No Comment Necessary

From the WSJ, via Carpe Diem

Dispatches from District 48

Posts tagged ‘recession’

From the WSJ, via Carpe Diem

Well, it looks as if the "stumulus" bill has passed, and its all over except for the conference committees (which will likely comprimise the House and Senate bills by adding a $100 billion or so).

There is just no way there can be a Keynesian muliplier above 1 for such spending. Even if someone could show me a theoretical example crafted for a particular economic situation with the best of all governments, there is simply no way this real-world government is going to spend the money that well. 500 geniuses with perfect incentives couldn't do it, and certainly the folks in Congress are not geniuses and have far less-than-perfect incentives.

So you ask, will we get any stimulative effect? I would answer: Just one. Obama and Congress will now shut the hell up trying to panic everyone into battening down the hatches for the worst economy in history, and folks can get a bit of breathing space to look around them and see that business opportunity is still there. This is $800 billion in hush money, a bribe we are paying Obama and Pelosi in the form of passing a lot of their pent up leftish wish list, in return for them taking some ownership interest in real economic health.

At what point do politicians bear some public accountability for their public statements and the effect those statements have on the economy? I almost want to ask Obama and Pelosi -- what is the minimum size of pork-spending bill you will accept so we can just go ahead and pay the money and get you and your cohorts to shut the hell up on trying to convince everyone we are in the Great Depression. Because, to some extent, such statements can be a self-fulfilling prophesy. Seriously, the biggest stimulative effect of passing this stimulus bill will be, almost without doubt, that it will end the felt need for Washington weenies to create an atmosphere of panic.

Now, I suspect that I would have a different observation if I lived in Detroit, but I ask every business owner or manager I meet for the personal evidence they have of economic cataclysm. Is their business down? And in a surprising number of cases, I get the answer that their business is doing OK, but they are cutting back because surely the worst is soon to come, based on everything they see in the media. And do you know what? I have done exactly the same thing. I had one bad month, but since then things have been pretty steady, but I am cutting like crazy anyway, because I can't ignore the only other information source I have on the economy, which are pronouncements in the media.

I strongly believe that public pronouncements of doom, starting last October with Henry Paulson and continuing now to almost daily excess by Obama (today's statement: the economy is in a "virtual free fall") have measurably contributed to job losses in this country. Many people who are on the street without a job today can probably trace their unemployment to "just in case" cuts made more in response to government assurances of doom as on actual declines in output.

I can't prove this, of course, but I will present one pretty good pointer that I might not be totally full of it. With the January jobs report, the recent recession has become one of the five worst since WWII in terms of jobs losses as a percentage of the work force (I know you may, from reading the paper and listening to Obama, think it is the worst, but it is still only the fourth or fifth worst). Let me compare the job losses and the output declines at this point in the recession for these 5 recessions:

As you can see, we have had far more job losses relative to output losses than any major post-war recession. This does not mean that more output losses are not coming, but it means that, perhaps unique to this recession, job losses are preceding rather than following output losses -- in other words, job losses are occurring more than in any other recession based on the expectation of output losses, rather than in reaction to them. I wonder who it is that is setting these expectations?

Wow, using panic to achieve political aims and in the process accelerating job losses. And they say we libertarians are heartless!

Data updated by the Minn. Fed here. They actually have job losses through 13 months, but I jused 12 months because there are only quarters for the output numbers.

Update: Via the Washington Times:

Just Friday, Mr. Obama said a report that 600,000 jobs were lost in January meant "it's getting worse, not getting better. ... Although we had a terrible year with respect to jobs last year, the problem is accelerating, not decelerating." Last week he said, "A failure to act, and act now, will turn crisis into a catastrophe."

But he isn't the only Democrat ramping up the rhetoric while talking down the economy. House Speaker Nancy Pelosi of California said last month that our economy "is dark, darker, darkest." Rep. David R. Obey of Wisconsin said, "This economy is in mortal danger of absolute collapse." And Sen. Claire McCaskill of Missouri said of the economic-stimulus bill, "If we don't pass this thing, it's Armageddon."

Barack Obama, in the Washington Post:

By now, it's clear to everyone that we have inherited an economic crisis as deep and dire as any since the days of the Great Depression

Sorry, maybe I am just cynical from having politicians call 8 of the last 3 recessions the worst economy since the Great Depression**, but I don't think this is the worst crisis since the 1930's. It's not even the worst since I was born. The late 70's were worse, the early 80's were worse, and from a financial/banking crisis point of view, the late 80's were worse.

What Americans expect from Washington is action that matches the urgency they feel in their daily lives -- action that's swift, bold and wise enough for us to climb out of this crisis.

Actually what I have come to expect is arrogance, a desire to turn any crisis into increased power for Washington, and general incompetence. So far, I have not been disapointed.

Our economy will lose 5 million more jobs. Unemployment will approach double digits.

OK, I will take that bet. 5 million more jobs with the base being the January employment numbers.

I won't get back into all the Keynsian arrogance in the rest of the piece -- suffice it to say that the overwhelming assumption is that the government can spend money more productively than can individuals. But check out this economic jumble:

In recent days, there have been misguided criticisms of this plan that echo the failed theories that helped lead us into this crisis -- the notion that tax cuts alone will solve all our problems; that we can meet our enormous tests with half-steps and piecemeal measures; that we can ignore fundamental challenges such as energy independence and the high cost of health care and still expect our economy and our country to thrive.

I reject these theories, and so did the American people when they went to the polls in November and voted resoundingly for change. They know that we have tried it those ways for too long. And because we have, our health-care costs still rise faster than inflation. Our dependence on foreign oil still threatens our economy and our security. Our children still study in schools that put them at a disadvantage. We've seen the tragic consequences when our bridges crumble and our levees fail.

Is he really implying that our economic problems were cause by use of fossil fuels, health care costs, aging bridges, and classrooms with out enough computers? Why yes, he seems to be saying just that. The rest of the piece is dedicated to just those things as a solution to the problem. Seriously, what does any of this have to do with a recession spurred by 1) banking liquidity crisis 2) loss of consumer new worth through falling home prices and 3) panicky statements by senior government officials. The answer, of course, is nothing. Basically Obama is pursuing the old "this crisis will be solved by all the piecemeal programs I was pushing before the crisis" argument.

I am sure there are folks who believe these things, if done well, might increase GDP 10 years from now, but is there anyone who really thinks this will create 3 million jobs in the next 18 months? I am reminded of the old joke, how do you make a million dollars in real estate? Start with 10 million. In the same vein, how does the government create 3 million new jobs? By destroying 5 million others.

By the way, speaking of bait and switch, these solutions Obama focuses on - health information, energy projects, school rebuilding, and highways - account for at most 6.5% of the total tax cuts and spending programmed by the stimulus bill for the first 2 years (34.1 of 525.5 billion, which is a bit outdated because it is based on a CBO report of last week, and has not kept up with the new pork added by Congress since then).

I just can't believe this guy actually represents change for people. To me, he sounds like a total flashback of every politician from the 1970s, who used to flail around with just this type of rhetoric. What's next, Whip Unemployment Now?

**Footnote I think I am going to try to trademark "Worst Economy Since the Great Depression" like Pat Riley trademarked "threepeat." Or maybe just trademark "WESGD." Here are a couple of past examples:

Clinton / Gore 1992: "Mr. Gore lambasted Mr. Bush for what he called 'the worst economic performance since the Great Depression'". The US unemployment rate peaked around 7.8% in 1992 and was headed down towards the 6's by the time Clinton was inaugurated. The 1991-1992 recession turned out to be one of the shortest on record.

John Kerry, 2004: "In his Sept. 2 speech in South Carolina, Kerry claimed the U.S. is suffering 'the greatest job loss since the Great Depression.'" The 2004 unemployment rate peaked at 5.8% and was headed down into the fours during Bush's second term. The 2003-4 recession was almost as short as the '92 recession.

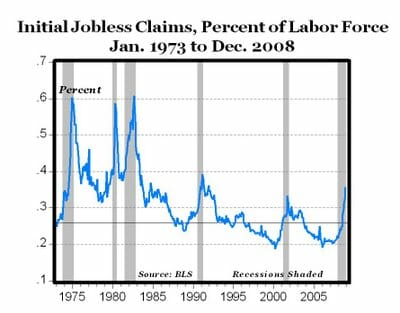

For perspective, via Carpe Diem, initial jobless claims as a percentage of the labor force:

The CBO is out with its scoring of the stimulus bill (pdf). Kevin Drum seems to think it refutes my statement that it would be impossible to have any kind of real infrastructure impact in the next 1-2 years. Drum says:

Specifically, they estimate that in the spending portion of the bill, $477 billion out of $604 billion would be disbursed either this fiscal year or in the next two fiscal years. That's 79% of the total.

I guess opinions can vary on this, but that strikes me as pretty good. What's more, most of the spending that comes in FY2012 or later is either for projects that simply take more than two years to complete (highways, school repairs) or infrastructure improvements that have long-term paybacks (renewable energy programs). There are a few other items in the out years that are more arguable, but they add up to a pretty small portion of the bill.

This is correct on its face. But here is the issue, and what drives me crazy about politicians and their enablers like Drum. This is being sold as an infrastructure bill. And even by Drum's admission, all the infrastructure spending is in the out years, well beyond any reasonable time frame for the recession.

Picking through the report, the "spending" (I object to calling tax cuts "spending") in the next two years, the recession window, is mainly in these categories ( I get slightly different numbers than Drum)

So do you see my point. The reason so much of this infrastructure bill can be spent in the next two years is that there is no infrastructure in it, at least in the first two years! 42% of the deficit impact in 2009/2010 is tax cuts, another 44% is in transfer payments to individuals and state governments. 1% is defense. At least 5% seems to be just pumping up a number of budgets with no infrastructure impact (such as at Homeland Security). And at most 6% is infrastructure and green energy. I say at most because it is unclear if this stuff is really incremental, and much of this budget may be for planners and government departments rather than actual facilities on the ground.

So don't call this an infrastructure bill. This is a tax cut and welfare bill, at least in 2010 and 2011. I guess I can understand a rush to do things like the welfare pieces, but that would argue for splitting the bill, into an emergency transfer payment appropriation and a infrastructure appropriation that can be studied and debated in more depth.

But that is never going to happen, because what we see is a unique kind of political synergy. The bundling of these two very difference spending streams gives yields two political advantages:

Update: The National Review has a lot more detail here.

The stimulus bill currently steaming through Congress looks like a legislative freight train, but given last week's analysis by the Congressional Budget Office, it is more accurate to think of it as a time machine. That may be the only way to explain how spending on public works in 2011 and beyond will help the economy today.

According to Congressional Budget Office estimates, a mere $26 billion of the House stimulus bill's $355 billion in new spending would actually be spent in the current fiscal year, and just $110 billion would be spent by the end of 2010. This is highly embarrassing given that Congress's justification for passing this bill so urgently is to help the economy right now, if not sooner.

And the red Congressional faces must be very red indeed, because CBO's analysis has since vanished into thin air after having been posted early last week on the Appropriations Committee Web site. Officially, the committee says this is because the estimates have been superseded as the legislation has moved through committee. No doubt.

In addition to suppressing the CBO analysis, Democrats have derided it. Appropriations Chairman David Obey (D., Wis.) called it "off the wall," never mind that CBO is now run by Democrats. Mr. Obey also suggested that it would be a mistake to debate the stimulus "until the cows come home." We'd settle for a month or two, so at least the voters can inspect the various Congressional cattle they're buying with that $355 billion.

The reason this is so was explained by yours truly last week. In short:

A year from now, any truly new incremental project in the stimulus bill will still be sitting on some planners desk with unfinished environmental impact assessments, the subject of arguments between multiple government agencies, tied up in court with environmental or NIMBY challenges, snarled in zoning fights, subject to conflicts between state, county, and city governments, or all of the above. Most of the money will have been spent by planners, bureaucrats, and lawyers, with little to show for in actual facilities.

Even with the government throwing money at it in multi-billion dollar chunks, GM seems to be sinking too fast for even the Treasury department to keep it afloat:

The target date for General Motors Corp. to get its second installment of government loans passed last week, but a top company executive says he expects the money to arrive in the next several days.

Fritz Henderson, GM's president and chief operating officer, said without the second installment of $5.4 billion, the company would run out of cash long before March 31.

In December, the Treasury Department authorized $13.4 billion in loans for GM and another $4 billion for Chrysler to keep both automakers out of bankruptcy. GM received $4 billion late last year and was to get $5.4 billion Jan. 16 and another $4 billion on Feb. 17, the day it is to submit its plan to show the government how it will become viable.

Henderson told the Automotive News World Congress in Detroit that the money is critically needed to pay its bills. He attributed the delay in receiving the second installment to the Treasury Department's workload and the change in administrations.

"If we don't get our second installment of the funding we'll run out of cash, it's that's simple," he said. "We've been finalizing what we need to do. We anticipate receiving it. But it's critical that we receive it."

The AP article above actually softpedals GM's money burn rate by saying GM received the first $4 billion "last year." While technically correct, the fact is that GM received the money "last month." So it appears that GM's burn rate may be as high as $4 billion a month, and that is before we necessarily even hit bottom in the recession. This should be absolutely unsurprising, as GM was burning through about $2.5 billion a month of cash pre-recession, when times were good.

It is just incredible that Congress and the Administration (old and new) are spending this much money to help GM management hang on to their jobs and to protect GM bondholders. GM assets are not going to go away in a bankruptcy, but they may end up in hands that are more capable of using them productively. Just to get one tiny glimpse of the incompetence at work here, note this:

Henderson also disagreed with United Auto Workers President Ron Gettelfinger who said on Monday that that a mid-February deadline for General Motors and Chrysler to complete their restructuring plans may be "almost unattainable" and that the automakers may have been set up to fail.

So, through the fairly strong economy of the last several years, GM has been burning through cash but did not see the need to have a restructuring plan (for most companies, having an operating cash flow deficit at the top of the business cycle is a pretty big red flag, but apparently not so at GM). GM managers showed up in Washington to demand taxpayer money, and still didn't have a plan. Chagrined, they showed up again to beg humbly for money, and they still didn't have a plan (and frankly lie about their likely cash burn rate). Three months later, in February, they may still not have a restructuring plan.

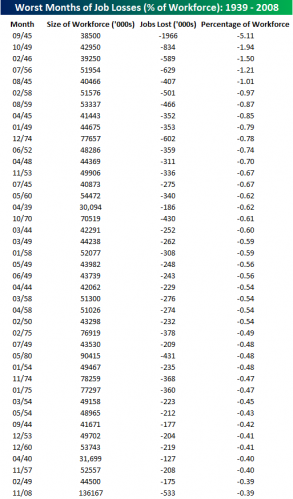

This was sent to me by a reader: Much as looking at percentage moves in the Dow is much more meaningful than looking at nominal points moves (500 points means a lot less when the average is at 10,000 than when it is at 1,000), it is useful to look at the recent jobs report in the same way. While 553,000 lost jobs is certainly a lot, it is only the 41st worst loss since WWII when looked at as a percentage of the workforce (and it would be much further down the list if we had similar metrics back into the 1930's and 1920's). Via Bespoke Investment Group:

This tends to confirm the statement I made last week, that this recession is likely worse than anything a 20-something Obama supporter can remember, but is not yet even close to some of the problem years of the 1970's, much less the 1930's.

By the way, it is interesting to see all those 1950's dates in there but no dates in the last 25 years, given there are many who have been writing about the current economy being so much riskier for workers than the 1950's.

MaxedOutMamma (an economist somewhere but she seems to only drop tantalizing clues as to where she plies her trade) is concerned:

I was troubled by how many people seemed to feel the economy wasn't in deep trouble. Profound skepticism and the belief that this is all media/political highjinks seem almost to be the consensus.

I guess you may have to put me in the majority. I certainly don't doubt that we are headed for a recession. And it would not surprise me if this is the worst recession that most 20-something Obama voters have experienced, though that is not saying much. But I am not sure we are even facing the Seventies in this one and we certainly are not facing the 1930s.

Here is the problem that we more casual consumers of economic news must struggle with -- the media has fairly accurately predicted 20 of the last 3 economic downturns. Everywhere you turn, you see analogies to the Great Depression, a period of time where unemployment topped 25%. Given the media's track record and the nearly breathless panic about the looming economic disaster, any sane person has to put a divide-by-X filter on economic news. It is certainly possible that I and other are using too large of an X as a correction factor, but is that my fault, or the fault of the purveyors of information who can't tell any story straight.

By the way, for us Polyannas, here are several interesting posts from Mark Perry

GM, as reported by Reason's Hit and Run, has actually already had something of a breakthrough in labor costs, at least for new employees:

The current veteran UAW member at GM today has an average base wage of $28.12 an hour, but the cost of benefits, including pension and future retiree health care costs, nearly triples the cost to GM to $78.21, according to the Center for Automotive Research.

By comparison, new hires will be paid between $14 and $16.23 an hour. And even as they start to accumulate raises tied to seniority, the far less lucrative benefit package will limit GM's cost for those employees to $25.65 an hour.

So this puts GM in the position of shoving experienced employees out the door as fast as they can, to make way for lower cost employees hired under this new deal. Apparently GM also has more flexibility to manage costs in a downturn. Good news, assuming they can accelerate a 20 year demographic transition to about 6 months, avoid giving away too much to these newer workers when times are good again, and arrest market share declines with better cars. Oh, and I presume the UAW has not abandoned seniority, which means that in recession-driven layoffs over the next year, GM must being by laying off these much cheaper younger workers. Layoffs will actually mix their labor cost upwards.

I still don't want to bail them out. Like numerous other industries, from steel to airlines, there is no reason GM shouldn't have to pass through Chapter 11 on the road to recovery. However, the argument that GM is turning a corner if we just give them a little help seems to be persuasive with many folks around me, so much so I am tempted to buy some GM stock as a way to go long on my prediction of the creeping corporate state.

Update: On the other hand, this is a sign that GM may be scraping the bottom of the barrel for cash:

Cash-strapped General Motors Corp. said Monday it will delay reimbursing its dealers for rebates and other sales incentives, an indication that the company is starting to have cash-flow problems....Erich Merkle, lead auto analyst at the consulting firm Crowe Horwath LLP, said GM wouldn't delay payments if it had enough cash.

In the third quarter of this year, GM's operations burned through $7.5 billion in cash, offset somewhat by asset sales and financing activities. But this is really a pre-recession burn rate. What will the burn rate be over the next 6 months? There is an argument to be made that $25 billion is not going to last even a year, particularly given the dynamic that layoffs will hit mostly the lower-cost workers, and a Democratic Congress and Administration that is handing over the money may well restrict GM's freedom of movement on layoffs anyway. I can see the Obama administration now -- don't lay them off, lets put them all in a factory making green energy, uh, stuff.

"I don't even think they've got 60 days," Merkle said. "Their cash position is probably getting pretty weak right now, and it's cutting into those minimum reserves that they need on hand."

The best way to mobilize people is to make them panic. That is why so many institutions have incentives to may you panic over the environment, or global warming, or the threat of terrorism, or the economy. In most cases (Naomi Klein's hypothesis not-withstanding) these folks want you to get so worried you will give up something, either money or freedom or both.

Some kind of recession at this point is unavoidable, I guess. But in fact, we really haven't seen what I would call a real recession since the early 1980's. We've had a really long run, and now its time to cut back on that spending and board up the financial windows for a little while. The economy has to de-leverage itself some, and that is going to slow things down for a while. People keep talking about the Great Depression, and I don't see it. I don't even think its going to be the 1970's.

The most visible symbol of financial problems seems to be the falling stock market. But all those companies in those indexes are the same ones that were there a month ago, and are still healthy and making money. The fall in the markets does not represent and change in the current health of industrial America. The lower prices reflect a changing expectation about those company's future prospects, but the folks driving the market are just guessing, and really, their guesses aren't really any better than yours or mine. Similar expectations drove oil up to $145 and now back down under $80. Wall Streeters work really hard to portray themselves as smarter than you or I, but they are not. I went to school with them. I know these guys. They aren't smarter, and they aren't any less susceptible to panic. In fact, because they are often highly leveraged and are worried about making payments on that new Jaguar they just bought for their mistress, they tend to be more easily stampeded.

In October of 1987, the stock market fell 22.6% in one day. If you date the current financial issues to about September 22, when the market closed around 11,000, then the market has fallen over these tumultuous weeks by 22.0% at last night's close -- dramatic, but still not as bad as the one day drop in '87.

Reader Tim Allen writes:

I wanted you to consider that in a recent previous post you had

mentioned that people are filling up their gas tanks before they

previously would, and they are filling up all their other cars, and

spare gas tanks because of the fear of not having enough necessary gas.

This is a market reality and is completely rational considering the way

the game's rules are set up (no gouging, as per the govt).I would like you to consider that I, as a small business man,

maxed out all my lines of credit and deposited the money in my bank

accounts. If fear is driving this market, and if it causes banks to dry

up credit, I want to be the first to be tanked up on money,

so-to-speak. The negotiated rate of interest is not high enough for me

to be disinclined to borrow, at least until this credit storm blows

over. I know I am not the first person to have this idea and I won't be

the last, and we (together) will create the situation that you think

can't happen. The tighter credit gets, the more people will borrow, if

just to have the cash on hand, to not need to borrow in the future.

I have done the same thing. I am maxed on my line of credit, because the interest rate is low and I would rather have the money in hand and pay the interest rather than find out later my line is somehow revoked or frozen. The money is not needed for near term expenses, but I want to have resources in hand if the recession creates a business opportunity that requires funding. Does this worsen the near term crunch, the same way panic buying of gas worsens local gas shortages? Probably. And again, price is the key. Like with gas, I would rather rationing by price rather than shortage. In other words, I would rather my line of credit go up to a 15% interest rate, if that what it takes to put things in balance, than to be revoked entirely so a few businesses can still have 6% money.

I have never said that letting banks fail was without cost. I just think the cost is going to be there, one way or another, and the cheapest and quickest solution is to let the whole mess sort itself out.

By the way, the notion that small business lives on short term credit is a hoot. ExxonMobil may have access to the commercial paper market on short notice, but borrowing for our company, even in good times, generally takes a panzer division and a long war of attrition. Even layup deals have taken me 6 months or more to finance. Stephen Fairfax, via Mises, makes this point:

None of the small business owners I know depend upon easy credit to

make their payroll. When things get to the point where you need to

borrow to pay your employees, the end is near. Most small businesses

fail in the first few years, in large part because business is not

easy, it is hard. Not everyone is good at it. But it is an essential

part of free trade and the market economy that businesses fail, so that

new, better ones can arise in their place.Few small businesses depend upon easy credit. Banks are generally

reluctant to lend to small businesses, with good reason. Most small

businesses are funded by owner's savings. Sometimes start-up money

comes from loans by parents or friends. While I can understand that

small businesses involved in building houses might profit from easy

credit, the market is sending unmistakable signals that there are too

many houses that are too expensive. Flooding the system with still more

easy credit can't be the cure, it is the problem.

It is always dangerous to argue with the insane, but I am actually willing to answer Lou Dobbs question:

And what I can't quite figure out amongst these geniuses who are

so-called free traders is, why do they think that about a 35 percent to

40 percent undervaluation of the Chinese yuan to the dollar is free

trade? Why do they think 25 percent duties in tariffs on American

products entering China is free trade?

I will leave aside the question of how he or anybody else knows the yuan is undervalued by this much. I will accept his premise on the basis that we know the Chinese government spends money to keep the yuan lower than it might be otherwise. Here is my answer:

Yes, it is not perfectly free trade. But we let it continue because the freaking Chinese government, its consumers, and its taxpayers are subsidizing Americans. The Chinese government is making all of its consumers pay higher prices and higher taxes just so American consumers can have lower prices. Napoleon advised that one never should interrupt an enemy when he is making a mistake -- after all, this same strategy managed to earn Japan a decade and a half long recession. Our correct response is not tariffs, it is to say, "gee, thanks." This is for the Chinese people to stop, not our government.

Why is China doing this? Because it government is using monetary policy to help out a few favored exporters who have political influence at the expense of all of their consumers and exporters. And Lou Dobbs wants the US to respond exactly the same way, to punish our consumers to favor some of our favored politically-connected exporters so the Chinese consumers can have lower prices. Great plan. Is Lou Dobbs an Chinese agent?

I thought this was pretty funny, via TJIC. The Fed apologizes for the Great Depression:

Ben Shalom Bernanke (born December 13, 1953)"¦ is an American

macroeconomist who is the current Chairman of the Board of Governors of

the United States Federal Reserve ("the Fed")"¦On Milton Friedman's Ninetieth Birthday, Nov. 8, 2002 he

stated: "Let me end my talk by abusing slightly my status as an

official representative of the Federal Reserve. I would like to say to

Milton and Rose: Regarding the Great Depression. You're right, we did

it. We're very sorry. But thanks to you, we won't do it again.""¦

The quote is from Wikipedia, so I take it with a huge grain of salt. Anyone have a link to another source, because the quote is pretty funny. Good to see the government take responsibility for the economic messes it creates, even if 75 years late. Of course, 75 years after the Hawley-Smoot tariffs helped throw a recession into the Great Depression, Congress is about to launch us down the same protectionist path, so don't give the feds too much credit.

I was wondering this morning if I could turn public opinion against penicillin. After all, hundreds of people die every year from taking penicillin. If I ran a newspaper, every day I could feature another heart-rending story about a small child or a single mother with four kids dieing from a penicillin allergy. Sure, some heartless fools who don't understand these poor people's suffering will say that penicillin is a net benefit. But that will be easy to counter - I'd ask them to show me who was saved. Sure, lots of people take it, but how can you prove they would have been worse off without it? How can you prove how many people would have died without it? I would have an easy time, because the victims of penicillin are specific and very visible, and the beneficiaries are dispersed.

I thought of this analogy while I was reading Jon Talton's column on the front page of the Arizona Republic business section celebrating the Democratic victory in Congress because we may finally be able to get rid of this awful free trade stuff. As an aside, Talton has always been an interesting choice as the primary business columnist int he Republic, given that he doesn't really feel bound by the teachings of economics and he really does not like business. His socialist-progressive formulations may be appropriate somewhere in the paper, but seem an odd choice for lead business columnist, sort of like finding a fundamentalist evolution denier, who still accepts Archbishop Usher's age of the earth, as lead science columnist.

I would fisk Talton's column in depth, but he doesn't really say anything except throwing together a hodge-podge of progressive rants against globalization (CEO pay, China, decimation of manufacturing -- he's got everything in there). Like most progressives, he extrapolates flatness (not even declines, but flatness!) from 2001-2004 and declares that the world economy has changed and he has seen a major macro-economic trend (no mention of how the business cycle and recession we had in the same period might have affected things).

I will just take on one piece, where he says:

Americans were assured that new trade accords and China's membership in

the World Trade Organization would mean better living standards for

American workers. That's because China and other countries supposedly

would buy American exports.

Economists, what grade does Mr. Talton get? F! Because he demonstrates that he does not understand the economic argument for trade. Because the argument does not actually require that foreign countries buy our exports for us to be better off with trade. Comparative advantage says that even imports alone help our economy, allowing us to purchase inputs more inexpensively and refocus our domestic labor on tasks which we do comparatively better.

The second fallacy with his statement is that export numbers grossly understate the amount of goods and services that foreigners buy from us. Exports are only the goods they buy from us and take back to their country. But foreigners buy many goods from us and use them in the US (say to build a factory or as an investment or financial instrument) and these foreign purchases of American goods don't show up as exports. As long as the US is the safest and most stable country in the world, we will probably always run a trade deficit, as foreigners will continue to want to keep the goods and financial instruments they buy from us in the US where these assets are safer. I wrote a lot more about this topic, and the recycling of dollars from China, here.

Finally, implicit in this anti-globalization view of trade is an assumption that the economy is zero-sum -- ie, there is sort of a global fixed pool of jobs, and if China gains steel market share and employment, the US net loses employment. I have taken on this zero-sum mentality before, but it is particularly wrong-headed in this case. Historically, the argument makes no sense. For example, the automation of the farm sector wiped out 80 or 90% of the farm jobs in the US over the last century. By the zero-summers logic, we should be impoverished. Instead, these people were redeployed to manufacturing and service jobs that create far more wealth than the old 19th century farm employment. But while people can sort of accept this historically, they can never accept this in real-time. But the fact is that when we lose, say, a textile job to foreign competition, we not only gain because everyone pays less for textiles and thus has more money to spend on other things, but that worker gets redeployed over time to higher-value functions. Look at the old textile belt in North Carolina - what's there now? Electronics and Bio-tech.

The problem with trade is very like the one in the penicillin analogy -- it is all-to-easy to identify the few short term losers, who lost their job in American industries that can't compete with foreigners, but all-too-hard to find the huge dispersed benefits from lower prices and the continuing creative destruction that comes with strong competition. This doesn't mean that individuals lives aren't disrupted, but it does mean that it's short-sighted to the point of being a Neanderthal to use these disruptions as an excuse to throttle free trade, just as it would be short-sided to ban penicillin because some people have allergic reactions.

It will be interesting to see if the Lou Dobbs populists rule the day on this issue. If so, they it will be ironic that it is the Democrats, not the Republicans, who take the first major steps to dismantling the work of Bill Clinton (because it sure as heck hasn't been GWB supporting free trade).

My prior posts on why you should stop worrying and learn to love the trade deficit are here and here and here and here. I also looked at trade with China from the other side, and found it is China that should be mad about their government's trade policies and currency manipulation, not us:

It is important to note that each and every one of these

government interventions subsidizes US citizens and consumers at the

expense of Chinese citizens and consumers. A low yuan makes Chinese

products cheap for Americans but makes imports relatively dear for

Chinese. So-called "dumping" represents an even clearer direct subsidy

of American consumers over their Chinese counterparts. And limiting

foreign exchange re-investments to low-yield government bonds has acted

as a direct subsidy of American taxpayers and the American government,

saddling China with extraordinarily low yields on our nearly $1

trillion in foreign exchange. Every single step China takes to

promote exports is in effect a subsidy of American consumers by Chinese

citizens.This policy of raping the domestic market in pursuit of exports

and trade surpluses was one that Japan followed in the seventies and

eighties. It sacrificed its own consumers, protecting local producers

in the domestic market while subsidizing exports. Japanese consumers

had to live with some of the highest prices in the world, so that

Americans could get some of the lowest prices on those same goods.

Japanese customers endured limited product choices and a horrendously

outdated retail sector that were all protected by government

regulation, all in the name of creating trade surpluses. And surpluses

they did create. Japan achieved massive trade surpluses with the US,

and built the largest accumulation of foreign exchange (mostly dollars)

in the world. And what did this get them? Fifteen years of recession,

from which the country is only now emerging, while the US economy

happily continued to grow and create wealth in astonishing proportions,

seemingly unaware that is was supposed to have been "defeated" by Japan.

Why am I not surprised to hear this from a Florida attorney.

"Litigation is the No. 1 growth area. It's always recession-proof," said Peter Prieto, executive partner of the Miami office of Holland & Knight, in an interview.

If only our economy was litigation-proof. We operate in Florida because there are a lot of great recreation opportunities there - you can't transport them out of state. I am not sure why anyone else who could move their business out of Florida actually stays there.

Jeb gets a lot of press for being smarter than his brother George W., but George made a lot more progress on tort reform than Jeb has in his state.

UPDATE#1

The world's whales, porpoises and dolphins have no standing to sue President Bush . Umm, I guess this is good news, though on the other hand what does it say that this even came up before a Circuit court of appeals (the ninth, of course).

UPDATE#2

Fixed link