The Corporate State, In One Chart

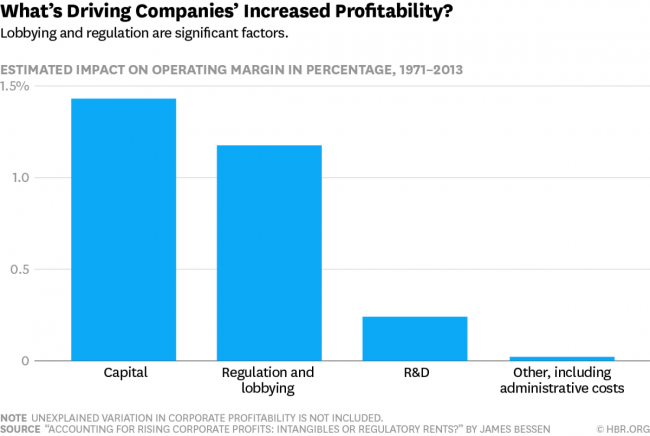

James Bessen has a terrific article in the Harvard Business Review on the estimated contribution to corporate profits of rent-seeking, or the acquisition of special favors, subsidies, and protections from the government that shelter a company from the normal competition of a free market. Bessen argues that such rent-seeking is major explanatory factor for recent rises in corporate profits.

This topic will be a familiar one to Coyoteblog readers. Show me a regulation and I will show you the large corporation that is able to use it to throttle competition. I remember when everyone claimed the retail minimum wage was going to hurt Wal-Mart, but in fact Wal-Mart actually supported it because it was paying a higher wage than its smaller upstart competitors and thus the minimum wage would tend to hurt Wal-Mart's competition worse than it would be hurt. Taxi service is one of the most regulated businesses in the country (at least in relation to the complexity of the business) and we are seeing just how much these regulations have supported taxi profits as we watch the taxi companies use the regulations to try to hammer Uber and Lyft.

According to Bessen, the effect is both large and on the rise:

I find that investments in conventional capital assets like machinery and spending on R&D together account for a substantial part of the rise in valuations and profits, especially during the 1990s. However, since 2000, political activity and regulation account for a surprisingly large share of the increase....

The pattern around the 1992 Cable Act is representative: I find that firms experiencing major regulatory change see their valuations rise 12% compared to closely matched control groups. Smaller regulatory changes are also associated with a subsequent rise in firm market values and profits.

This research supports the view that political rent seeking is responsible for a significant portion of the rise in profits. Firms influence the legislative and regulatory process and they engage in a wide range of activity to profit from regulatory changes, with significant success. Without further research, we cannot say for sure whether this activity is making the economy less dynamic and more unequal, but the magnitude of this effect certainly heightens those concerns.

Two characteristics make these changes particularly worrisome. First, the link between regulation and profits is highly concentrated in a small number of politically influential industries. Among non-financial corporations, most of the effect is accounted for by just five industries: pharmaceuticals/chemicals, petroleum refining, transportation equipment/defense, utilities, and communications. These industries comprise, in effect, a “rent seeking sector.†Concentration of political influence among a narrow group of firms means that those firms may skew policy for the entire economy. For example, the pharmaceutical industry has actively stymied efforts to address problems of patent trolls that affect many other industries.

I would add two other industries to this list -- medicine and legal. The reason it likely does not show up in his study is that the returns in these businesses show up to individuals or small private firms. But heavy regulation, and in particular a licensing process wherein one must get permission from the incumbents in order to compete with them, has always kept prices and returns in these businesses artificially high.

Note by the way that the breakpoint year of 2000 makes this a bipartisan issue, occurring in equal measure in Republican and Democratic Congresses and Presidencies.

And I don't think I need to remind folks, but both of our Presidential candidates are absolutely steeped in and committed to this cronyist, corporatist system