Obamacare and Jobs in One Chart

This is a pretty amazing chart from Jed Graham and IBD which I have annotated a bit

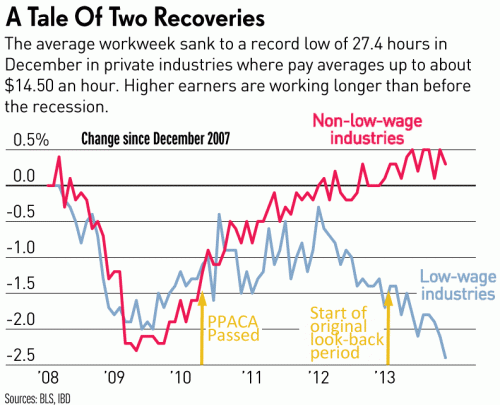

Note first that the diversion between high and low-wage** industries did not occur during the recession, and in fact through the recession the two groups tracked each other pretty closely until early 2010. Then, in early 2010, something made the two lines start to diverge and in 2012-2013 they really went in opposite directions.

Well, my suggestion for the "something" is Obamacare. In March 2010, the PPACA was passed. Looking at the jobs data, one can date the stall in the economic recovery almost precisely from the date the PPACA was passed (e.g. here).

The more important date, though, is January 1, 2013. This is a date that every business owner was paying attention to at the time but which seems entirely lost on the media. All the media was focused on the start-date of the employer mandate on January 1, 2014. Why was the earlier date important? Let's go back in time.

At that time, the employer mandate had yet to be delayed. The PPACA and IRS rules in place at the time called for a look-back period in 2013 where actual hours worked for each employee would be tracked to determine whether the employee would classified as full or part-time on the Jan 1, 2014 start date. So, if a company wanted to classify an employee as part-time at the start of the employer mandate (and thus avoid penalties for that employee), that employee needed to be converted to part-time as early as possible, preferably before 2013 even started and at worst by mid-year 2013 [sorry, I typo-ed these dates originally].

Unlike the government, which apparently waits until after the start-up date to begin building large pieces of major computer systems, businesses often tackle problems head on and well in advance. Faced with the need to have employees be working 29 hours or less a week in the 2013 look-back period, many likely started making changes back in 2012. Our company, for example, shifted everyone we could to part time in the fourth quarter of 2012. I know from talking to the owners of several restaurant chains that they were making their changes even earlier in 2012. One employee of mine went to Hawaii in October of 2012 and said that all the talk among the resort employees was how they were getting cut to part-time over Obamacare.

Yes, the employer mandate was eventually delayed, but by the time the delay was announced, every reasonably forward-looking company that was going to make changes had already done so. Having made the changes, there is no way they were going to switch back, and then back yet again when the Administration finally stumbles onto an actual implementation date.

If this chart gets any traction over the next few days, expect to see a lot of ignorance as PPACA defenders claim that the fall in low-wage work hours can't possibly have anything to do with the PPACA because the employer mandate has not even started. Now you know why this argument is wrong. The PPACA, and associated IRS implementation rules, drove companies to convert full-time to part-time jobs as early as 2012.

Usual warning: Correlation is not causation. However, I will submit that I was predicting exactly this sort of result years before it occurred. This is not a spurious correlation that is ex post facto blamed on whatever particular bete noir I might have. I and many other predicted that Obamacare would drive down work hours per week in lower-wage industries, and now having seen exactly that correlated with key Obamacare dates, it is not going to far to hypothesize a connection.

** Why could low-wage industries be impacted more than high-wage? Two reasons. One, low-wage industries are far less likely to offer a full Obamacare-compatible health plan to employees than high wage industries. Second, the fixed penalties ($2000 and $3000 per employee) for lack of insurance plans are obviously a far higher percentage of the total pay in low-wage vs. high-wage industries. A penalty that is 15% of annual pay is much more likely to cause employers to shift or reduce work than a 3% penalty.