Question for Keynesians: What Are You Doing To Prepare for the Next Cycle?

When I was in school learning macro 101 from Baumol and Blinder, my memory is that the theory of Keynesian stimulus and managing the economic cycle was that deficits should be run in the bottom part of the economic cycle, paid for with surpluses in the top half. So we are now almost certainly in the top half of the cycle. But I don't hear any Keynesians seeking to run a surplus, or even to dial back on government deficits or spending. In fact, our Keynesian-in-chief says he is done with "mindless austerity" and wants to start spending even harder in 2015.

Its enough to make one suspicious that all the stimulus talk is just a Trojan Horse for a desire to increase the size and power of government.

But for Keynesians who really believe what they are saying, that deficit spending somehow saved us from a depression in 2009 and 2010, then I ask you -- what are you going to do next time? It appears that when we enter the next recession in this country, that US debt as a percentage of GDP is going to be almost twice what it was entering the last recession. Don't you worry that this limits your flexibility and ability to ramp up deficit spending in the next recession?

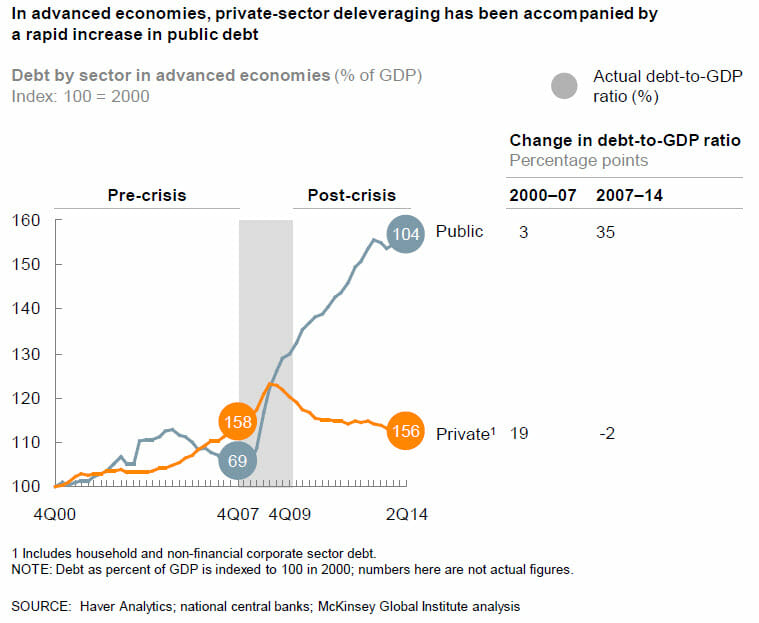

The situation in the US is the same as it is worldwide. While those evil private short-term-focused private actors have used the improving economy to de-leverage back below 2007 levels, governments have increased their debt as a percentage of GDP by just over 50% since just before the last recession.

Since 2007, according to my old friends at McKinsey, global government debt has risen by $25 trillion since 2007. If you really care about Keynesian stimulus in recessions, and not just "mindlessly" (I can use that term too) increase government spending, wouldn't you want to be building up some reserves for next time?

What an idiotic statement.

After doubling debt outstanding to the public, observing that slightly reduced deficits are below historical trend is about a effective as bringing a squirt gun to a 5 alarm fire.

LMFAO

You think Al fucking Gore would have been fiscally disciplined?

My God, you’re dumb.

Better buy gold.

Hmm, I wonder who came up with welfare reform, and who vetoed it at least twice then decided to sign a third time he figured the veto would get overridden.

Go slap yourself on the back and make up history with you lefty buddies, there are still some of us around who are old enough and have good enough memories to know what really happened.

As for the deficit reducing budgets, they came out of the house as well, but one problem with them is that both parties were a little too generous raping defense spending and werenok with not keeping the peace overseas which helped contribute to our Ben Laden situation.

marque2: I wonder who came up with welfare reform,

Clinton campaigned on welfare reform.

marque2: and who vetoed it at least twice then decided to sign a third time he figured the veto would get overridden.

There was no reasonable chance of an override, however, if Clinton had vetoed a third time, the bill would have died. The Clinton Administration was determined to pass welfare reform. They didn't consider the bill perfect, but the best possible given the political situation. Ultimately, Clinton signed the bill fulfilling his campaign pledge.

marque2: As for the deficit reducing budgets, they came out of the house

That's correct. The 1993 Omnibus passed without a single Republican vote in the House or the Senate, with Gore casting the deciding vote in the Senate.

marque2: but one problem with them is that both parties were a little too generous raping defense spending and werenok with not keeping the peace overseas which helped contribute to our Ben Laden situation.

Another aircraft carrier wouldn't have stopped the 9-11 attacks.

tex: I don't think “America chose” in the sense citizens knowingly changed course, but rather the politicians changed course by selfish intent.

Most voters cast their vote for Gore, but due to peculiarities of the American electoral system, Bush was elected president.

"Another aircraft carrier wouldn't have stopped the 9-11 attacks."

Not decimating our defense department spy program might have helped though. Thanks President Clinton (though congress is to blame too - but since you can attribute anything good congress did to Clinton, I am surely allowed to do the reverse.)

Again every you said above is a revision. You strike as someone who wasn't an adult during the Clinton administration, so you are hearing all this stuff 3rd hand, cuz in middle school you, like I was in middle school, weren't really paying attention.

As noted, either way the course would have changed w/o citizens knowingly doing themselves harm.

Gore would have been no better and probably worse with his Global Warming agenda though Bush was worse than Clinton who shifted towards less gov ("This is the end of big government") and I've seen no evidence of Gore's concurrence.

The citizens are routinely blamed for the gov we have such as responding to Obama's slow recovery with “You liberals got what you voted for.” I find it more like M Friedman's speech & the article re gov policy vs voters. Our MSM is filled 24/7 with politicians & their mouthpieces debating the issues with messages of nonsense, blatant lying & doing other than what they say (Gulf of Tonkin, WMD, Read my lips, will cut the cost of a typical family's premium by $2,500/yr, etc.) rather than economics profs debating things economic, doctors those things re care, etc. You may note citizens may be sold on a policy, say Obamacare, but no policies are canceled for failure to meet the objectives given for its passage - "fooled ya" is the SOP.

The citizens, the madding crowd, have some very silly & dangerous notions but politicians are not following such except those that serve their own cause and craft messages to appease or encourage their developed followers.

You refer to “most voters.” The following better represents reality:

When asked how he chooses whom to vote for Richard Epstein* said “Anyone but the Big Two who are just two members of the same statist party fighting over whose friends will get favors."

*Law Prof & author Simple Rules for a Complex World, advocating minimal legal regulation.

Or worded to allow us to smile at it all:

“The government at all levels is all coercion, all the time, about everything, and in their hearts most government functionaries of both parties have a profound contempt for their constituents, and get elected solely on assembling a coalition of voters with a profound contempt of just less than half their fellow citizens.”

--Sippican Cottage

The economy did indeed plummet in 2008 and 2009. But that fall had nothing to do with the federal debt or fiscal policy -- whether Keynesian or Supply Side. The problem was federal housing policy, especially those policies stemming from the dozen cabinet-level initiatives that that Clinton Administration took to bully lenders into making risky loans. There is plenty of blame to go around for the federal housing policy, and there is not one individual to blame -- but if there were ONE individual, it would be Barney Frank who stymied several Bush Administration initiatives to curb the policies that led to the Financial Crisis. With the media on his side, Barney Frank's accusations of racism and bigotry won the day, and the policies persisted that led to the Financial Crisis.

Truth is a pesky thing.

It is hard to find a presidential candidate who does not promise deficit reduction. It is a meaningless campaign position.

The Budget surplus did not come from the tax rate increase in 1993. It came from the tax rate decrease later in the decade. Truth is a pesky thing. Tax revenues from the rich soared with the tax rate decrease. For Reagan and Bush, their tax rate cuts also included low income. Therefore, their tax collection decreased because income recharacterization is not has cost effective for them. In summary, the key reasons why tax collections did well in the 1990s: reduced tax rates on wealthy and no tax rate reduction for lower incomes. Truth is a pesky thing.

to say that "Clinton also oversaw cuts in the capital gains tax" is like saying that Nixon oversaw his resignation.

"A significant difference is that Greek debt is denominated in a currency they do not control." That is true. We seldom anticipate that that a country issuing debt in own currency would default (even though it has happened). Nevertheless, creditors could still ask for austerity measures in a country issuing debt in its own currency. Those austerity measures could come at the most inopportune time -- especially in the Keynesian view. The possibility of being forced into austerity measures is one of the key risks of carrying a huge debt.

Our earlier mistake on Keynesian economics was to ignore the question where the money comes from that the government spends. Whether the $ comes from taxes or borrowing, that $ loss has a negative multiplier effect at least as equal to the positive multiplier effect in federal spending. At one time, we had an idea that the balanced budget multiplier was one because we thought savings was a BAD leakage -- which is true only if savers convert their savings to cash and hides savings under the mattress.

Better stop spending.

And you're going to need more than just gold, if the wheels come off...

I have way less power over the federal government than you presume.

I don’t presume you have any power, which is a relief given your idiotic comment about an infinitesimal drop in deficits after blowing the fiscal doors off.

TruthisaPeskyThing: Our earlier mistake on Keynesian economics was to ignore the question where the money comes from that the government spends.

Um, it's not ignored in Keynesian economics. It's a trade between wealth and economic activity.

TruthisaPeskyThing: Whether the $ comes from taxes or borrowing, that $ loss has a negative multiplier effect at least as equal to the positive multiplier effect in federal spending.

That is incorrect. It depends on the economic state. If the economy is working at capacity, then a stimulus will cause inflation. If the money markets are lending at capacity, then borrowing will cause a rise in interest rates. However, if the economy and money markets have slack, then a stimulus will increase economic activity.

TruthisaPeskyThing: At one time, we had an idea that the balanced budget multiplier was one because we thought savings was a BAD leakage -- which is true only if savers convert their savings to cash and hides savings under the mattress.

The deflationary effect is due to investment capital moving to liquidity. It doesn't have to be hid in the mattress.

TruthisaPeskyThing: The economy did indeed plummet in 2008 and 2009. But that fall had nothing to do with the federal debt or fiscal policy -- whether Keynesian or Supply Side.

It was due to a bubble in the shadow market in securities, however, the procyclical, anti-regulatory policies of the Bush Administration exasperated the problem.

TruthisaPeskyThing: but if there were ONE individual, it would be Barney Frank who stymied several Bush Administration initiatives to curb the policies that led to the Financial Crisis.

The Democrats were in the minority until 2007, so that can't be the primary factor in a bubble that was several years in the making.

Truth is a pesky thing.

TruthisaPeskyThing: The Budget surplus did not come from the tax rate increase in 1993.

1993, -255, income tax increases

1994, -203

1995, -164

1996, -107, welfare reform

1997, -22, capital gains cut

1998, +69

1999, +125

2000, +236

Tax increases certainly weren't the only factor, however, you will notice that the deficits were already decreasing significantly before the capital gains cut. Furthermore, the tax increases certainly didn't prevent both a growing economy and increased tax receipts.

TruthisaPeskyThing: to say that "Clinton also oversaw cuts in the capital gains tax" is like saying that Nixon oversaw his resignation.

Clinton signed the bill cutting capital gains taxes. He could have vetoed. Truth is a pesky thing.

Zach, I hope sometime that you get some reality in your thought process. Near the end of 2000, the US economy was heading toward a recession. Little doubt about that then. Bush proposed fiscal policy that was definitely Keynesian in overall tone . . . some Supply Side, but mostly Keynesian. It was anti-cyclical. Following the 9/11 attack . . . Again anti-cyclical proposal. in 2008, again anti-cyclical.

Regarding anti-regulations. . . those major decisions were made in the 1990s.

There are plenty of Bush actions with which I disagreed, but you appear to have so much Bush hatred running through your mind that your statement and analysis come out nonsensical. We will have major problems if we do not recognize the 2008 Financial Crisis for what it is was . . . if we just try to make political points off it, we run the risk of repeating similar crisis in the future.

Zach, I doubt that you can be so politically ignorant as to not recognize that the minority party has power in Washington, especially if the media sympathizes with the minority party. I encourage you to watch the House Finance Committee hearings where Barney Frank and his colleagues devastated the Bush Administration for its proposals to rein in the dangerous lending and housing policies in play before the crisis. The charges of racism and bigotry stopped those proposals.

Zach, it is truly disappointing to see how shallow your analysis can be. At the start of the 1990s, we anticipated that the 1990s would be a good decade for federal tax revenue. The Baby Boomers were entering their best earning years, and the technology advancements of the 1980s (spurred in part by the deregulations and tax policies of the previous decade), were going to be deployed into businesses in the 1990s. These technology innovations were going to -- and they did -- decrease costs, improve productivity, expand job opportunities, and create new businesses. The growth in tax revenues is no surprise. BUT please remember, the tax collections from the wealthy stumbled after the tax increase of 1993. Let me be blunt, not one of my high-income clients paid more in taxes in 1994. Rather they shifted more wealth and income to tax-preferred characterizations because the tax savings were worth the hassles and cost. (Tax collections over all increased because lower and middle income earners paid more in taxes.) On the other hand, every one of my high-income clients paid more in taxes following the cut in capital gains tax rates. Not only did the cut in rates increase tax collections, but it also removed tax impediments to better allocation of resources. Without these impediments, resources flowed to more efficient resources, creating jobs with increased income and increased tax collections.

If you want people to say that Clinton signed the bill, yes, we can all say that he signed the bill. What you are not going to get is people giving Clinton credit for signing the bill after working against it. Finally, his focus groups -- and Clinton did use focus groups well for political analysis -- convinced him to sign the bill. It was not because of his leadership that he signed the bill.

Truth is a pesky thing.

... and yet, if we're at the crest of a business cycle, it should be a surplus beyond the 40 year average.

(You might want to give some of the respective credit to the purseholder branch of government, namely congress.)

Wouldn't disagree that much (depends on the if and the definition of a manageable or viable government debt), but again, isn't that a Keynesian thought?

(Heh, I'd like to think that it is simply a rare but prudent thought.)

You say tomato.

I say even a stopped clock could be right twice a day.

Your statement implied a belief in the business cycle, and the desirability of counter-cyclical government saving/spending --including the need for surpluses during periods of economic strength. You called it "prudence" and "thought" but it seems to be some of the same prudent thought that underlies Keynsian economics. Maybe I missed something.

From interest rates to stimulus to long term debt it seems the world has largely accepted this stuff.

"Your statement implied a belief in the business cycle,"

Sorry, what does that have to do necessarily with Keynes? The concept has existed before that learned gentleman. And I said nothing about any necessary periodicity or macroeconomics either. One can paraphrase it as "save in times of plenty", which is a timeless insight.

It's all pretty much accepted as common sense today.

Which "it"? The necessity to save during plentiful times? Well governments appear not to have accepted that common sense ... which is the topic of the original article.

A consensus common sense for the long term doesn't preclude politicians with different short term goals from running interference and creating chaos.

Well and true ... so what's the quibble here? Yes, governments suck at prudent management of their finances. Those that claim Keynesian influences are simply more hypocritical.

tomato

Great article! Thanks for sharing! Find useful information, tools to take your trading to

the next level and much more provided by FX World. Read more at https://fxworld.trade/