Two-Income "Trap", aka the Government Trap

Todd Zywicki has a nice post on the The Two-Income Trap: Why Middle Class Mothers and Fathers are Going Broke by Professor Elizabeth Warren and Amelia Warren Tyagi.

In his writings on the tactics for engineering the communist state, Karl Marx talked a lot about the need to "proletarianize the middle class." This has been a very popular tactic among leftish writers and politicians today, attempting to convince the middle class that they never had it so bad.

I won't repeat Zywicki's whole post, but the books author's argument revolve around examples which purport to show that as families go from one to two earners, their costs (health care, child care, cars, mortgage, etc.) go up by more than the additional income, making them poorer on a discretionary spending basis.

Zywicki first points out the same thing I immediately thought of when I read a summary of the book:

It is not clear what to make of all of this, except that it is hard to

see how this confirms the central hypothesis of "The Two-Income Trap"

that "necessary" expenses such as mortgage, car payments, and health

insurance are the primary draing on the modern family's budget. And

again, this unrealistically assumes that all increased spending on

houses and cars is exogenously determined, ignoring the possibility

that an increase in income leads to an endogenous decision by some

households to increase their expenditures on items such as houses and

cars.

While the assumption seems crazy, it makes sense in the context of leftish ideology, which holds that the middle class have only limited free will and tend to have their decision making corrupted by advertising and other corporate pressures.

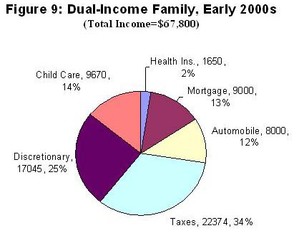

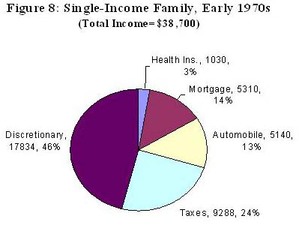

But Zywicki goes further, and actually digs into the author's numbers. He finds that the authors are surprisingly coy about addressing changes in taxation in their numbers. Zywicki then uses the authors' own numbers, this time with taxes factored in using the authors' own assumptions, and gets these two charts:

As Zywicki summarizes:

As can readily be seen, expenses for health insurance, mortgage, and automobile, have actually declined

as a percentage of the household budget. Child care is a new expense.

But even this new expenditure is about a quarter less than the increase

in taxes. Moreover, unlike new taxes and the child care expenses

incurred to pay them, increases in the cost of housing and automobiles

are offset by increases in the value of real and personal property as

household assets that are acquired in exchange.Overall, the typical family in the 2000s pays substantially

more in taxes than in their mortgage, automobile expenses, and health

insurance costs combined. And the growth in the tax obligation

between the two periods is substantially greater the growth in

mortgage, automobile expenses, and health insurance costs combined. And

note, this is using the data taken directly from Warren and Tiyagi's

book.