Alarmism Fail

Anthony Watt has a nice catalog of past predictions of doom (e.g. running out of oil, food, climate issues, etc). It really would be funny if not such a serious and structural issue with the media. I would love to see someone like the NY Times have a sort of equivalent of their reader advocate whose job was to go through past predictions published in the paper and see how they matched up to reality. If I had more time, it is the blog I would like to start.

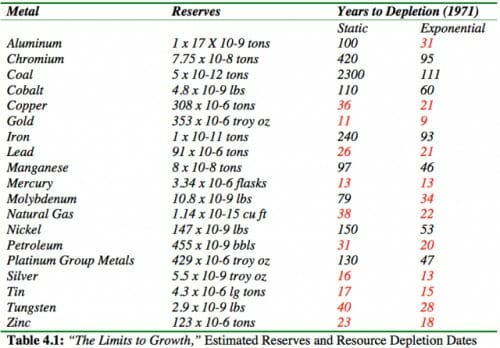

Update: One of his readers Dennis Wingo took the resource depletion table from Ehrlich's Limits to Growth and annotated it -- the numbers in red show the resources Ehrlich predicted we should already run out of.

However, rather than ever, ever going back and visiting these forecasting failures and trying to understand the structural problem with them, the media still runs back to Ehrlich as an "expert".

If it bleeds it leads. Doom sells news, we're going to be fine doesn't

I personally love to rub "experts" noses in their past predictions and listen to their creative excuses for why I should give any weight to their predictions this time.

I work in the investment management field, which is absolutely overrun with "experts" whose predictive abilities are rarely better than random chance and often much worse.

I'm not saying that "experts" are stupid or ignorant... some are truly brilliant, but no matter how intelligent and well-informed they may be, the very fact that they work within a chaotic system is inevitably going to limit their predictive abilities. The most dangerous thing is when they get something right, even if it's by pure luck, they delude themselves into believing "they knew it all along", and become even more overconfident in their predictive abilities.

What's too often lacking isn't intelligence, but wisdom and humility.

}}} Doom sells news

Really? Then why does "fiscal doom" not "sell news"? "overspending doom"? "debt crisis doom"?

No, the only "doom" that "sells" is the kind of doom that requires massive government expansions of control to solve.

...Other "dooms" need not apply.

Even better news is the fact that most of the proven metal reserves do not consider what's available on or under the ocean floors. When land-mined metals become scarcer, we'll find ways to prospect and mine undersea.

That explains not only the investment field but many others, including "management". I am convinced that many CEOs are less talented (in ways beneficial to the company they run) than they are lucky, also lacking in wisdom and humility.

I'd prefer to see comp packages that stretch 10-20 years before vesting to emphasize strategic long term health of the company vs the current focus on 3-12 months that many are at. In that case, it is a clearer link to strong strategic foresight, decision making, and management talent at play.

Also note that technology can change the definition of "scarce" with existing known reserves of resources - e.g. fracking. drilling at angles.

Environmentalists look at this as a closed static system, not unlike socialists who see the world as a fixed pie where winners take from losers with no room for any mutual benefit. Technological breakthroughs can have incremental or dramatic changes in both supply and demand of any resource.

This is excellent. I have long lamented that no one has compiled a list of all of the failed AGW or climate ctastrophe predictions that went nowhere (all of them?), similar to the Warmlist (http://www.numberwatch.co.uk/warmlist.htm). It's a start.

Then why does "fiscal doom" not "sell news"?

Well actually it does. Just reel back 5 years and read the papers. They were all railing about bad times. Course that was under Bush. The Ptompkin Press have a vested interest in the current administration. Hence they will make sure that anything bad is not leaked out.

We already have the means to mine the sea floor by using technologies used by the offshore oil and gas industry. Nautilus Minerals is already developing its Solwara 1 project in PNG as it looks to go after concentrated mineral deposits found in volcanic smokers on the sea floor. If successful the project could set off a deep water mineral production industry. That said, there is no suitable replacement for those old open pit mines that began to appear after the development of heap leaching revolutionized the industry in the 1970s. Most of the easy targets are now gone and we will need massive new investment to keep the production of some minerals from declining.

What you need to keep in mind is the fact that the theory is not that we run out of some economic good but that the production of that good peaks so we need a suitable substitute. It is a fact that whale harvesting peaked in the 19th century. It is a fact that the production of light sweet crude peaked about five to seven years ago. And if we had transparency in production reporting it would be very easy to find out when the exact peak for all crude will happen. Sadly the lack of transparency has meant some wild estimates but also means that we will not know until the peak appears in the rear view mirror. That in turn means a massive destruction of capital that will make society poorer until suitable substitutes are found.

Reading that table is interesting cause common sense even in 1971 would have shown some of it to be wrong. Aluminum -- fourth most common element in the earth. The average suburban lawn holds around 20lbs of the stuff in the soil. Extraction is the issue. Gold, really? The stuff is too expensive to waste and as a monetary unit it will be hoarded. Doubtful it would be depleted. Silver the same thing. For both there are now firms in this country that do a booming business in reclaiming both metals from circuit boards and the like. Lead and mercury won't deplete thanks to the EPA and the stringent usage rules for both materials.

Probably the most strategic metals are tin and zinc. Only because US supplies are sourced overseas.

You are correct that reclaiming gold goes on a lot here, but much of the circuit board material is collected, but due to EPA requirements it is difficult to reclaim the metals from circuit boards here, so the stuff is shipped to Europe and Asia where they have an easier time legally reclaiming the metals.

I have an brother in law who set up such a shop and is refining materials from dentists, hospital medical equipment (there are disposable kits for things like heart surgery and the metallic tools, are coated in platinum.) Even carpets from jewelry stores is burnt so the scrap metal can be reclaimed. .

Manganese nodules!

http://en.wikipedia.org/wiki/Manganese_nodule

We are continually finding new supplies of oil. No doubt it will peak, but the peak date is always moving forward. I learned in school that oil production would drop precipitously in 1991 - and all of a sudden reserves were discovered everywhere.

Again in 2003 we were reading how oil has peaked and so has natural gas. In fact we were running out of natural gas and helium. Now 10 years later, that prediction seems crazy, and when we run out of fracking NG, it can be mined off the ice formations deep in the water on every continents edge - a 3000 year supply for us, just off our own coast.

Yes eventually we will run out of one resource or another (England had a shortage of trees long ago and went to coal as a substitute) but the actual date is much further than the alarmists predict. I wouldn't be surprised if in 2100 we still have abundant oil.

To be fair, Ehrlich is not the go-to expert in metal mining in any media and he has a reputation as a bit of an alarmist on population biology/evolution issues where he is an expert.

And there are quite a few materials that are in tight supply (rare earth metals, helium, copper, refined steel) more from rates of consumption periodically outpacing rates of production. And global oil production is now flat. We don't run out of stuff, lesser uses just get priced out of the market.

Rare earth metals are in tight supply because 1: China is restricting the supply and 2: EPA rules basically ban the mining of such minerals in the USA. We used to mine our own, but rules have made it cost prohibitive.

Helium is now quite abundant again, now that we have widespread fracking, Copper has gone up in price, but I think that is more due to currency manipulation (people would rather invest in gold and copper, and silver than dollars)

China undercut the price for years and then implemented an export quota. The EPA rules wouldn't have been a problem if the global price hadn't been set to put the California mine out of business, and you can't spin up a mine overnight.

Helium market is still tight and there's limited extraction facilities (focused on extensive 1% helium content gas deposits). We're producing more natural gas but the distributed nature (and short term production period) of fracking makes the capture difficult. In the Bakken they're burning off the natural gas because the liquids are the economical part and they can't be bothered to build pipelines for it. You think they're going to build facilities to capture the helium?

No one is stockpiling copper beyond a 3-6 month inventory. People are investing in mines but the production hasn't met demand yet. The giant new Mongolian mine will help. The current price is 4x the 2004 price. That's why people are stealing copper wiring out of every unguarded industrial facility in the nation.

There is a difference between not building pipelines because it isn't economical, and not building pipelines because of government stonewalling. Keystone was suppose to help in many regards. ND has been screaming for years for the need for more gas and oil pipelines.

And yes if your oil well produces very little gas, it probably is better to just burn it off.

Small detail: Ehrlich was not the author of The Limits to Growth. That was the subtitle of the famous "Club of Rome" report. Ehrlich was, however, the author of The Population Bomb, and pushed a similar theme. Both failed to appreciated that effect prices have on supply, or the extent of human ingenuity.