The tech site Engadget directed me to this article on Visual FX and CGI as a "must-read". What I found was one of the odder economics and business hypotheses I have encountered lately.

The article begins by relating that VFX and digital effects specialty houses all lose money, even when they are providing effects for wildly profitable movies (e.g. Avengers) and purports to explain why this should be. The author believes that this is a result of Hollywood purposely criticizing the artistry of VFX movies as a way to keep returns in the VFX companies down (and thus increase the returns of film producers).

As the debate surrounding what visual effects are worth rages on, it is clear that the studios themselves have an interest in perpetuating the myth that VFX are the product of clinical assembly lines and the results are equally lifeless and mechanical. Blaming computers for the dumbing down of movies has become a journalistic trope that is bandied about to squeeze the one part of the Hollywood machine that has no union or organizational skill to push back. The right hand asserts they are something not worth paying top dollar for, while the left lines up an interminable roster of VFX-based box office juggernauts for the foreseeable future.

The author goes so far as to say that Avatar was denied the best picture Oscar specifically to support the anti-VFX sentiment and keep returns of VFX companies down (emphasis added).

In 2010, James Cameron’s Avatar became the highest grossing film of all time just 41 days after its release, raking in an incredible $2.7 billion by the end of its run. Weta Digital, the VFX studio that created the majority of the visual effects, along with Lightstorm Entertainment, invested years in developing the tools and talent necessary to create Cameron’s almost entirely computer generated vision, with the cost of making the film rumored to be upwards of $500 million. Cameron had promised to show the world what visual effects could do and he succeeded. The results were universally lauded as visually stunning and unparalleled.

Yet, rather famously, the film and Cameron were snubbed that year at the Academy Awards, both for Best Picture and Best Director. The blame was laid at the feet of the critical success of The Hurt Locker. However, awarding Avatar the Academy’s highest honor would have been acknowledging visual effects as not only lucrative, but high art as well, worthy of its astronomical price tag. And that was a bargaining chip Hollywood was unwilling to concede to an industry it continues to hold hostage with threats of outsourcing to unskilled laborers around the globe.

This hypothesis seems outlandish, and in fact the author never really provides any evidence whatsoever for her hypothesis. At least equally likely is that Hollywood insiders are snobbish and conservative and reject new approaches to film-making in a way that the public does not. Or it could be that Avatar wasn't a very good movie (go try to watch it again today, you will be surprised what a yawner it is). So why are VFX companies really losing money on profitable films? Let's take a step back, because there is a useful business lesson buried in here somewhere. I think.

This discussion is a sub-set of an age-old business problem -- how do rents in a supply chain get divided up? Think of the billion plus dollars the new Avengers movie will make. Everyone in the supply chain for making that movie, from the actors to the caterers to the VFX houses to the distribution companies believe their contribution has immense value, and that they should be getting a solid cut of the profits. But profits in a supply chain are not divided up based on some third party assessing value, they are divided up by negotiation. And the results of that negotiation depend on a lot of factors -- the number of competitors, the uniqueness of the service, regulatory rules, etc. The most visible example of this sort of negotiation we see frequently in the news is in sports, where players and team owners are explicitly negotiating the division of the end revenue pie between themselves.

If we return to the article, the author actually gives us a hint of the true dynamic that is likely bringing down VFX profits.

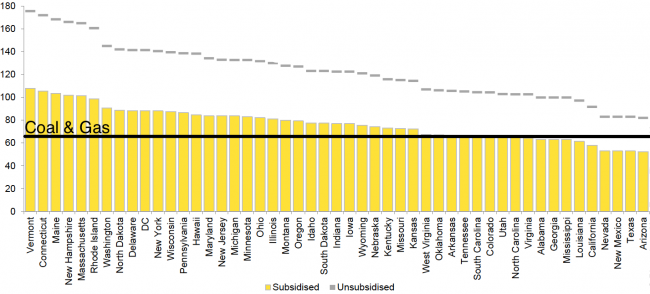

The international subsidies-driven business model under which VFX companies operate has been well documented. In pursuit of tax rebates offered by various governments to produce films in their jurisdiction, studios insist that VFX companies open branches in these locations or reduce their bids by the amount of the subsidy in question. Even as studios, directors, and audiences demand the latest in cutting edge technology, VFX houses must underbid one another to get the work and many have been shuttered due to operational losses in the wake of explosive blockbuster budgets. The cost of research and development, shrinking schedules, and the unlimited changes that are the building blocks of every tentpole film, are shouldered entirely by VFX houses.

This is the best clue we get to the real problem. Here is what I infer from this paragraph:

- This is a high fixed cost industry. There are enormous up-front investments in research into new techniques and large investments in the latest technology, which presumably must be constantly refreshed because it has a short half-life before it is out of date. The situation is worsened by government policy, which provides incentives for VFX companies to build extra capacity in multiple countries, losing economy of scale benefits from large concentrated production facilities. One would presume from this that these companies' marginal cost of output, say 15 seconds of finished effects, is way way below their total costs.

- There is rivalry among VFX companies that seem to have excess capacity, such that bidding for work is very aggressive. In such situations (think American railroads in the late 19th century) competitors lower prices down to marginal cost to keep their capacity and their trained people working. Over time, of course, this leads to numerous bankruptices

I will add a third point which the author fails to cover. To do so I will return to one of my favorite things I learned at Harvard Business School (HBS). At HBS, in the first two days of strategy class, we studied two very different business cases. The first was of a water meter manufacturer, a dead boring predictable unsexy business. The second was a semiconductor company, which was hip and cool and really sexy. It turned out that the water meter company coined money. The semiconductor business was in and out of bankruptcy.

Why? Well the water meter company had limited investment (made the same meters the same way for decades) and made most of its money off the replacement market, where it had no competitors since users pretty much had to replace with the same meter. The semiconductor business had numerous shifting competitors and was constantly trying to scrape up enough investment money to keep up with shifting technology. But there was one more difference. By being sexy, tons of people wanted to be in the semiconductor business. They got non-monetary benefits from being in it (ie it was cool and interesting). When there is an industry where lots of people are getting into the business for reasons other than making money, look out! The profits are probably going to be terrible. This is why most restaurants fail. The business-for-sale listings are awash in brew pubs. The aviation industry was like this for years, and I would argue this also suppresses rents in farming.

I don't know this for a fact, but I would bet that the VFX industry attracts a lot of people because it is sexy. Yes, like a lot of programming, the actual work is detailed and dull. But if the coding is detailed and dull, would you rather be doing it for Exxon's new back-office system or to put Ironman on the big screen (and have your name deep into the film credits, seen by the dozen or so people who hang around waiting for the Marvel Easter egg at the end)?

This is why I think a conspiracy theory to believe Hollywood is dissing the artistry of VFX movies as a way to keep VFX company rents down is silly. It is totally unnecessary to explain the bad rents. Had you told me it was a high investment business with huge fixed costs and much lower marginal costs and alot of rivalry driven by participants who piled into the business because it was sexy, I would have told you to stop right there and I could have immediately predicted poor returns and bankruptcies.

So what can VFX companies do? I have no idea. The first idea I would offer them is branding. If you are buried deep in the supply chain and want to increase your bargaining power, one way to do it is to develop a brand with the end consumer. If consumers suddenly latch on to, say, the CoyoteFX brand as being innovative or better in some way, such that they might be more likely to go to a movie with CoyoteFX sequences, then CoyoteFX now has a LOT more power in negotiations with producers. Dolby Sound is a great example -- you probably don't even know what it is but movies used to advertise they had it. Certain camera technologies like Panavision are another, where movies actually sold themselves in part on the features of one member of their supply chain. As a digital house, Pixar effectively did this -- so well in fact its brand actually was bigger than Disney's (its distributor) for a while, and Disney was forced to buy them. This does not happen just in movies. I just bought a car that advertised it had a premium Bose sound system. The car maker doesn't advertise who made, say, the fuel tanks, so my guess is that Bose, via branding, gets a better cut of the supply chain than does the fuel tank maker.