The Most Negative Leading Economic Indicator

Will we look back on 2009 as the tipping point where productive resources began to spiral faster and faster into the government black hole? A few stories that have caught my eye the last few weeks:

Federal salaries exploding, from USA Today via Q&O

The number of federal workers earning six-figure salaries has exploded during the recession, according to a USA TODAY analysis of federal salary data.

Federal employees making salaries of $100,000 or more jumped from 14% to 19% of civil servants during the recession's first 18 months "” and that's before overtime pay and bonuses are counted....

The trend to six-figure salaries is occurring throughout the federal government, in agencies big and small, high-tech and low-tech. The primary cause: substantial pay raises and new salary rules.

The highest-paid federal employees are doing best of all on salary increases. Defense Department civilian employees earning $150,000 or more increased from 1,868 in December 2007 to 10,100 in June 2009, the most recent figure available.

When the recession started, the Transportation Department had only one person earning a salary of $170,000 or more. Eighteen months later, 1,690 employees had salaries above $170,000.

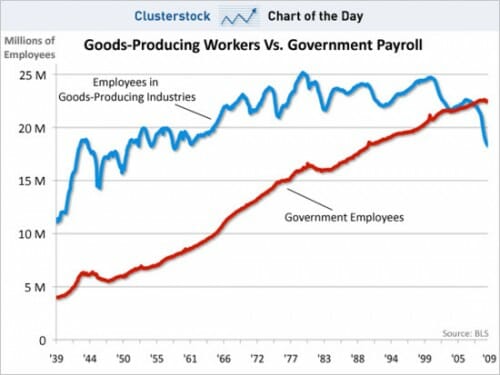

Government Employment Rising, via Glenn Reynolds

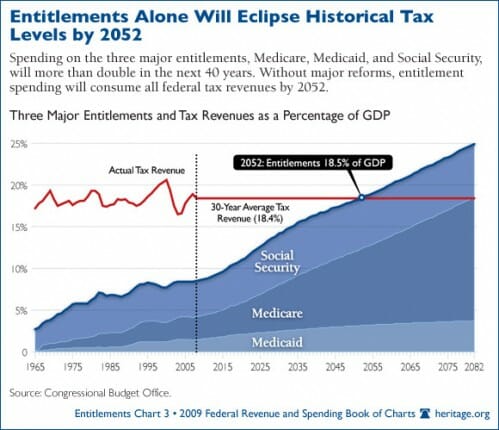

Government services rising as a percent of the economy (from the Heritage Foundation via the same Glenn Reynolds link above)

Capital to private firms is increasingly allocated by the state -- the new Corporate State. First, Representative Paul Ryan in Forbes:

Thirty years later, this crony capitalism is back with a vengeance, accelerated by an aggressive program by President Obama and the Democratic congressional leadership. It is wreaking havoc on economic recovery and fueling continued resentment among the American people.

The actions taken at the height of the financial panic last fall, with credit markets frozen, succeeded in preventing a systemic--and catastrophic--collapse. Since bringing us back from the precipice however, the Troubled Asset Relief Program [TARP] has morphed into crony capitalism at its worst. Abandoning its original purpose providing targeted assistance to unlock credit markets, TARP has evolved into an ad hoc, opaque slush fund for large institutions that are able to influence the Treasury Department's investment decisions behind-the-scenes. No longer concerned with preserving overall financial market stability, Treasury's walking around money continues to be deployed to reward the market's Goliaths while letting its Davids suffer.

Further, via Reuters:

U.S. banks that spent more money on lobbying were more likely to get government bailout money, according to a study released on Monday.

Banks whose executives served on Federal Reserve boards were more likely to receive government bailout funds from the Troubled Asset Relief Program, according to the study from Ran Duchin and Denis Sosyura, professors at the University of Michigan's Ross School of Business.

Banks with headquarters in the district of a U.S. House of Representatives member who serves on a committee or subcommittee relating to TARP also received more funds.

Political influence was most helpful for poorly performing banks, the study found.

"Political connections play an important role in a firm's access to capital," Sosyura, a University of Michigan assistant professor of finance, said in a statement.

The Government has gained new power to allocate capital in the future. This was perhaps one of the most under-reported stories of the last few months (mea culpa as well).

To close out 2009, I decided to do something I bet no member of Congress has done -- actually read from cover to cover one of the pieces of sweeping legislation bouncing around Capitol Hill....

The reading was especially painful since this reform sausage is stuffed with more gristle than meat. At least, that is, if you are a taxpayer hoping the bailout train is coming to a halt.

If you're a banker, the bill is tastier. While banks opposed the legislation, they should cheer for its passage by the full Congress in the New Year: There are huge giveaways insuring the government will again rescue banks and Wall Street if the need arises....

Here are some of the nuggets I gleaned from days spent reading Frank's handiwork:

-- For all its heft, the bill doesn't once mention the words "too-big-to-fail," the main issue confronting the financial system. Admitting you have a problem, as any 12- stepper knows, is the crucial first step toward recovery.

-- Instead, it supports the biggest banks. It authorizes Federal Reserve banks to provide as much as $4 trillion in emergency funding the next time Wall Street crashes. So much for "no-more-bailouts" talk. That is more than twice what the Fed pumped into markets this time around. The size of the fund makes the bribes in the Senate's health-care bill look minuscule....

But don't worry, trust Congress to get at the heart of the financial meltdown

The bill calls for more than a dozen agencies to create a position called "Director of Minority and Women Inclusion." People in these new posts will be presidential appointees.

It will never be easier to run a political campaign in our lifetime than it should be to run against all this in November. If the GOP can't win then, they should abandon politics.

It doesn't bother me whether the 'phants can win vs the donks. Folks vote for change, don't ya know. That the 'phants helped create the mess does bother me. I have little reason to expect that their party has learned not to do what it has done.

Rather than legislators reading spending bills before voting, much as I endorse that practice, I'd rather they read Orwell, Huxley, CS Lewis (That Hideous Strength outdoes both Huxley and Orwell), Rand, and Solzhenitsyn and then (or maybe these first, perhaps because Rand and Solzhenitsyn, as all Russian authors, don't write short books) Frederic Bastiat's "The Law", some Ludwig Von Mises, some Hayek.

Mene mene tekel upharsin.

Gov't salaries have been skyrocketing for many years now. It's why Fairfax County often has the highest per capita income in the country. And why Maryland has that title at the state level.

It isn't just "official" gov't salaries, it includes contractors (yes that includes me). And private companies send (well-paid) lobbyists and Bus Development people to work the area.

And salaries rise quickly b/c it's easy to leverage 1-2 years experience from one job to get a promotion for another job.

This is a nasty spiral, b/c the DC high cost of living means you need high salaries to recruit new people, and that just drives the cost of living higher. Modest restaurants charge high prices, b/c it's hard to find workers who live close. Same with retail and other low-skill occupations. Fairfax Cty was even suggesting increasing taxes to pay school teachers, fire fighters and other "essential" county employees who could no longer afford to live where they worked.

And all of this while producing very little. Gov't produces little of value (power point presentations don't really count) so it's taking billions from the economy and producing nothing for it. In fact many regulations impede the economy.

Sorry, guess this got long-winded. My original point was that this has been going on for some time.