Welcome to the Tesla Earnings Presenta... Squirrel!

Several years ago I was pretty active in the online community that was deeply skeptical of Tesla. When I backed away from blogging for several years, the Tesla fanboi community immediately decided that I was scared off by Tesla's success, as measured by a stock price that went through the roof for several years. I still get DM's on X from time to time taunting me for all sorts of past heresies, when in fact I was just exhausted with blogging, and remained certain that Tesla stock had become a sort of Bitcoin-equivalent, without any underlying value except for a community belief that it had value.

In fact, I was so embarrassed about my past criticism of Tesla that one of my first posts back here was... a criticism of Tesla.

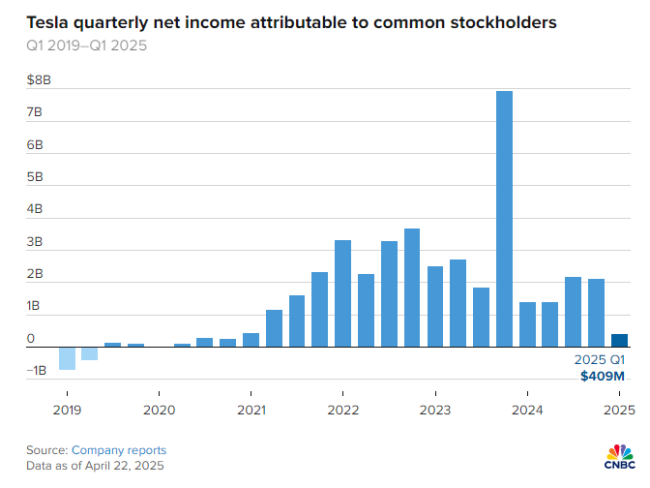

I was distracted a month or two ago when Tesla first quarter financials came out, but they are worth looking at because they were a disaster (of course, for anyone who knows the history of Tesla stock fandom, the stock price was up the next day after the release). But I want to get into it now because it is pretty stunning.

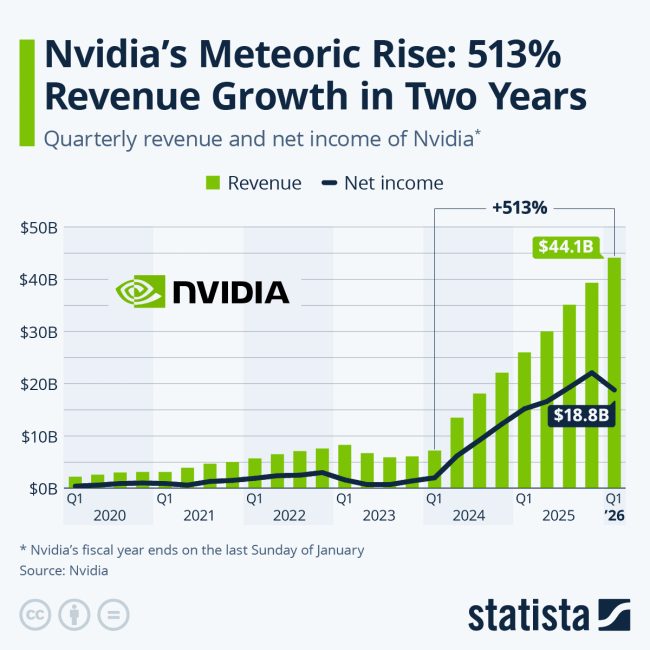

Before I get to the earnings number, note that Tesla stock closed today with a trailing PE ratio of 174. This sort of PE (except in turnaround situations) is only granted to astronomically-high-growth companies. For comparison, AI darling and the superstar growth stock of the last year or so Nvidia, has a PE just under 53. To justify a 53, Nvidia has demonstrated this sort of revenue and earnings growth the last several years:

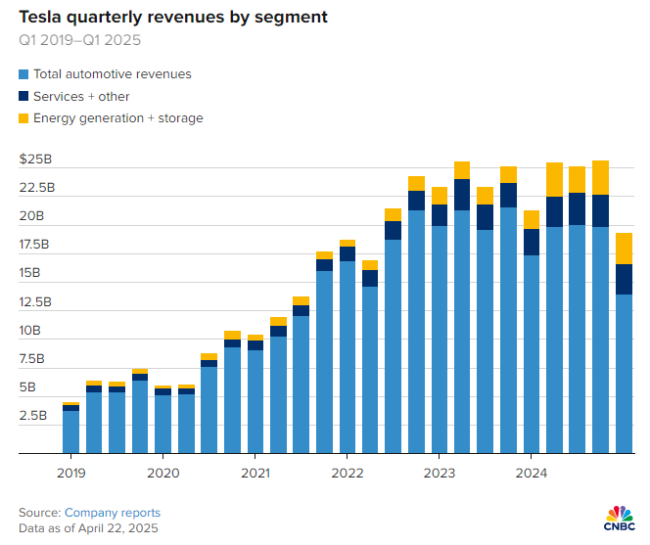

So, one would expect Tesla to have demonstrated something even more spectacular to justify a PE of 174. Drumroll please:

Tesla has 13 quarters, or over 3 years, of essentially zero revenue growth and an even longer period of zero net income growth. Freaking General Motors has seen more revenue growth over the same period and they have a PE south of 8. A PE of 8 seems about right for Tesla as a car company, meaning it is 20x overvalued. This would lead to a value of $50 billion vs. its approximate $1 trillion market cap.

So what is driving the other $950 billion in market cap? Whatever this $950 billion business is -- and we know it is not cars -- it constitutes the 10th largest company in America. So here is the answer for you ... squirrel!

Tesla and Musk are very very very good at getting their fanbase to buy into the fact that they are more than whatever the company actually is at the moment (ie anything but a US automaker with an 8 PE). We are a solar company... until Solar City crashed and burned. We are a solar roof company ... until that business was shown to be all flim flam and no substance. We are a battery change innovator ... until that was shown to be a stunt. We are an electric truck company ... until they never made more than the prototype. We are a battery storage company .. until that growth stalled. We are a leader in the huge Chinese market... until we weren't. We are the leader in full self driving ... until, after selling the product for years, we still have never delivered to those who bought it. One squirrel after another.

Today, it is the same game with only the exact future promise changing. Every chance they get today, Tesla and its supporters will tell you that they are not a car company. Go to Seeking Alpha and look at the Tesla buy recommendations, they say things like this:

- Tesla's current valuation isn't justified by traditional metrics, but its potential as an AI, robotics, and energy company is unmatched.

- The robotaxi and autonomous vehicle market could drive Tesla's valuation to $900B alone, thanks to its vertically integrated stack and cost advantages.

- Optimus robotics and other moonshot projects could add $300B+ in value, with further upside from energy, insurance, and software businesses.

- Tesla's valuation is now primarily driven by its robotaxi and humanoid robotics ambitions, not near-term automotive delivery growth/decline.

- Despite recent deliveries disappointment and renewed political fallout with Trump, investor sentiment has remained remarkably robust.

- The market is starting to price in significant operating income potential from robotaxi deployment, with a medium-term outlook in the next five years.

- Tesla investors are starting to take its AI ambitions (robotics and autonomy) very seriously, suggesting automotive hiccups could become less market-moving going ahead.

As I am writing this, enjoying the latest movie snark from the fabulous Critical Drinker on my iPad, I even got an ad for this crazy Tesla-pump video with the same basic message.

So apparently buyers and holders of this stock believe that Tesla's robotaxi business and AI/robotics business is worth at least $950 billion (as a comparison Uber is worth less than $200 billion). So let's think about that.

I am a frequent user of Waymo driverless taxis and have been in a number of friends' Teslas (totally white-knuckle nervous) in whatever passes for self-driving in Tesla models. And they do not even compare. Waymo is top to bottom a superior, better thought out product and way more reliable in its driving. We have hundreds of these things on our streets around my house in Phoenix such that I cannot even drive to the grocery store without one driving through the same roads and intersections. Yesterday I saw them stopped 3-wide at a nearby intersection. And I have never seen a Waymo -- whether I am inside it or driving next to it -- do anything that makes me nervous. They are incredibly well-driven and safe vehicles (not to mention always clean and comfortable). I have seen them navigate situations, like left-turns in complicated intersections, that might confuse me as a driver. Tesla continues to double down on Musk's early mistake of eschewing Lidar (Musk claiming good AI can work with cameras only) and I am convinced Tesla is thus in a technology dead end. Part of the proof of this is that Tesla has actually been selling full-self driving for years and years and still have not delivered that product to the people who paid for it.

But forget all that for now, and assume I know nothing about self-driving (partially true) and nothing about AI (totally true). Tesla made hay in its early growth phases by competing on technology and particularly electronics and automation with auto companies who are not really leaders in this stuff. I had a Mercedes for a while and those Germans build a nice car but damn their electronics such as their entertainment system always suck. I remember someone lauding the US military for being capable and the response to that was that the US military only appears capable and advanced because it competes with other militaries. Same for Tesla cars -- they brought fresh technology into an industry that is basically the special needs kid of innovation and software.

Now, though, consider Robotaxis and AI. With Robotaxis Tesla is competing with Google. In AI it is competing with Microsoft, Google, and Meta. Musk has made formidable investments in that space, but he is no longer running up the score against Appalachia State but has to take on the first teams of Alabama, Georgia, and Texas. Not impossible, but $950 billion is a ridiculous valuation to put on what to date is simply arm-waying and talk, particularly given how much of past Tesla talk and arm-waving has turned out to be total bullsh*t.

It has got to be a bad idea to invest in a 22-year old company on the proposition that 95% of their value is in new things you haven't really seen yet. This sort of shift almost never happens, and tends to be the equivalent of a company like Gamestop trying to keep investors excited in a no-growth low-margin business by announcing they are really a bitcoin company. A tiny tiny few companies have pulled this off -- I think of Amazon with cloud computing eclipsing their retail business. But even in this case the shift was something that was only really recognized and drove valuations after Amazon made it real.

Postscript: "But SpaceX" is not an adequate retort. I love SpaceX, and give Musk a lot of credit for being the founder and visionary behind it. But SpaceX just performs in its original business, without all the shifting promises and BS. And for every SpaceX, I can say "But SolarCity" of another Musk business that ended up in the toilet after tons of hype.

Warning: Please don't take this as a recommendation to go short Tesla. I am sometimes short Tesla and I can assure you that Tesla fanbois can keep the stock overvalued much longer than you can endure the pain. Always short with caution. Remember, Tesla stock is up over 25% since the day in April that it announced the terrible results above. If you had reasonably shorted the stock during the abysmal last earnings call you would be getting margin calls.

Update: I forgot to link the source for the Tesla earnings charts. It is here.

I have followed your blog for decades. You are stuck in old world thinking.

Elon has created an Innovation Engine powered by first principles thinking. And the first principle he is following is to "seek first the Kingdom of God", by doing the most for all of humanity, instead of what benefits himself. He is living a Jesus like life compared to the vast majority of CEO's. As he does so, "all things are added" and he has become the wealthiest and most influential resident of the old world. He himself is not yet a resident of the Kingdom of God, but he is living as though he is one.

As he blesses others, he is blessed, by God, again and again.

You have apparently grown old, but not yet wise. It is not too late for you.

When you analyze opportunities by the numbers rather than by the Spirit of God in you, you will not understand Tesla.

A great example of a man that "get's it", the opposite of you, is Steven Mark Ryan, proprietor of the Solving the Money Problem Youtube channel. He, like Elon, is not a religious man, he may even be an atheist. Yet he understands that when you work for the good of humanity, as Elon, does, God cares little of your theology background.

SMR is the person who drew the penis shaped expanded service area for the Austin Robotaxi service. Elon saw it, and actually adopted it, only 17 days after it was put on X.

SMR and Elon know implicitly that what you do, serving others, is vastly more important than what you believe or how much sense what you do in the old world is comprehended by the old world.

There are two parallel worlds here on Earth at all times. The "world" governed by the evil force which is fundamentally selfish, and the Kingdom of God, which is governed by the true power, who is Jesus, and through Whom all things were made and are now sustained. The Kingdom is fundamentally other centered, pouring out your life for the good of others, as Elon does.

You don't get Tesla because you have not yet gotten Jesus, so do not have the eyes to see and the ears to hear the Truth.

Fortunately you live in an area with a lot of great saints to help you leave the dark world behind and step into the Kingdom of God. Many of them are members of my Church, the Church of Jesus Christ of Latter-day Saints, that I joined about 8 years ago at the age of 56 after beginning to have the eyes to see and ears to hear.

If you go to my website (beasJesus dot org) and converse with me, I will be happy to send a pair of young missionaries to your home to explain how the Kingdom of God works. And even come to Arizona myself if necessary.

You are thoroughly educated in the ways of the world. You are no longer young. It is time for you to come to Jesus and comprehend that the world we are born into here is just a nursery school for learning the ways of eternity, the Way of eternal progression.

Tesla, because of Elon Musk, reflects the eternal first principle, live your life in the service of others, on the largest scale you can manage, and you will be blessed, both here and eternally, by Jesus.

I began my career just before the real estate crash of the mid 1980's

The one important financial lesson I learned was that the value of any asset is the present value of the future cash flows, with a proper adjustment for risk. That valuation method applies whether it is a stock, a piece of real estate, machinery or an operating business.

There are temporary bubbles - yet bubbles always burst

I was wondering if the political involvement and ensuing chaos with Musk would cause the blinders to come off enough for the stock price to fall closer to a level not simply supported by blind optimism. However, that hasn't happened.

I agree, at the moment there is no simple business expansion path along new ventures despite wild ideas and notions being thrown out. And the EV market in the US already captured the low hanging fruit type customers a few years ago and is likely to grow very slowly from here. So it's not surprising that Tesla's revenue has stalled.

"But SpaceX" is actually a decent argument, because it doesn't just perform in its original business. According to reports, SpaceX's 2024 revenue was about $5B from launching rockets and $8B from Starlink. Some are projecting Starlink will bring in $12B by the end of the year.

SpaceX was already a multi-billion dollar, 15+ year old company before Starlink launched, and Starlink nearly tripled the size of the business in a couple years.

Obviously Tesla is an order of magnitude bigger, but so are the markets Tesla is arguably targeting (universal robotics/AI).

This isn't to say that your analysis on the Tesla stock price is wrong. I don't think the Tesla valuation makes any sense either. But I also wouldn't bet against Musk.