Why Europe Won't Let Banks Fail

Dan Mitchell describes three possible government responses to an impending bank failure:

- In a free market, it’s easy to understand what happens when a financial institution becomes insolvent. It goes into bankruptcy, wiping out shareholders. The institution is then liquidated and the recovered money is used to partially pay of depositors, bondholders, and other creditors based on the underlying contracts and laws.

- In a system with government-imposed deposit insurance, taxpayers are on the hook to compensate depositors when the liquidation occurs. This is what is called the “FDIC resolution” approach in the United States.

- And in a system of cronyism, the government gives taxpayer money directly to the banks, which protects depositors but also bails out the shareholders and bondholders and allows the institutions to continue operating.

I would argue that in fact Cyprus has gone off the board and chosen a fourth option: In addition to bailing out shareholder and bondholders with taxpayer money, it will protect them by giving depositors a haircut as well.

The Cyprus solution is so disturbing because, hearkening back to Obama's auto bailout, it completely upends seniority and distribution of risk on a company balance sheet. Whereas depositors should be the most senior creditors and equity holders the least (so that equity holders take the first loss and depositors take the last), Cyprus has completely reversed this.

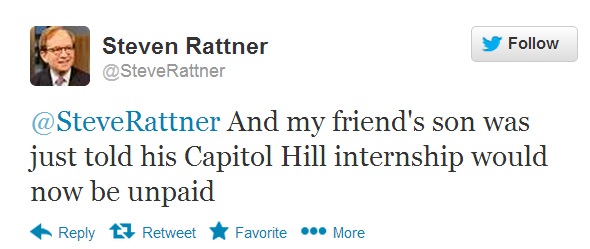

One reason that should never be discounted for such behavior is cronyism. In the US auto industry, for example, Steven Rattner and President Obama engineered a screwing of secured creditors in favor of the UAW, which directly supported Obama's election. In Cyprus, I have no doubt that the large banks have deep tendrils into the ruling government.

But it is doubtful that the Cyprus banks have strong influence over, say, Germany, and that is where the bailout and its terms originate. So why is Germany bailing out Cyprus bank owners? Well, there are two reasons, at least.

First, they are worried about a chain reaction that might hurt Germany's banks, which most definitely do have influence over German and EU policy. There is cronyism here, but perhaps once removed.

But even if you were to entirely remove cronyism, Germany and the EU have a second problem: They absolutely rely on the banks to consume their new government debt and continue to finance their deficit spending. Far more than in the US, the EU countries rely on their major banks continuing to leverage up their balance sheets to buy more government debt. The implicit deal here is: You banks expand your balance sheets and buy our debt, and we will shelter you and prevent external shocks from toppling you in your increasingly precarious, over-leveraged position.

Update: Apparently, there is very little equity and bondholder debt on the balance sheets -- its depositor money or nothing. My thoughts: First, the equity and bondholders better be wiped out. If not, this is a travesty. Two, the bank management should be gone -- it is as bad or worse to bail out to protect salaried manager jobs as to protect equity holders. And three, if depositor losses have to be taken, its insane to take insured depositor money ahead of or even in parallel with uninsured deposits.