Why Valley Metro (Phoenix Light Rail) Can't Be Trusted and Shouldn't Be Given More Tax Money to Play With

I was reading this article in the Arizona Republic (which is generally an unskeptical cheerleader for light rail investments) and looking at the claim that Valley Metro (the operator of Phoenix light rail) had a 45% fare recovery ratio in 2013. One would think that means that their fares cover 45% of their costs -- which would be awful for any real enterprise but is pretty good for government-run rail systems.

But in fact, Valley Metro (along with rail supporters in the Administration) stack the deck by defining most of the costs out of this metric so it looks far better than it really is. In fact, by my reading of their financial statements, the true fare recovery is at best 15.2% and likely much worse.

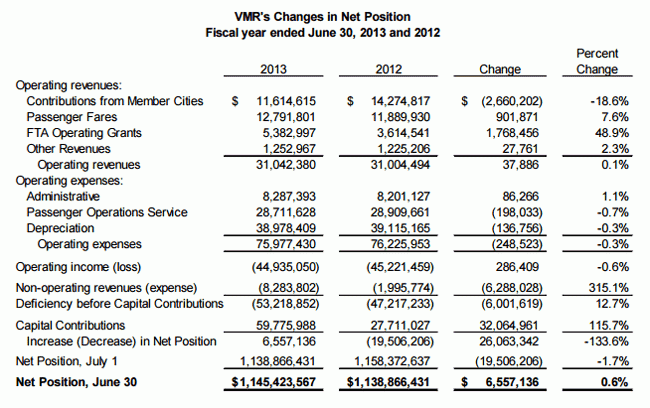

Here are the Valley Metro financials for 2013, from their annual report

Look at their costs of $75+ million and fares of about $12.8 million. How do they get to 45%? Simple -- they leave the majority of their costs out. They exclude administrative costs, financing costs, and depreciation (essentially their capital cost) from the equation. This means that their fare recover is 45% -- IF you ignore their large administrative costs and you ignore the $1.4+ billion the line cost to build. Further, because of the way the government does its finances, it is also missing any financing costs (interest and such on debt).

So the true cost recovery, stated in a way that a reasonable person would think about such a number, is 16.8% at best. If one takes into account the $8.28 million in "non-operating expenses" the number is 15.2%. And it is even lower if you were to include interest and other financing costs.

I am sure Valley Metro will argue that this is the way the Feds measure it. I don't care. It has an obligation to accurately report its financial position to the public who is paying for it, particularly when the public is considering further investments in the form of higher taxes. The 45% is a meaningless number that is crafted solely to make light rail look financial stronger than it really is.

This, by the way, is why total ridership of rail + buses has stalled since the construction of the light rail line. Light rail is so expensive per rider that it is starving cash from the rest of the system.

PHX is just not a commuter-conducive town. Nor Houston, Dallas, LA etc. You need higher core densities and some metric defining hub/spoke tendencies like those of Seattle, SF, NYC, Denver, etc. Goes back to "just because you can, does not mean you should. Same for solar power in upper midwest.

"Why Valley Metro (Phoenix Light Rail) Can't Be Trusted and Shouldn't Be Given More Tax Money to Play With"

I can explain this in just one word. Government.

If capital cost to build a line can be considered $0 for accounting purposes, then I assume for future new rail lines they would be happy with a $0 allocation to cover the new construction?

So do the operating expenses include benefits and retirement contributions for the workers? This is one place the government loves to make finances look better, by getting credit today, and letting whoever is in charge a couple decades later get the blame when the bills come due...

Right. People (voters and other citizens) get pwned on this topic time and again.

Elected officials and special interest groups support and celebrate these manufactured pyrrhic victories behind a thin veil of public service, when it is all self-serving.

All are good examples, especially LA, where the problem has been ongoing for 30 years...

"the sad reality is that there has been no increase in MTA transit ridership since before the rail expansion began in 1985... Much of the problem, notes Tom Rubin, a former chief financial officers for the MTA's predecessor agency, stems from the shift of funding priorities to trains from the city's more affordable and flexible bus network"

http://www.joelkotkin.com/content/00273-mass-transit-great-train-robbery

Also, as a general observation, government (at all levels) does not operate anywhere close to the same standards that our elected officials require of private entities (e.g. corporations and GAAP) for financial reporting (Dodd-Frank anyone?).

People may intuitively "know", but, even amongst the financially savvy, they would be shocked if someone ever actually walked them through it as a comparison. It almost seems designed to obscure and obfuscate.

One might also ask, where is the media? Oh, right...they are the ones reporting "facts" like the "45% fare recovery". No wonder this goes on without any public accountability, when the media adds smoke to cover already opaque numbers.

Fringe benefits are typically included. One instance where skepticism should be advised though, is when employees are given pensions as part of their benefits package. Reporting on public pension funding is far more easily manipulated than other types of benefit expenses.

The cost of building the line should be accounted for in the depreciation. However, $40 million a year seems to be low for assets originally costing $1.4 billion, unless they are using a depreciation schedule that stretches far past 30 years.