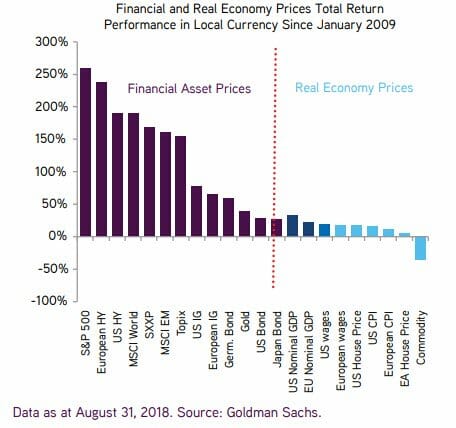

Have We Already Been Seeing Inflation, Just Concentrated in Financial Assets Rather than Consumer Products?

A while back I wrote:

Is it possible that inflation exists but it shows up mainly in financial assets (stocks, bonds, perhaps real estate) that don't really factor into standard inflation metrics? Every step the Fed has taken, as well as other western central banks, appears to me to be crafted to pump money into securities markets rather than into main street. Certainly we have seen a huge inflation in the value of financial assets and real estate over the past several years.

It was an honest question -- I am not an economist. Business school gives one a pretty good working knowledge of micro but macro is usually outside my ken. However, I see this is not a new idea and others make the same point. Saw this chart on the Zero Hedge Twitter feed

I will add that progressives want to use this data to make some sort of fairness / income inequality point about wages vs. rich people's asset holdings, but this chart is not a natural result of unbridled capitalism. It is the predictable result, even the desired result by its creators, of Fed policy in general and quantitative easing in particular.