Everyone Except Me, I Guess

Barack Obama, in the Washington Post:

By now, it's clear to everyone that we have inherited an economic crisis as deep and dire as any since the days of the Great Depression

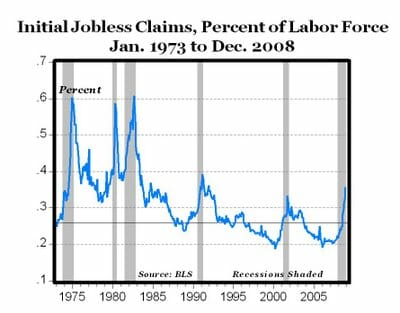

Sorry, maybe I am just cynical from having politicians call 8 of the last 3 recessions the worst economy since the Great Depression**, but I don't think this is the worst crisis since the 1930's. It's not even the worst since I was born. The late 70's were worse, the early 80's were worse, and from a financial/banking crisis point of view, the late 80's were worse.

What Americans expect from Washington is action that matches the urgency they feel in their daily lives -- action that's swift, bold and wise enough for us to climb out of this crisis.

Actually what I have come to expect is arrogance, a desire to turn any crisis into increased power for Washington, and general incompetence. So far, I have not been disapointed.

Our economy will lose 5 million more jobs. Unemployment will approach double digits.

OK, I will take that bet. 5 million more jobs with the base being the January employment numbers.

I won't get back into all the Keynsian arrogance in the rest of the piece -- suffice it to say that the overwhelming assumption is that the government can spend money more productively than can individuals. But check out this economic jumble:

In recent days, there have been misguided criticisms of this plan that echo the failed theories that helped lead us into this crisis -- the notion that tax cuts alone will solve all our problems; that we can meet our enormous tests with half-steps and piecemeal measures; that we can ignore fundamental challenges such as energy independence and the high cost of health care and still expect our economy and our country to thrive.

I reject these theories, and so did the American people when they went to the polls in November and voted resoundingly for change. They know that we have tried it those ways for too long. And because we have, our health-care costs still rise faster than inflation. Our dependence on foreign oil still threatens our economy and our security. Our children still study in schools that put them at a disadvantage. We've seen the tragic consequences when our bridges crumble and our levees fail.

Is he really implying that our economic problems were cause by use of fossil fuels, health care costs, aging bridges, and classrooms with out enough computers? Why yes, he seems to be saying just that. The rest of the piece is dedicated to just those things as a solution to the problem. Seriously, what does any of this have to do with a recession spurred by 1) banking liquidity crisis 2) loss of consumer new worth through falling home prices and 3) panicky statements by senior government officials. The answer, of course, is nothing. Basically Obama is pursuing the old "this crisis will be solved by all the piecemeal programs I was pushing before the crisis" argument.

I am sure there are folks who believe these things, if done well, might increase GDP 10 years from now, but is there anyone who really thinks this will create 3 million jobs in the next 18 months? I am reminded of the old joke, how do you make a million dollars in real estate? Start with 10 million. In the same vein, how does the government create 3 million new jobs? By destroying 5 million others.

By the way, speaking of bait and switch, these solutions Obama focuses on - health information, energy projects, school rebuilding, and highways - account for at most 6.5% of the total tax cuts and spending programmed by the stimulus bill for the first 2 years (34.1 of 525.5 billion, which is a bit outdated because it is based on a CBO report of last week, and has not kept up with the new pork added by Congress since then).

I just can't believe this guy actually represents change for people. To me, he sounds like a total flashback of every politician from the 1970s, who used to flail around with just this type of rhetoric. What's next, Whip Unemployment Now?

**Footnote I think I am going to try to trademark "Worst Economy Since the Great Depression" like Pat Riley trademarked "threepeat." Or maybe just trademark "WESGD." Here are a couple of past examples:

Clinton / Gore 1992: "Mr. Gore lambasted Mr. Bush for what he called 'the worst economic performance since the Great Depression'". The US unemployment rate peaked around 7.8% in 1992 and was headed down towards the 6's by the time Clinton was inaugurated. The 1991-1992 recession turned out to be one of the shortest on record.

John Kerry, 2004: "In his Sept. 2 speech in South Carolina, Kerry claimed the U.S. is suffering 'the greatest job loss since the Great Depression.'" The 2004 unemployment rate peaked at 5.8% and was headed down into the fours during Bush's second term. The 2003-4 recession was almost as short as the '92 recession.

For perspective, via Carpe Diem, initial jobless claims as a percentage of the labor force:

but I don’t think this is the worst crisis since the 1930’s. It’s not even the worst since I was born. The late 70’s were worse, the early 80’s were worse, and from a financial/banking crisis point of view, the late 80’s were worse.

You're right, if all you're looking at is what's happened to this point. But by the time this is over it will indeed be the worst crisis since the 1930s. We've basically taken just the one bullet so far (subprime residential real estate), but corporate bond defaults and commercial real estate loans are going to be #2 and #3 - and in any case the economic shock of even the first round of failure has yet to fully work its way through the system.

The nonsense about "health care costs rising faster than inflation" seems foolish to me. Unless all costs rise at the rate of inflation, some set of costs will necessarily rise faster than inflation. Everything can't be below the average. Would they rather food rose faster than inflation? Housing? Energy (haha, how much whining does that generate?)? What class of goods is allowed to rise faster than inflation?

"What class of goods is allowed to rise faster than inflation?"

Wages for union crybabies.

those who claim that an economy can recover from recession without the government providing massive stimulus are like flat earthers and climate change deniers. i mean, where's the evidence? if they hire Mann to "get rid of the 2004 bull market" i swear i'm moving to australia...

I'll go one step farther: I think this entire "crisis" is made up, like the fake nerve gas spill in Spielberg's "Close Encounters of the Third Kind."

I'm in California. I don't see ANY failed industries here. Banks are running like they always have. Demand for housing is still good. I still have to stand in long lines to get into restaurants. I see no regged bums on the street, other than the same ones who have been on duty for the last ten years. In short, it's "business as usual" here.

I saw yesterday that Cisco reported lower earnings on lower demand, but I'm not surprised. When enough people run around telling you that a massive downturn is going to be upon you any day, eventually some people begin to believe it and cut back on orders. "Things aren't bad YET, but we better cut back because they're telling me they will be." It's the same thing that the Clintons accused Bush of in 2000: "talking down the economy." Her Goebbels would be proud of this administration.

This is not to say that SOME industries haven't been hit. Certainly Detroit has, for good reason. New York's banking industry took it in the shorts, and deservedly so. Some people who in reality could not afford to own a house have lost them, as they should.

But other than those isolated cases, where's the collapse? Other than in Sacramento, there's nothing here!