A Failure of Nerve

October 2008 was a failure of nerve. As so often happens, folks who normally support letting failing institutions fail when times are good tend to lose their nerve when the crisis is at hand, and find some way to convince themselves that somehow, this time is unique and different. But it is not. Only later is there remorse. I won't want to pick on Megan McArdle too much, if for no other reason than she is generally the first person on the planet to admit she is wrong, but you can start to see some of the remorse here:

We're now making many of the mistakes that Japan did. I know, I know--I supported TARP I. But I did so because at the time, there seemed to be a reasonable possibility that the funds could stop a liquidity crisis from turning into a solvency crisis. But if liquidity crises go on long enough, they become solvency crises, so whatever we had then, we now have a badly crippled banking system. More of the same isn't going to help.

We need a plan that is going to force the banks to recognize and write down their bad loans, restructure dysfunctional borrowers, shut down the banks that are too far gone, and inject substantial capital into the banks that are strong enough to pull through. But that kind of radical action is scary. And whether they decide to do it by nationalizing bad banks, or by injecting capital into good ones, the political cost is going to be very high. So we get baby steps and vague promises of major leaps forward down the road.

Another political problem is that recapitalizing the banking system involves, in the initial stage, conserving capital (read: cutting credit limits), and writing down bad loans means unpopular actions like restructuring failing companies (read: layoffs) and foreclosing on hopeless borrowers. One of the major arguments against bank nationalization is that a government-owned bank will find it harder, not easier, to do those things. The temptation to keep large employers on life support will be large, and every congressman will have a list of firms in their district that can't be allowed to go bust.

I have tried to have this and other bailout arguments with a number of folks. This is often a hard conversation, because people have trouble separating in their minds the productive assets of these companies (factories, investments, systems, deposits, trained people) from the institution itself. So when we talk of bankruptcy of, say, GM, they think if GM goes poof, then all those factories and cars go poof.

But that is absurd. Remember the huge gas shortages that resulted from the loss of the Enron gas trading desk and transportation infrastructure when Enron went bust? Yeah, neither do I. That's because all of Enron's productive assets flowed through the well understood chapter 11 (or was Enron Chapter 7) process to new owners.

By the way, by management, I mean something broader than just the CEO or the top tier of managers:

A corporation has physical plant (like factories) and workers of various skill levels who have productive potential. These physical and human assets are overlaid with what we generally shortcut as "management" but which includes not just the actual humans currently managing the company but the organization approach, the culture, the management processes, its systems, the traditions, its contracts, its unions, the intellectual property, etc. etc. In fact, by calling all this summed together "management", we falsely create the impression that it can easily be changed out, by firing the overpaid bums and getting new smarter guys. This is not the case - Just ask Ross Perot. You could fire the top 20 guys at GM and replace them all with the consensus all-brilliant team and I still am not sure they could fix it.

Bankruptcy is a scary term, but here is what makes it beautiful -- it takes assets out of the hands of failed management, failed business plans, failed management cultures, etc. and puts those assets in the hands of new owners and managers. These new owners and managers are not guaranteed to be better at managing the assets, but the odds are they will be since the performance bar set by the last management team is by definition so low (ie, they went bankrupt!)

When we interrupt the bankruptcy process and bail out a failing company, we do two things:

- We leave the productive assets of the company in the hands of the same failing management (again, with this term defined broadly as above) that got the company into the current straights, rather than putting the assets in the hands of new owners

- We focus the country's limited investment capital (via taxes or government borrowing that crowds out private borrowers) towards what are by definition among the worst managed institutions in the country. If someone asked you to invest a billion dollars either in the top 10 most successful companies or the bottom 10 least successful, where would you put the money to create the most jobs and growth? In the top 10, right? But the government is doing EXACTLY the opposite.

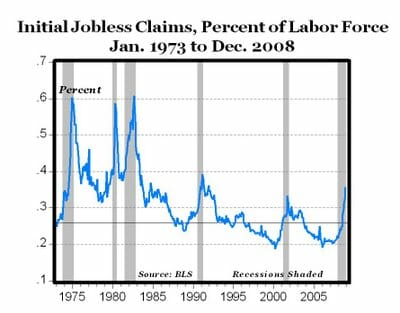

Here is the true economic miracle of the 80's and 90's: Not Reagan's tax cuts or Clinton's economic plan or Alan Greenspan in the Fed. It was the fact that the government, with the American economy sweating under some very difficult conditions (worse than they are today, but you would never know it in the press) and under strong threats from Japan and Europe, basically did ... nothing. There was all kinds of pressure to create an American MITI (seriously, it seems like a joke today, but the push was strong). We did not. The American economy was allowed to restructure itself.

This is why our recessions tend to be shorter than those in Japan and Europe. These other economies are generally more of a corporate state, with a major goal of the government to maintain the incumbents in the corporate world. I would argue that the key determinants to recovering from a recession quickly are asset, capital, and labor mobility. Japan has many structural limitations on these, and it dragged their recession out for years. In the name of trying to avoid the problems Japan has faced, we are repeating the exact same mistakes. Every step we have taken so far to deal with the "crisis" have reduced the asset, capital, and labor mobility the economy needs to right itself.