Help for the Super Committee: Is It A Tax or Spending Problem

You decide (origins and data for chart here)

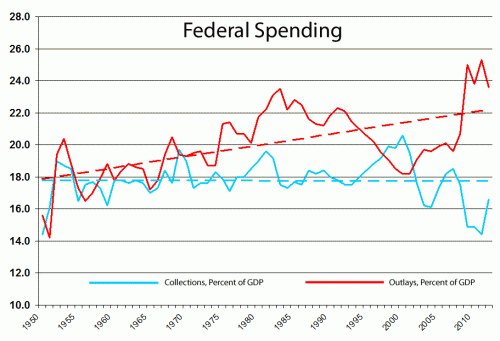

I am generally opposed to tax increases because they never seem be matched to spending cuts -- the tax increases are passed but Congress finds ways to gut the spending cuts. But I would accept this proposal in a heartbeat: Return to both Clinton era tax and spending levels. There, that's my super committee proposal. Taxes and spending both targeted at 19% of GDP. Problem solved.

The crazy thing is that they just had to cut next years budget by 3.4%.

And that is on the increase 8% increase assumed - 3.4% - so next years budget will increase only 5.6%

They can't increase spending by merely 5.6% next year? You have got to be kidding me.

Sounds good on paper, but returning to Clinton-era spending means returning to pre-9/11 levels of military spending (since military spending, outside of entitlements, is the biggest part of the budget).

I'm not saying we need to keep spending at current levels on the military, and I think there are a lot of ways to trim the military budget without putting ourselves in danger. But I don't think it's realistic to go back to military budgets of $300 billion a year, approximately the levels seen during the Clinton years. It's like saying we can go back to $2 gasoline.

Entitlement spending needs major cuts. We need to change the entire way we handle Medicare. I have no solutions. Tort reform and changes in the way doctors are paid so they're not encouraged to do unnecessary procedures would help, but I'm not going to claim I have the answers.

I agree we need to bring collections back to a more realistic level, as they're extremely low now as a percentage of GDP. This could be resolved by letting the Bush tax cuts expire, bringing rates back to the level of the Clinton years. It will be interesting to see how this plays out in Congress now that the super-committee has failed.

Given the huge amount of waste in our Defense-Homeland Security-VA megaplex---a $1 trillion-a-year boondoggle---I think we can shrink the fed share of GDP down to 16 percent, and we should.

Imagine $3,333 for every man, woman and child in the USA---that's how much we spend on Defense-Homeand Security-VA. $13,000 for a family of four. Every year. And growing.

Other nations spend about 2 percent of GDP on defense. No one invades them. The Cato Institute has said we could cut defense spending in half---and that was before we doubled outlays in real terms (2001-2011).

Our only "enemies" are some guys armed with homemade bombs. The Soviet Union---the reason for our permanent mobilized state---disappeared decades ago.

No federal agency ever truly dies.

I assure Coyote readers of one thing: In 10 years, the Defense guys will come to Congress and speak of rising global threats, aging equipment, and difficulty in retaining good soldiers---so even after spending $10 trillion in the next 10 years, we will need to spend even more.

t is never enough.

Nope. 16% ... or less.

Based on the graph above, from about 1957 to 1968 (Vietnam era defense spending), tax collections were approximately flat at about 17.5% of GDP while spending was approximately flat at about 19%.

Through the decades I have led and achieved well over $50 million in net expense reductions in operations at various companies. It is quite easy for an operation that has never previouly practiced rigorous expense reduction to achieve equivalent results while spending at least 10% less than its historical average.

According to the quality guru, Dr. Joseph Juran, a typical operation consumes 25% of its expended resources generating waste in all of its forms. I'd argue that an operation, and government in this context is an operation, that has never before rigorously pursued expense reduction will experience higher than 25% wasted resource. Thus, achieving at least a 40% (10%/25% * 100%) reduction in waste is certainly achieveable.

Another idea - tax at 18% of GDP, spend at 16% of GDP, attack government waste to reduce spending while maintaining effectiveness, and use the surplus to pay off national debt. Once done, then reduce tax to 16% of GDP while keeping spending at 16%.

There are just two barriers to this idea. First, legislators who say won't do, and, second, bureaucrats who say can't do. If the legislators and bureaucrats could ever achieve some "can do, must do" fire in the belly, then it would be a fairly simple matter to overcome any structural barriers.

Will this work? No, sadly. I have no confidence in our legislators as a body to keep their paws off of the surplus to pay down the debt. I have no faith that the government and our legislators will not bend the definition and calculation of GDP to enable making an end run around the figures and therefore spend more. I have consummate faith that our legislators would enact taxes and call them "fees" so that such income would not be counted as a tax. I am sure that readers of this blog will enumerate other reasons why this suggestion will not work.

One can dream, though.

benjamin-

you are ignoring that data here. it is not defense spending that has grown as a % of GDP. the culprit is entitlements and transfers.

defense spend as a % of GDP is lower than the 80s, and not even half of the 60's.

meanwhile, healthcare, social security, and wealth transfers have accounted for all of the growth in federal spending.

from the 60's, milspend is down, and these programs have taken up that slack and added their own 6%.

http://www.usgovernmentspending.com/past_spending

as the man said, you are entitled to your own opinion, but not your own facts.

@Dan

I don't think there are ways to cut military spending that would make us just as safe. After all, we spend only 7 times as much as the next militarized nation, and this is with our borders constantly threatened by Canada and Mexico. I swear, if not for the nukes, they'd invade anytime now.

http://en.wikipedia.org/wiki/List_of_countries_by_military_expenditures

While other countries waste their GDP on such fallacies as education and healthcare, we stand strong! We'll see who has the last laugh...

There are a lot of places we could cut defense spending if it weren't for politicians out to serve the defense industry. And VA benefits are a third rail in politics, but expenses are outrageous, and vets are barely asked to pay anything for their healthcare. Not to mention the pensions doled out to vets. They serve 20 years and at age 40 can retire and be paid for life.

I'm all for serving one's country (and I admit I never did, though I was never asked to), and I'm willing to pay for veteran's healthcare, especially if it's necessary to treat them for battle injuries. But there are areas we can cut back, even on spending for veterans.

I agree we can keep the country safe for well under the $1 trillion a year we're spending now. But I stand by my comment about Clinton level defense spending not being possible. I'd be happy just to get military spending down to $500 billion a year. That may be impossible, however, in the current environment on Capitol Hill.

@Dan

Ah, sorry for being a jackass there. I blame lack of coffee ;)

My take as a complete outsider is that I not so much object to federal spending (which, unfortunately equals taxation by necessity - the entire "is it a spending or a revenue problem" thing is utter BS), but to it's wastefulness in the US in particular. It seems that we're hellbent as a country on investing substantial portions of our national output into hamstringing ourselves with meaningless rules and regulations or enjoying all the benefits of boatownership (for those who don't know it, the quip is that the joy and pleasure of owning a boat can be easily simulated by standing on your lawn, setting a bundle of 20ies on fire and having your spouse shower you with a garden hose).

Oh, and because I still haven't had any coffee, two angry links along the same lines of American exceptionalism:

http://shanghaiscrap.com/2011/11/one-for-the-minnesotans-heres-what-a-housing-start-really-looks-like/ (China - the most free market country in the world [for good and for bad]. Go figure.)

http://www.fluentin3months.com/no-usa-for-me/ (One Europeans rant about what's not perfect in the US, either)

Even if we had a sensible government, demographics would make it very difficult. Older people are a net drain on government. They pay lower taxes and consume more government spending. Realistically, spending will have to be slightly higher to pay their pensions and medical bills.

That is why it was so important to have surpluses before the baby boomers retired. Instead we had bozos looking for new and improved ways to spend their children’s money.

Hear hear. If only our "leaders" would accept this proposal.

Wonder what the correlation is between the red line and blue line.

Morgan-

I am well aware of entitlements, and I think they should be trimmed. I am open to vouchers for Medicare, and higher retirement ages.

However, I notice that entitlements--largely Medicare and Social Security--are wrongful taxes that at least come back to me in the form of retirement checks or medical services.

Income taxes are wrongful taxes that go into the black hole of federal agencies---largely Defense, VA, Homeland Security and USDA---and are never seen again, except by the gaggle of grifters and parasites attached to those agencies.

Oddly enough, "less government" in this case would mean cutting agency spending. Funny how the "smaller government" crowd never get this.

That is because the current-day GOP is completely corrupted by federal agency spending.

Somewhat off-topic, but I would love to see this graph coded somehow to indicate which party was in control of the House of Representatives.

How do the states do it?

We have gotten used to the U.S. government perpetually being out of control of its budget. However, U.S. states regularly operate within the means of their tax income. How do they do it?

If their processes could be mapped to how things are done at the federal level, then it really would be practical to follow Warren's suggestion. The feds could first agree on the taxation and spending level, and then go through the bitter negotiations on how to target them.

BTW, I am gratified to see comments on this "right-wing" board, and by Ron Paul and Pat Buchanan and the Cato Institute, that defense is ripe for very serious cuts.

I would be happy to vote for a GOP not run by warmongers.

One issue with defense is that in almost every regard it has become just another entitlement. Most military now have desk jobs, and are not there to actually fight. We have congress forcing larger than needed salaries, and weapons programs the military doesn't even want.

Defense could go down 3 - 5% and with efficiency gains, not have to lay anyone off, or provide a reduction in service.

In fact if we cut a lot - and just go back to the idea that war is for killing and not for coddling people who hate us, (oh we must have 0% percent collateral damage, and zero innocent civilians should be hurt ...)we could accomplish a lot more with a lot less.

Social Security takes in about $840 billion a year and pays out about $840 billion a year. The federal government has since the mid 50's taken much of the SS trust fund to the extent that they now owe the SS system about $4 trillion. SS is NOT the problem, it is more than adequately funded. It should be split out from the general fund and out from under the thumb of congress and run independently.

When "defense" is cited it of course includes wartime spending. Defense itself should not be cut but feel free to end the wars and save those billions. After all defense is one of the very few things our federal government does that is both mandated and allowed by the constitution.

Eliminate homeland security/FEMA, the education and energy department. And Interior, Agriculture, Commerce, Labor, Housing and Urban Development, Transportation and HHS.

Instead of whining about SS which pays for itself lets cut welfare which costs the taxpayers about $1.2 trillion a year at the federal level and about the same for all the states.

What the bigger government crowd never seems to get is that most of the federal budget is spent on programs neither authorized nor allowed by the constitution.

The increase in tax revenue to 19% of GDP will come about by a strong recovery. This can be spurred on by cutting regulation, and the non-expansionary parts of the recovery package. (Much - like the subsidies for renewables - is ineffective). Strong economic growth (like the USA used to have post recession for instance in 1920/21 and 91/92) increase the tax take enormously. It is also reduces the some of the entitlement payments.

@Dan blabbers:

"And VA benefits are a third rail in politics, but expenses are outrageous, and vets are barely asked to pay anything for their healthcare. Not to mention the pensions doled out to vets. They serve 20 years and at age 40 can retire and be paid for life. "

As a Vietnam vet who gets no benefits other than a rather minor mortgage price reduction (VA Mortgage), this is nonsense. I was means tested out of VA - you have to be relatively poor now to get VA benefits unless you have a service related disability.

Furthermore, vets, without any union, have contracted benefits (my contract was violated by Congress when they retroactively added means testing).

You seem to think that being in the military is just like a civil service job.

I suggest you join and find out what an idiot you are about this.

And another interesting comment for the day: GE is paying $0 in taxes on profits of 14B. Pretty impressive.

It's the reason why I want a 0% tax for enterprises in the US - clearly, the large corps can evade taxes by all sorts of creative accounting. But I suspect we would all be much better off if all corporations in America were on equal footing and could focus on creating value. We'll get the tax revenue via salaries paid.

http://marginalrevolution.com/marginalrevolution/2011/11/the-57000-page-tax-return.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+marginalrevolution%2Ffeed+%28Marginal+Revolution%29&utm_content=Google+Reader

John,

I appreciate your service to our country. My dad is a Vietnam-era vet, and my grandfather and uncle fought in WW2 (my uncle was a soldier who stormed the beaches at Normandy). So I understand some of the sacrifices you and they made, though not being a veteran myself I can't begin to really say I know what you all went through.

I also know many vets, like yourself and my father, don't get a lot back from their service in terms of money from the government. I didn't mean to sound like I was referring to all vets.

But my information comes from an interesting September article in The New York Times. I will excerpt below:

"Military pensions and health care for active and retired troops now cost the government about $100 billion a year, representing an expanding portion of both the Pentagon budget — about $700 billion a year, including war costs — and the national debt, which together finance the programs."

And:

"Under the current rules, service members who retire after 20 years are eligible for pensions that pay half their salaries for life, indexed for inflation, even if they leave at age 38. They are also eligible for lifetime health insurance through the military’s system, Tricare, at a small fraction of the cost of private insurance, prompting many working veterans to shun employer health plans in favor of military insurance.

The annual fee for Tricare Prime, an H.M.O.-like program for military retirees, is just $460 for families and has not risen in years, even as health care costs have skyrocketed. Critics of the system say the contribution could be raised substantially and still be far lower than what civilians pay for employer-sponsored health plans, typically about $4,000."

And:

"While health care costs for active and retired troops are growing faster, military pension costs are larger. Last year, for every dollar the Pentagon paid service members, it spent an additional $1.36 for its military retirees, a much smaller group. Even in the troubled world of state and municipal pension funds, pensions almost never cost more than payrolls.

Citing the fiscal hazards and inequities of the system, the Defense Business Board proposal would allow soldiers with less than 20 years of service to leave with a small nest egg, provided they served a minimum length of time, three to five years. But it would prevent all retirees from receiving benefits until they were 60.

The business board says that its proposal would reduce the plan’s total liabilities to $1.8 trillion by 2034, from the $2.7 trillion now projected — all without cutting benefits for current service members."

I think this is a reasonable proposal.

Time to end all public pensions, including the military's. A way to kick the can down the road. Except taxpayers get stuck with the can eventually.

We need to cut military outlays in half. Who is going to invade the USA? By what method?

Benjamin,

Agree to some extent, though I think someone who spends 20 years serving his country deserves long-term benefits, especially if they served in combat or suffered a combat wound. Less so for someone who served 20 years in the military but spent most of that time at a desk job.

Govt. workers (and I'm including members of Congress and the president) should get retirement benefits like those of us in private industry. If 401Ks are good for the rest of us, Congress, state and federal workers should have them as well.

There's a good reason for military pensions - the military needs career officers and NCO's, but it has very little use for them once they hit middle age. You might think that the military could use over-40 personnel to fill the many state-side desk jobs, but there are two problems with that. One is that in a large military service, it's pretty much necessary to treat personnel as interchangeable parts; having a large pool of active duty regulars whose physical fitness for field duty is questionable makes it considerably more difficult to fill the TO for a field unit, and impossible to re-purpose existing units to a more active role. Or to fill a gap in the supply chain by getting the clerks out of their chairs and loading trucks.

I was an electronics technician for the Air Force - but loading cargo was a critical part of my job. Unless Pancho Villa returned, we weren't going to fight any war from our base in New Mexico. If we couldn't pack our gear and be on a cargo plane to the other side of the world in 8 hours, we couldn't do our real job, so we had frequent exercises where we packed up and moved to the other end of the base. I never intended to stay to retirement, but I re-upped one more time so I could finish an engineering degree on the Air Force's dime, and so got out at 34. At that age, I could already tell that I couldn't take the pace of those exercises much longer.

The second reason the services don't want many older members is that, when a major war starts, a significant number of over-40's will turn out to be unfit even for desk jobs. It may be the same job they've been doing for 8 hours a day all along, but in the confusion and hurry of a major expansion in the military, they're doing it 12-16 hours a day. Most old men can't handle that.

Prior to WWII, we did not have military pensions that encouraged servicemen to retire after 20 to 30 years - and when WWII started and every branch had to grow by several times in the first year, it turned out that they had to kick out a bunch of oldsters that couldn't even handle a stateside support role. Nor was this the first time such problems occurred; right at the start of the Civil War, Lincoln had to replace the highest ranking general. "Fuss and Feathers" Scott was immensely experienced and respected, but he was too damned old to even run a desk during a full-scale mobilization.

So the choices are:

1) Pay pensions starting at about 20 years as we do now (with an increased pension for those that can handle another 10 years).

2) Allow the military to once again get loaded up with careerists that are too old to hack it when the requirements change from practicing for war to actually fighting one.

3) Pay a whole lot more to persuade people to follow a career that throws them away long before normal retirement age. And (unlike my time as an electronic technician), most of military members will not have much job experience that applies to civilian jobs.

@markm

Interesting point; it stipulates the need for an enormously large military force though - to me it reads as another example of "our military is simply an example of wasteful spending". If the enormous pension burden (in addition to all other military entitlements) is a necessity, that is just one more argument to downsize the US military and maintain a smaller force. I'd bet that a generous sign-on bonus (with no special pensions) plus the attraction of being able to pick up valuable skills during the tour of duty would attract sufficient numbers of soldier for 4-8 years of active duty during the ages 18 to 26. Offer the best of the bunch another sign-on bonus for an extension of 8 years in the officer track (with the understanding that they are out with no special pensions after), and I am pretty sure enough would take on the responsibility to maintain a healthy pyramid.