Kevin Drum Inadvertently Undermines His Own Keynesianism

This is a follow-up from a post this morning here. Kevin Drum is a Keynesian who thinks that the government is committing economic suicide if it does not increase its spending substantially during and after a recession. Kevin Drum is also a fierce partisan who wants to defend President Obama against his detractors. Unfortunately, trying to do the two simultaneously has led to what I think may be an embarrassing result for him.

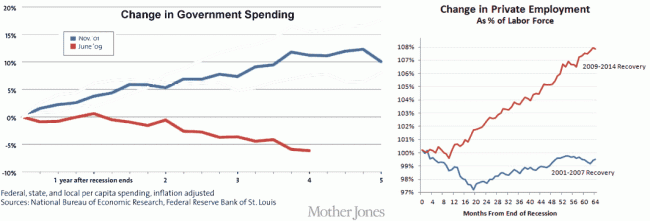

In the chart below, I combine two graphs of his. The one on the left is a chart from last year in a Mother Jones cover story blasting "austerity" and lamenting how dumb it was to decrease spending in the years after a recession. The chart on the right is from the other day, when Drum is agreeing with Paul Krugman that the recession recovery under Obama has been much stronger than the one under Bush II. The result is a juxtaposition that seems to undermine his Keynesian assumptions - specifically, the recession where we had the "austerity" was the one with the better recovery. The only thing I have done to his charts is removed lines in the left chart for other past recessions and changed the line colors on the two charts to match. You can click to enlarge:

The blue line is the Bush II recession, the red line is the Obama recession. I believe the start dates are consistent in both charts. All the numbers and choice of start dates and measurement scales are Drum's. Don't yell at me for something in the chart construction being unfair -- they are his choices.

The conclusion? Higher government spending seems to inhibit recovery. Thanks Kevin!

I am not (NOT) seeing what you are saying. It appears that spending has decreased under Obama and jobs have increased (if I read the charts correctly), and I don't see any way for that to have happened.

Government spending decreased, private employment increased. That's perfectly plausible, if considered unlikely by some economic theories.

I don't think this means what you think it means. If government spending dropped after 2008, then probably less government workers were hired, so private employment as a percentage of the total would have to go up. It would be interesting to know how much of the spending drop (if any) was actually due to the so-called "austerity" at the federal level, compared to the state and municipal governments.

Government spending is not the main driver of Keynsian economic expansion. It is government deficit, and only that deficit that is controlled by creating new money. While the economy has been sluggish, you can see where the newly created money has gone, reinflating the stock market.

The irony of this is that we are talking about a recover that only this year has achieved sub 6% unemployment. The last recession *peaked* at 6.3% unemployment. Of course this recovery has had higher increases in employment, we started out in a 10% unemployment hole so had much room for improvement. The previous Bush recession was much more shallow, thus so was the recovery.

It is not clear how much of the spending graphed is military, where Bush greatly outspent Obama, and which has less effect on the

homefront economy than does "stimulus" spending where Obama one-upped Bush significantly, though much of Obama's stimulus

went to prop up state and local governments. Employment figures for the past several years have discounted those not longer looking

for work, so unemployment numbers were lowered from real numbers if you look at total employment versus population. To say

nothing of the boom in "disability" and of course retirements where retirees did so because their job disappeared and nothing else was

available. One reflection on the economy is the increased employment among those 65 and older versus previous decades for those

able to keep working.

Don't forget 9-11 security state bullshit, medicare expansion, housing bubble-supported state spending during the Bush administration.

In short: leave my neoliberal Democrats aloone?

No. "During the Bush administration" refers to a period of time. During that time government spending went up -- see graph. The commenter above mulled over the cause.

Among the possible causes are military, security state, medicare, state spending. Pretty sure all the politicians in the country were involved.

I have one question and one recommendation for you.

The Q: Is Robert Reich a right winger?

The recommendation, and I hope that you will show an open mind and give it a few minutes of your time, in spite of the title, is this article from The New Left Review May/June issue: HOW WILL CAPITALISM END? - http://newleftreview.org/II/87/wolfgang-streeck-how-will-capitalism-end#_edn6

Exactly. And deficit spending in the first three years after the 2008 recession was huge.

And growth was incredibly sluggish. The only thing that really improved was the stock market as the cash that the Federal Reserve pumped into the system was used to inflate that.

As far as Keynes expectations, the difference is that Keynes incorrectly assumed that all forms of taxes were teh same. They arent. A tax cut is not simply "bouncing tax dollars" back into the economy.

"relatively neutral" -- I don't think anyone (even Keynes) thinks/thought government spending = government spending or tax-cuts = tax cuts. Or that only one or another had an economic effect. I'm not sure what cartoonish view Coyote has of Kevin Drum's "neo-Keynesianism" but that doesn't come across.

As far as deficit spending goes, Bush's TARP and auto bailout were fairly drastic short-measures where the benefits went to a relative few and probably did pump up the stock market. Different than a transportation bill or cash for clunkers. Capital gains tax cuts have a different impact than payroll tax cuts. Etc.

------

The stimulus basically used deficit spending to take the edge off the temporary drop in national cash flow. As austerity goes, the US wasn't. The drop in federal spending just wasn't as bad as it would have been.

If you look at the true underlying theory of TARP it is more closely tied to Monetarism than Keynsianism. The injections of capital in the market were done from a true liquidity position, not to foster economic growth.

Keynsianism is a very limited economic policy.It is tied to the political system, not the economic system. It is slow. It is manipulated. Most often it is less effective than jsut doing nothing because of its delay and inefficiencies. I think that another thing Keynesians miss is that the "multiplier" is probably less than 1.0. Maybe at one time, for example, building a new canal into the Wilderness, the multiplier might have been significantly higher than one. But like every other economic factor, there is diminishing returns. Dollar 1 might have been effective. Dollar $10 trillion, much less so.

Yes ... hard to fault Warren for using Drum's own charts, but obviously the "Change in Private Employment" chart is ridiculously misleading given the different levels of unemployment in the two recessions. And again, to be clear, I'm criticizing Drum for the chart, not Warren for using the chart to make fun of Drum.

I'm not sure there's much of a point in writing an economic text book in the comments, but yes, all spending is not equal in purpose or effect and ill-advised spending can have significant delayed and/or negative effects. Also up is up and gravity is hard to avoid.

My only real point was that the graphs don't say anything about Coyote's contention.

It is not clear how much of the spending graphed is military, where Bush

greatly outspent Obama, and which has less effect on the homefront economy than does "stimulus" spending where Obama one-upped Bush significantly...

Doesn't matter how it was spent, or on what. In a purely Keynesian model it's all just 'G'.