Obama Bravely Fighting Against Deleveraging

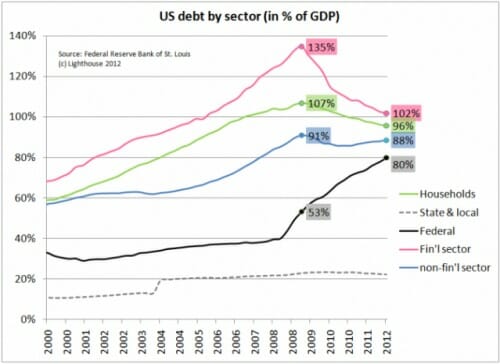

I found this chart interesting, but am not entirely sure what conclusion to draw (via Zero Hedge)

In 2009, I think most everyone understood that the economy would have to reduce debt and that this process would be painful in terms of creating years of slow growth. The good news from this chart is that the financial and consumer deleveraging has indeed been occurring, so at least our pain is not for naught. The debate that will likely go on for years after this recession is whether the rapidly increasing Federal debt helped or hurt: did it help offset the cost of the private deleveraging, or did it drag out the recession by keeping total debt levels from dropping? Is it private debt that matters, or total debt? Of course this makes the analysis more complicated.

The ratio is still to high regardless of the drop in the private sector. A healthy economy cannot sustain itself with the debt load show. Nothing positive about the numbers listed here.

Deleveraging has a nice ring to it because it sounds like a plan any rational person would follow when trying to return to solvency after a financial set back. It won't work because the debt is simply too large to ever be paid.

The worst part of our situation is we cannot free ourselves from the fools responsible for this problem. It like you divorced your crazy spouse with the unrepentant gambling problem but judge Bernake rules you - not the ex, have to cover the losses. As an added bonus you are also on the hook for the ex-spouse continued gambling habit, forever!

@TXJim: That's about the best description of America's political and economic situation I've read yet.

If I read the second chart correctly, it indicates that the Fed is busy printing money. This may reflect the reason that inflation is so high - much higher than the official numbers, since the official inflation numbers deliberately ignore certain important factors.

Much of the inflation is carefully hidden. For example, lots and lots of products have introduced new packaging over the past few years. While the price has remained nearly the same, the contents have been reduced. However, anyone on a tight enough household budget will attest to real inflation of around 10% a year.

Since wages are not rising at anywhere near this level, we are getting poorer. More, inflation driving by printing money is really a hidden tax on wealth and savings.

The Federal Debt in this graph is understated. It uses the measure of federal debt that leaves off the debt to the Social Security Trust Fund (based on the argument that the government owes the debt to itself so therefore that it is not really debt). I vehemently disagree with this measure of the federal debt. As a society, we are counting on the Treasury making good on its debt to Social Security so that Social Security recipients can get their checks. We need to collect taxes to pay off this debt.

I look at two recessions that preceded this one. Kennedy came into office on the heels of the third recession during Eisenhower's eight years in office (how was Ike so beloved with such horrible economic performance?). He called for marginal taxes to be cut across the board and for a sound dollar (no lower interest rates). This was a policy mix put forth by a young PhD in economics working for the international monetary fund named Robert Mundell. The policy mix is contained in a paper Mundell wrote for the IMF around 1960 that wasn't published until 1962-"The Appropriate Use of Monetary and Fiscal Policy for Internal and External Stability." Kennedy's tax cut was passed by LBJ after the assassination. The economy boomed from 1964-1969 as a result. The point I want to make, no slow growth from a recession. I know the debt load was nothing like Obama faced, but the policy mix worked without creating a huge debt. In other words tax cuts that created enough growth to pay for them. Ronald Reagan followed Mundell's policy mix in 1981. He slashed marginal taxes across the board and Paul Volker kept interest rates high (strong dollar policy by any other name). The Reagan recovery is the strongest from a recession since the 1920's. We incurred a massive debt as a result of Reagan's massive military buildup and not from his tax policy. The recession Reagan faced was much worse than Obama's with higher unemployment, massive inflation, and coming at the end of a dozen years of stagnant economic growth, 1969-1981. To get more details simply read the finest economic history written on the subject by the Chair of Sam Houston State's History Department, Brian Domitrovic, "Econoclasts." He also writes a blog and a column for Forbes.

The point of the whole diatribe being there is no reason whatsoever that the debt levels we encountered in the Financial Meltdown would necessarily result in years of slow growth . The Fed's massive quantitative easing fueled the stagnation coupled with the massive animosity shown towards the business community (not the financial community). Do away with QE policy, cut marginal tax rates, and have pro business rhetoric emanating from the White House bully pulpit instead of class warfare rhetoric and "you didn't build that" fantasy and slow growth disappears in this reporter's opinion.

I write this as a degree holder and professor of economic history and the owner of a small business with my wife.

Reply to Dave Thomas:

The country – and the world – would be much better if Congress and the people understood the principles that you are explaining. I will add a few nuances in this reply.

1. We have seen throughout history that increasing the debt has not by itself stymied recoveries or economic growth. However, those historical examples have taken place with far lower levels of debt that we have now, and there are reasons to believe that the economy suffers negative consequences when federal debt exceeds national income.

2. Yes, despite misleading analysis by opponents and the media, the reduction in marginal rates by Kennedy, Reagan and Bush led to increase in tax revenues. The key to proper analysis is to look at the time of implementation, not the time of passage. It took three years to fully implement Reagan’s cuts and over two years to implement Bush’s cuts. When cuts were implemented, tax revenues rose. Tax revenues also rose with the Republican / Clinton cut in capital gain tax rates.

3. The Reagan and Bush tax rate cuts did NOT increase tax revenue from lower and middle income earners. Rather increased tax collections came from increased receipts from the wealthy. This is was also true for the 1997 cut in capital gain tax rates. It is easy to see the reason for this phenomenon when examining the nature of income for the different classes. With high capital gain tax rates, the wealthy will forego realizing capital gains to avoid paying the taxes. The 1997 cut in capital gain tax rate led to massive realization of capital gains which not only increased tax revenues but also spurred better allocation of capital and helped with the information technology boost to the national economy. Also, Bush’s encouragement of dividend income led hundreds of companies to start or dramatically increase dividends – that means more tax revenues!

4. Another key outcome of #3 is the huge increase in the percentage of income tax revenues paid by the wealthy.

5. Despite #3, it is not clear to me that further reducing rates will increase tax collections from the wealthy. It is obvious that reducing ordinary rates from 70% to 35% will increase tax revenues, and it is also obvious that decreasing capital gains rates down to 20% or 15% will increase tax revenues. But it is not obvious that further reductions will induce the wealthy to expose more of their wealth to taxation. To reduce rates for middle and lower levels of income will reduce tax collection. Indeed, the only reason to increase rates on the wealthy (besides short-sighted envy motivations) is so that you can feel better down the road when we need to increase rates on the middle class to pay off the Social Security Trust Fund debt.

6. However, back to #1: if you are going to accept higher debt to fight recessions, do it through lower taxes and not higher government spending. Higher levels of government spending distort economic decisions & motivation and undercut economic health. Put the 1930s in perspective: President Roosevelt did not lead us out of the Great Depression. Rather, he led us through the Great Depression. While his massive spending gave money to those lucky enough or savvy enough to get government favors, the economy languished under his leadership. It was not until he stopped warring with business in 1940 did the economy recover – two years before WWII. Meanwhile, in this century, President Obama faced economic turmoil much less severe than Reagan who had to contend with high interest rates which usually undercut recoveries. Yet, despite low interest rates, Obama has led a lethargic recovery which is reminiscent of Roosevelt’s recovery. Both recoveries were marked with an attitude that the government has the solution and unregulated business is the enemy.

In these cases it's the government deficit that funding the deleveraging of the other entities. Look at this chart and you'll see the accounting relationships- the government, private and foreign sectors must balance to 0. Since the private sector is trying to pay down debt and increase savings, and the trade deficit isn't going away, the government must run a deficit to accommodate that savings.

http://www.priceactionlab.com/Blog/wp-content/uploads/2012/05/Sector-Financial-balances.jpg

The above isn't prescriptive for any particular policy, it's a description of the accounting and the constraints of reality. There's nothing in there that argues that the government must be bigger or do anything in particular and I share the skepticism of government's abilities to do anything all that effectively. What it does show however is that any calls to simultaneously cut the deficit and have the private sector delever are as impossible as asking somebody to lose weight by eating more calories.

Just a question - would anyone know. is the non-financial debt, debt by companies that are not directly involved in the financial industry, or is it something else?

thx.

First thing we need to do is put the government on GAAP accounting. There are so many games being played we have no hope of getting to the real numbers.