which I don't totally agree with, but his basic point is one I can partially accept -- that real economic growth over time comes from productivity growth. I agree that technology is part of the productivity equation, but unlike the author I also see other drivers such as trade (which he calls "noise"). Trade is a critical factor in productivity improvement as specialization and comparative advantage greatly increase productivity.

But where I think he really goes off the rails is to say that because technology is wealth-creating, we need to monopolize that technology in the US.

The core issue remains: we continue to offshore our advanced industries at an alarming pace, which will only increase the likelihood that the “next big thing” will be invented abroad. If we do not reverse this trend, we will soon be on the outside looking in.

It would be entertaining to discuss the origins of the American textile industry in the late 18th and early 19th century with the author, which were largely based on spinning jenny and powerloom designs that were literally stolen from manufacturers in the UK (countries don't own technologies, only individuals and their companies do). The UK at the time had strict technology export restrictions of which I am sure the author would have been approving.

So did the UK suddenly become poorer as America built a lively cloth industry? No, in fact the UK boomed along with the US. It turns out that spreading new technology and productivity techniques around more widely made everyone richer. This only makes sense. Would the West really be wealthier if they had kept all technology from spreading, and thus were surrounded by countries dominated by subsistence farming and medieval crafts? A skeptic might argue that the UK did eventually become poorer relative to the US and upstart Germany, but Andrew Carnegie could have told you why at the beginning of the 20th century. He went back and toured manufacturers in his old home and was horrified at how little they reinvested in new technology.

Which brings me back to Chinese high speed rail, the example he started with. Clearly the Chinese have a growing high-speed rail manufacturing industry, and they DIDN'T invent the technologies originally in China. This is what trade is all about. Rather than keep technologies locked up in a secret underground bunker in the Rockies, as the author seems to prefer, it spreads technologies around the world. Production then shifts around the world based on a variety of factors such as comparative advantage in ways that are hard to predict, but seldom has a strong relationship to the country in which the technology was first invented. One place production does NOT shift, though, is towards countries whose government has artificially raised critical raw material prices through border taxes on its consumers called tariffs.

Which reminds me, if the problem is China "stealing" things like high-speed rail technology, then why in the hell are we imposing steel and aluminum tariffs? What the heck does this have to do with technology transfer? In fact, if the US really had a high-speed rail industry we were worried about, or if one were exclusively concerned with the auto industry, the author is essentially telling them "we are sorry you had your technology stolen so to help you out we going to substantially raise the prices of your two largest purchases (steel and aluminum) so that you can be even less competitive internationally." Ahh, I can feel the economic growth from that already.

If the author wants better intellectual property protections for US companies and individuals, I am generally supportive of efforts to achieve this (as long as we don't over-specify intellectual property and end up again with endless patent troll suits). For all its flaws, though, joining the TPP seems to be a better path to this end (it actually addresses, you know, intellectual property protections rather than just raise steel prices for consumers).

To conclude, I love this quote from his article because, despite being anti-trade, he in fact is echoing the pro-trade observation by Steven Landsburg.

Yet our trade policy does exactly the opposite. After the North American Free Trade Agreement took effect in 1994, U.S. corn exports surged, as did our imports of automobiles. The problem is that automobile manufacturing is much more likely to benefit from disruptive technology than is growing corn—under NAFTA, the preponderance of long-run benefits went to Mexico, not the United States. The same is true with America’s trade relationship with China: America’s advanced goods trade deficit with China now tops $120 billion. Meanwhile, our biggest export is soybeans.

Free trade is, quite literally, turning America into China’s mercantile resource colony: we buy their value-added, manufactured products, and we sell them raw materials.

This is freaking awesome! We grow and sell soybeans and get back advanced technology products. Brilliant! No wonder we are the richest nation on Earth.

Postscript: So to save the time clicking through to Steven Landsburg, here is a part of what he said (via Carpe Diem):

There are two technologies for producing automobiles in America. One is to manufacture them in Detroit, and the other is to grow them in Iowa. Everybody knows about the first technology; let me tell you about the second. First you plant seeds, which are the raw material from which automobiles are constructed. You wait a few months until wheat appears. Then you harvest the wheat, load it onto ships, and sail the ships eastward into the Pacific Ocean. After a few months, the ships reappear with Toyotas on them.

International trade is nothing but a form of technology. The fact that there is a place called Japan, with people and factories, is quite irrelevant to Americans’ well-being. To analyze trade policies, we might as well assume that Japan is a giant machine with mysterious inner workings that convert wheat into cars. Any policy designed to favor the first American technology over the second is a policy designed to favor American auto producers in Detroit over American auto producers in Iowa. A tax or a ban on “imported” automobiles is a tax or a ban on Iowa-grown automobiles. If you protect Detroit carmakers from competition, then you must damage Iowa farmers, because Iowa farmers are the competition.

The task of producing a given fleet of cars can be allocated between Detroit and Iowa in a variety of ways. A competitive price system selects that allocation that minimizes the total production cost. It would be unnecessarily expensive to manufacture all cars in Detroit, unnecessarily expensive to grow all cars in Iowa, and unnecessarily expensive to use the two production processes in anything other than the natural ratio that emerges as a result of competition.

That means that protection for Detroit does more than just transfer income from farmers to autoworkers. It also raises the total cost of providing Americans with a given number of automobiles. The efficiency loss comes with no offsetting gain; it impoverishes the nation as a whole.

Confirmation Bias and the Morningstar Story in the WSJ

Like many folks, including Mark Perry, I would tend to agree with the following statements

- Past performance is not a very good indicator of likely future performance

- One should generally eschew managed funds in favor of low-cost index funds

However, I think a lot of folks who believe these same things are applying confirmation bias when looking at the data in a recent WSJ story on Morningstar. Morningstar analyzes mutual funds and rates them based on their past 1/3/5/10-years performance in relation to other funds of the same type. Funds in the upper quintile of past performance get 5 stars, the next quintile gets 4 stars, etc.

Morningstar is sort of coy about whether the ratings are supposed to have predictive value. They will say that of course they only measure past performance, but there would be no way to sell these ratings to folks for millions of dollars (as they do) without there being some implication the ratings were at least partially indicative of future performance.

So the WSJ did something interesting -- they went back 10 years and took all the 5 star funds and looked at how they have done since (as measured by Morningstar itself with its star ratings). So how many 5-star funds ten years ago actually had 5-star performance over the subsequent years, and so on. And it turns out that a lot of the 5-star funds have not performed very well. This is a good reminder to us all.

BUT. Look at their own data:

Yes, the 5-star funds from 10 years ago only average 3 today. Everything regresses towards the mean, as we random walk folks might expect.

But the 5-star funds did better than the 4, which did better than the 3, which did better than the 2, which did better than the 1. This actually understates the difference, because many of the lowest performing funds in the lower star categories closed in this 10 year period, so are not in the final metrics, which likely raises the scores of some of the lower buckets because they dropped out (59% of the 1-star funds closed or merged in this period while only 22% of the 5-star funds did so).

This is actually -- to someone who doesn't really buy into the whole stock-picking thing -- a pretty impressive achievement. I challenge you to take stocks or bonds or mutual funds of roughly the same type and divide them into 5 buckets, rank the buckets by expected performance, and actually have this ranking hold for 10 years.

Quick Thanks to Mark Perry

I know Mark Perry reads this blog from time to time, so I thank him for not hammering me (specifically) in his annual grammar day post. I actually do know all this stuff (and had a uselessly high score on my verbal SAT all those many years ago, though my kids claim it was a much easier test then) but I seem to be the worst proofreader in the world.

Trade and Consumer Advocacy, Part 2

Yesterday, I suggested we needed a new, real consumer advocacy organization to replace the economically ignorant Nader-led PIRG organizations. The reason is that it is time that consumers banded together and resisted Trump's protectionism, since such protection generally protects a few politically favored unions and corporations while raising prices and reducing choice for all consumers.

A couple of hours after I posted that, the absolutely indispensable Mark Perry brings us a great post on academic research about how protectionist actions nearly always cost consumers more than they help producers.

The empirical evidence above helps us to understand a very important economic lesson about international trade, call it “protectionist math” — and that mathematical reality is that the costs of protectionism imposed on American consumers in the form of higher prices and a reduction in trade will always be greater than the benefits generated for the protected industries and the workers in those industries. And here’s another part of that “protectionist math” that helps us answer the question: Sure, we can save US jobs with protectionist trade policies, but how much does it cost consumers for every job saved with protectionist trade policy, and is that cost worth it? Economic analysis and the empirical evidence presented above suggest that it’s very, very expensive to save US jobs with protectionism — more than half-a-million dollars on average per year per job in 2016 dollars (see chart above). If Trump enacts protectionist policies that save $50,000 per year US factory jobs but at a cost to consumer of $500,000 annually for each job saved, that’s a surefire formula to “Make America Expensive and Poor Again,” not “great again.”

I won't reprint his chart, but he has detailed results form a number of academic studies in different industries that back this statement up.

My point about needing a new consumer advocacy group was a little tongue in cheek, but here is Perry quoting from a study at the Federal Reserve Bank of St Louis a number of years ago (back during the last wave of protectionism, which was based on Japan rather than China bashing).

The primary reason for these costly protectionist policies relies on a public choice argument. The desire to influence trade policy arises from the fact that trade policy changes benefit some groups, while harming others. Consumers are harmed by protectionist legislation; however, ignorance, small individual costs, and the high costs of organizing consumers prevent the consumers from being an effective force. On the other hand, workers and other resource owners in an industry are more likely to be effective politically because of their relative ease of organizing and their individually large and easy-to-identify benefits. Politicians interested in re-election will most likely respond to the demands for protectionist legislation of such an interest group.

Why the Minimum Wage is A Bad Anti-Poverty Policy in One Chart

This is a regular chart used by Mark Perry, updated for the most recent data. It is one of my favorites.

Mark has a lot of great analysis of this data, too long to excerpt, so I refer you back to the link to see his comments. But I want to add one of my own.

Let me restate the numbers in this chart one other way to give a pretty stark view of utility of raising the minimum wage as a poverty program. Let's look at the first lowest vs. the second lowest quintile.

Raising current workers in the poorest quintile to second quintile earnings ($28,970 to $35,858) would increase the first quintile's average income by $2,962. On the other hand, keeping first income wages flat but raising first quintile household's average earners to second quintile number of earners (0.43 to 0.91) increases the first quintile's average income by $13,905.

By this analysis, increasing first quintile hours worked (and % employment) has 4.7 times more leverage than fiddling with wage rates.

So now consider raising the minimum wage, which will raise some wages but reduce unskilled employment -- it is exactly the wrong thing to do, even before we consider that the majority of minimum wage earners who benefit from such an increase and keep their jobs are not in the lowest quintile but are 2nd and third earners in rich and middle class households.

Anatomy of Activism

There is one thing that activists can never, ever do: declare victory and go out of business. For activists, their chosen problem is always worse than ever and continuing to go downhill.

Here is an example, the book "Failing at Fairness," written in 1994 to make the case that education was failing girls. Here is one summary of the book:

Drawing on findings from 20 years of research on sexism in American classrooms, this book examines the history of women's education and its shortcomings. The hidden curriculum, the effect of gender bias on self-esteem, test results, and professional orientation of girls from primary education through college were examined through naturalistic observation. The results suggest that girls are systematically denied opportunities in areas where boys are encouraged to excel, often by well-meaning teachers who are unaware that they are transmitting sexist values. Girls are taught to speak quietly, to defer to boys, to avoid math and science, and to value neatness over innovation, appearance over intelligence. In the early grades, girls, brimming with intelligence and potential, routinely outperform boys on achievement tests, but by the time they graduate from high school they lag far behind boys--a process of degeneration that continues into adulthood.

All of this will seem familiar, as women's groups typically claim that things have gotten worse on all of these fronts since 1994. I have no doubt that these flaws exist, along with many others, in the government education system. You certainly won't get me defending the public schools. But I thought of this book today when I saw the chart below from Mark Perry, which I annotated with the publication date for Failing at Fairness:

It takes some work to look at this situation and decide that the main issue you want to highlight is how girls are getting hosed. But trust an activist to be up to the task.

Postscript: This seems relevant (it has been around the net for a while, so I don't know what source to link, sorry)

How True

from Mark Perry

Raising the Cost of Hiring Unskilled Workers by 50% is A Bad Way to Fight Poverty

After my prior post, I have summarized the chart I included from Mark Perry to the key data that I think really makes the point. Household income is obviously a product of hours worked and hourly wages. Looking at the chart below, poverty seems to be much more a function of not working than it is of low wages. Which makes California's decision to raise the price of hiring unskilled workers by 50% (by raising their minimum wage from $10 to $15) all the more misguided.

Note the calculations in the last two lines, which look at two approaches to fighting poverty. If we took the poorest 20% and kept their current number of hours worked the same, but magically raised their hourly earnings to that of the second quintile (ie from $14.21 to $17.33), it would increase their annual household income by $2,558, a 22% increase (I say magically because clearly if wages are raised via a minimum wage mandate, employment in this groups would drop even further, likely offsetting most of the gains). However, if instead we did nothing to their wages but encouraged more employment such that their number of workers rose to that of the second quintile, this would increase household income by a whopping $13,357, a 115% percent increase.

From this, would you logically try to fight poverty by forcing wages higher (which will almost surely reduce employment) or by trying to increase employment?

Why The Minimum Wage Does Not Make Moral Sense: Unemployment, Not Low Wage Rate, Causes Most Poverty

In response to his new $15 minimum wage in California, Governor Jerry Brown said:

Economically, minimum wages may not make sense. But morally, socially, and politically they make every sense because it binds the community together to make sure parents can take care of their kids.

Let me explain as briefly as I can why this minimum wage increase is immoral. We will use data from the chart below which was cribbed from Mark Perry in this post.

The average wage of people who work in the poorest 20% in the US is already near $15 ($28,417 divided by 2000 full time hours - $14.20 per hour). This is not that much lower than the hourly earnings of those in the second poorest or even the middle quintiles. So why are they poor? The biggest different is that while only 16% of the middle quintile households had no one who worked, and 31.5% of the second poorest quintile had no one who worked, of the poorest 20% of households a whopping 63% had no one who worked. Only 16.1% of poor adults had a full time job.

The reason for poverty, then, is not primarily one of rate, it is one of achieving full time employment. Many of these folks have limited education, few job skills, little or no work experience, and can have poor language skills. And California has just increased the cost of giving these folks a job by 50%. The poor will be worse off, as not only will more of them miss out on the monetary benefits of employment, but also the non-monetary ones (building a work history, learning basic skills, etc.)

Past studies have shown that most of the benefit of the minimum wage goes to non-poor households (ie second and third earners in middle class homes). The targets Jerry Brown speaks of, parents earning the minimum wage to take care of families, are perhaps only 1/8 of minimum wage earners.

MaCurdy found that less than 40% of wage increases [from a minimum wage hike] went to people earning less than twice the poverty line, and among that group, about third of them are trying to raise a family on the minimum wage.

Of course, the price of a lot of stuff poor people have to buy in California is about to go up. We are going to have to raise our campground rates by 20-25% to offset the labor cost increase. But that is another story.

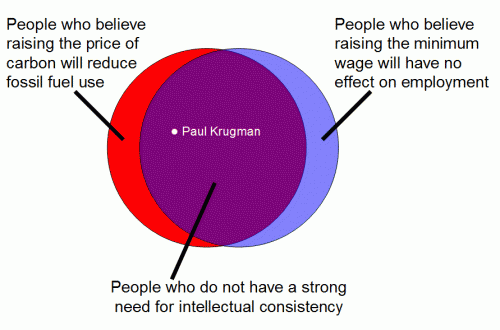

Mark Perry's "Best of Venn Diagrams" .... But Where Did They Start?

Mark Perry loves to use the Venn diagram format to point out hypocrisy or inconsistent arguments. He has a sort of best-of post with 12 of them here.

I am actually fairly certain the first one of these actually appeared here, on Coyote Blog. This was the chart I made:

Update: Good lord I wrote Rick Perry instead of Mark Perry. I am officially going senile. Sorry Mark.

Another Trump Triumph -- He Has The Left Defending the American Economic System

The American Left generally spends most of its time telling us how much better things are in Denmark or France. I can't find a lot of reasons to like Trump, but he has apparently convinced the Left that they need to defend the American economic model against other countries. This post by Kevin Drum at Mother Jones reasd more like what one might expect from Mark Perry at AEI.

"We're a poor country now." I wonder how many people believe that just because Donald Trump keeps saying it? In case anyone cares, the actual truth is in the chart on the right. There's not a single country in the world bigger than 10 million people that's as rich as the US.

I agree! In fact, not only are American rich richer, but the American middle class is richer and the American poor are richer. From an earlier post, here is the purchasing power of individuals across the income spectrum in the US vs. Denmark

Where's Coyote

Well, it is time for many of our seasonal operations to open over the next few weeks so I have been running in circles on business issues. Also, I must confess that blogging is becoming a sort of Groundhog Day (the movie) experience, with the same arguments circling over and over. How many more times can I write, say, a long article about how minimum wage increases are a terrible anti-poverty program only to get one line emails asking me why I hate poor people. So blogging will be light as I do real world work and try to recharge.

I will leave you with one note of optimism, from Mark Perry. I went to college in the nadir (1980) of the American beer industry, where a small oligopoly of mediocre beer producers was protected by government legislation. It was a classic example of how regulation drives monopoly, consolidation, and loss of choice. With deregulation, the American beer industry has exploded.

As an aside, my current go-to beer is actually Brazilian, Xingu Black

Poverty and the Minimum Wage

Mark Perry had this chart on the demographics of income distribution. From it, I want to draw a couple of conclusions about minimum wage and poverty

Note the household income per earner for the lowest quintile. It equates to something over $14 an hour, well above minimum wage almost everywhere in the US and nearly as high as the $15 national minimum wage proposed as an anti-poverty program.

The problem with most poor households is not wage rate, it is getting full time work. The household income per earner is nearly as high as the average income of the second quintile. The problem is that most poor households do not have full-time earners. The key stat is that only 16% worked full-time and only 30% had any sort of job at all.

This is what always amazes me about the minimum wage discussions. An increased minimum wage doesn't address the root problem of poverty at all, and in fact will tend to make it worse by pricing the 85% of the poor who need a job or need more hours out of the job market. If they can't find a job at $8, it is the purest insanity to think they will have a better chance with their limited skills of finding a job at $15.**

**Postscript: I suppose there is one set of facts that would lead to a minimum wage increasing employment in this lowest quintile: If people who don't work in this quintile are not seeking work because they are happy to live on government benefits and other sources of charity. This would imply that the reason they are not working full-time is not because no work is available but because they choose indolence. If this were the case, then a rising minimum wage would provide enough incentive, I suppose, for some to get off the couch and go to work. I am reluctant to buy into this explanation, but I am SURE that those on the Left who promote the idea of rising minimum wages increasing employment would not accept these assumptions.

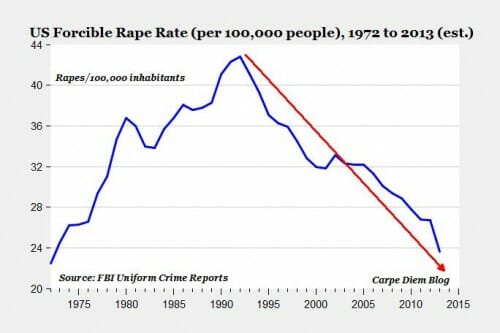

Trend That Is Not A Trend: Rape Culture

I suppose one could argue that there is some change in reporting rates, since rape is well-know to be an under-reported crime. However, I would struggle to argue that under-reporting rates are going up (which is what it would take to be the prime driver of the trend above). If anything, my guess is that reporting rates are rising such that the chart above actually understates the improvement.

PS- Folks commenting on this post saying that by reporting a declining trend I demonstrate that I don't care about rape or don't treat it seriously are idiots. I have lived through dozens of data-free media scares and witch hunts -- global cooling, global warming, the great pre-school sexual abuse witch hunt, about 20 different narcotics related scares (vodka tampons, anyone?). Data is useful. In this case, knowing there is improvement means we can look for what is driving the improvement and do more of it (though Kevin Drum would likely attribute it to unleaded gasoline).

"Trend that is not a trend" is an occasional feature on this blog. I could probably write three stories a day on this topic if I wished. The media is filled with stories of supposed trends based on single data points or anecdotes rather than, you know, actual trend data. More stories of this type are here. It is not unusual to find that the trend data often support a trend in the opposite direction as claimed by media articles. I have a related category I have started of trends extrapolated from single data points.

Holy Cr*p!

Four things I would do to help African Americans

- Legalize drugs. This would reduce the rents that attract the poor into dealing, would keep people out of jail, and reduce a lot of violent crime associated with narcotics traffic that kills investment and business creation in black neighborhoods. No its not a good thing to have people addicted to strong narcotics but it is worse to be putting them in jail and having them shooting at each other.

- Bring real accountability to police forces. When I see stories of folks absurdly abused by police forces, I can almost always guess the race of the victim in advance

- Eliminate the minimum wage (compromise: eliminate the minimum wage before 25). Originally passed for racist reasons, it still (if unintentionally) keeps young blacks from entering the work force. Dropping out of high school does not hurt employment because kids learn job skills in high school (they don't); it hurts because finishing high school is a marker of responsibility and other desirable job traits. Kids who drop out can overcome this, but only if they get a job where they can demonstrate these traits. No one is going to take that chance at $10 or $15 an hour**

- Voucherize education. It's not the middle class that is primarily the victim of awful public schools, it is poor blacks. Middle and upper class parents have the political pull to get accountability. It is no coincidence the best public schools are generally in middle and upper class neighborhoods. Programs such as the one in DC that used to allow urban poor to escape failing schools need to be promoted.

** This might not be enough. One of the main reasons we do not hire inexperienced youth, regardless of wage rates, is that the legal system has put the entire liability for any boneheaded thing an employee does on the employer. Even if the employee is wildly breaking clear rules and is terminated immediately for his or her actions, the employer can be liable. The cost of a bad hire is skyrocketing (at the same time various groups are trying to reign in employers' ability to do due diligence on prospective employees). I am not positive that in today's legal environment I would take free labor from an untried high school dropout, but I certainly am not going to do it at $10 an hour when there are thousands of experienced people who will work for that. Some sort of legal safe harbor for the actions of untried workers might be necessary.

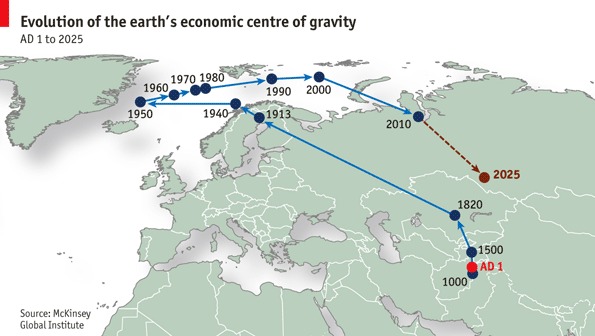

Wealth and China Through History

The media tends to talk about the growth of the Chinese economy as if it is something new and different. In fact, there probably have been only about 200 years in the history of civilization when China was not the largest economy on Earth. China still held this title into the early 18th century, and will get it back early in this century.

This map from the Economist (via Mark Perry) illustrates the point.

Of course there is a problem with this map. It is easy to do a center of gravity for a country, but for the whole Earth? The center in this case (unless one rightly puts it somewhere in the depths of the planet itself) depends on arbitrary decisions about where one puts the edges of the map. I presume this is from a map with North America on the far left side and Japan on the far right. If one redid the map, say, with North America in the center, Asia on the left and Europe on the right, the center of gravity would roam around North America through history.

Good News of the Day

I reached drinking age (mercifully 18 in those days) in 1980 and I can tell you from experience that the early 80's were a beer wasteland. Spent a lot of time learning foreign beers at a great little pub I discovered entirely by accident called the Gingerman in Houston (near Rice University). The beer landscape in the US today is awesome by comparison.

Let's Ban Exports of Dow Chemical Products

I have written before that trade policy is generally ALL corporate cronyism -- tariffs or restrictions that benefit a narrow set of producers at the expense of 300 million US consumers.

Mark Perry has yet another example, though with a small twist. Most corporations are looking for limits on imports of competing products and/or subsidies for their own products exports. In the case of Dow Chemical, they are looking for limits on exports of key inputs to their plants, specifically oil and natural gas. CEO Andrew Liveris wants to force an artificial supply glut to drive down his input prices by banning the export (or continuing to ban the export) of natural gas. If gas producers can't sell their product? Tough -- let them try to out-crony a massive company like Dow in Washington.

But here is the irony -- there is absolutely nothing in his logic for banning natural gas exports that would not apply equally well to banning the export of his own products. Like natural gas, his products are all inputs into many other products and manufacturing processes that would all likely benefit from lower prices of Dow's products as Dow would benefit from lower natural gas prices.

So here is my proposal -- any company that publicly advocates for banning exports for its purchases must first have exports of its own products banned.

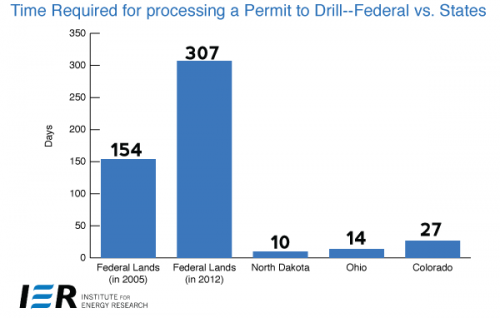

Oil Drilling (or Lack Thereof) on Federal Lands

Via Mark Perry. This issue came up in the debates, when Obama claimed that he tried to take credit for the recent oil and gas boom, when in fact all of the boom is occuring on public lands (oil and gas production on federal lands is actually falling during this boom). Here is one reason whyL

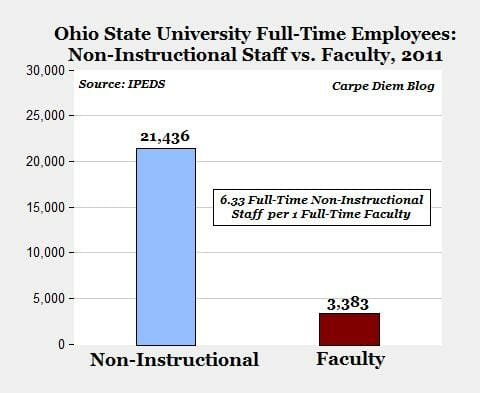

Administrative Bloat

Administrative bloat is a natural tendency of organizations. I am not entirely sure why, though I understand some of the drivers. Never-the-less, I have seen it in nearly every organization I have worked in or consulted for.

Even the best-run private companies still have this problem. To remain competitive, then, they have to come through every few years and wield the ax on these growing staffs, almost like trimming back a hedge that keeps trying to overgrow your house. I spent a depressing amount of time as a consultant helping them. It is uncomfortable, sometimes heartbreaking work, and one wonders the whole time why there is not some better way to keep staff in check. To my mind, there is a still a great academic work to be written on this topic some day.

The alternative, in organizations that can get away with it, is administrative bloat. Like, for example, in this public institution:

That staff adds up to an incredible billion dollars in administrative salaries, or nearly $21,000 a year per full-time student. And remember, if this is just salaries, the actual cost is much higher because they all need offices, supplies, travel, etc.

College Grade Inflation

Apparently the news of the week is that the letter grade "A" is now the most common. Mark Perry has more on college grade inflation.

I am actually a fan of the grading system at Harvard Business School when I was there. 15% of the students in each course get the top grade (category I) -- no more, no less. 10% get the bottom grade (category III) -- again by rule, no more and no less. All the rest are in the middle. It effectively acknowledges that for most folks, the point is to demonstrate you have satisfactorily learned the course material, while still allowing folks to distinguish themselves on both ends. Budding young executives who complain that it is unfair to automatically "fail" the bottom 10% of each course are reminded that this is exactly how many Fortune 500 companies run their HR systems, seeking to constantly weed out the bottom 10%.

Update: The argument usually is that students need high grades to compete with other kids from grade-inflated schools in the marketplace. I just don't think this is true. Colleges themselves deal with this all the time in admissions. When they get a high school transcript, attached to that transcript is a fact sheet about the high school that gives its distribution of grades. That way the recipient can discount the GPA as appropriate. Every company doing hiring should demand the same of colleges.

Here is a personal anecdote. My son Nic's school grades hard. Something like 2 kids over the last 2 decades have graduated with a 4.0. One could argue my son's grades could have been higher at another school, but knowledgeable consumers of high school GPA's know how our school works and we have never felt he somehow was at a loss due to the school's grading policies (but Oh God can type A parents fret about this incessantly among themselves). [edit: took out brag about my son. Nothing more boring than other people bragging on their kids.]