The Middle Class is Shrinking -- And That's a Good Thing

An important goal of Marxist thought is the proletarianization of the middle class -- to convince great numbers of people in the office worker and shopkeeper classes that they are not beneficiaries of a rising tide of success but are no better than coal shovelers in a boiler room, victims of capitalist oppression that need to join the revolution. It is impossible to view the recent mayoral election in NYC as anything but a sign of their success. People in NYC wail about how dehumanizing it is to sit in an office for 8 hours a day.

Socialists have been brilliantly successful at creating bad outcomes via institutions they control or policies they promote, and then blaming those bad outcomes on capitalism. Probably the most brilliant success has been the shittification of higher education. Socialist-controlled universities create sky-high expectations for their degrees, and reinforce these expectations with rampant grade inflation that makes every student feel like a success -- even when they do almost no work. Academics on the Left route students into degrees and classes with absolutely no economic value (e.g. Paraguayan Feminist Poetry) and then dump them into the world -- after loading them down with $250,000 or more of debt -- with no possible path to reaching the promised expectations or even paying off the debt. And when all this inevitably fails, the academic apparatchiks who live high on tuition money are quick to blame the failure on "capitalism." And since these schools no longer teach students much about reasoned engagement with difficult and complex ideas -- and in fact encourage emotional reasoning, virtue-signaling, and just wailing in anger on TikTok over logical argument -- voters respond that "yeah, it must be capitalism's fault."

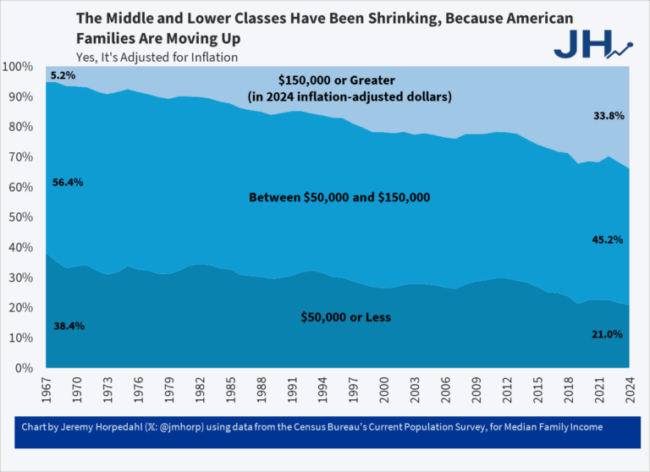

Anyway, in the context of all the turgid articles about the shrinking of the middle class and the failures of capitalism for the middle class, consider this which is all in 2024 $ (source):

Yes the middle class is shrinking -- because people in it are becoming richer. They are not (on average, certainly there are individuals who go up and down) getting poorer because the poorest band on this chart is shrinking even faster than the middle class. This is an enormous freaking victory for most everyone, but yet we are electing radical communists to tear down capitalism. Incredible.

Postscript: About a dozen years ago when my son was looking at colleges, like many parents I sat in a number of college admissions department presentations about the school. All these presentations were remarkably similar -- my kids and I started calling them the "how we are unique in the exact same ways every other school is unique" speeches.

But another thing I noticed quickly was all the encouragement of students that if they go to their school, they will all go out and change the world the moment they graduate. I guess it is good to be encouraging but this is a ridiculous expectation. Except for perhaps a half dozen kids a year across the whole country, no one changes the world at 22 with an expensive degree and little life experience. I have great respect for my son but at 22 he was happy to get a job with a beer company managing complex pricing lists and evaluating channel profitability. It was work that was of value to the company but it was certainly not changing the world. But he gained some great experience with data analysis, how to work in an organization, how to manage his time, etc. that were building blocks for better jobs or perhaps a future entrepreneurial excursion. He learned what he was interested in doing, which focused his future learning plan.

For myself, I eventually helped shape a new industry but I didn't even get started on that path until my forties. I had the opportunity to get fairly useful degrees at two renowned schools (Princeton engineer, Harvard MBA), but what I learned there was like 5%, at most, of the knowledge I used to eventually be successful.

Perhaps I am just old now and every older generation thinks this same thing, but haven't you noticed that many 22-year-olds that enter an organization today in an entry-level position seem to think they are in charge? I have been asked to speak to young people about school and careers and one of the things I tell them is that at 22 they are not going to be advising presidents, they are going to be updating pricing lists. And that is OK. Deliver value to the company and learn from it what you can. I think a lot of young people would be happier and in a better position to manage their learning and career if someone had just told them "your entry-level job is probably going to suck -- do a good job and work for something better."