When Investors Have Police Forces

I have argued many times that private investors, over the long haul, will make better investment choices than the government, in part because they have better incentives and information to guide their decision-making. The straw-man argument against this is to point out anecdotes of failed private investments. Heck, I can do that. Pets.com famously blew through $300 million of private capital with a corporate strategy that never made much sense to people.

The Pets.com investors were chagrined, and probably learned a lesson from their mistake. Certainly most of us thought the blame, if blame existed, for the debacle rested on the investors for pouring money into a bad proposition. Certainly no one accused the management of fraud -- I am sure they were diligently, honestly trying to make the company a success, even if they were misguided as to where that success lay.

As it turned out, everyone, not just the Pets.com investors, learned from the mistake. The failure was an important driver in an industry-wide rethink as to what a successful Internet business model might look like. This benefit only came because people were willing to acknowledge not just that the Pets.com investment was flawed, but that it represented a systematic mistake that was being made vis a vis Internet startup investments.

Now, consider solar manufacturer Solyndra. It failed this week, likely taking with it most of $535 million in taxpayer money that the Obama Administration was so eager to give them that it short-cutted its internal processes to fork over the cash more quickly.

Many of us on the outside would love to see the government rethink such investments in a systematic way, and reconsider if it is even possible for the government to make such investments, and in particular whether "green jobs" investments make any sense at all.

But the likelihood of that kind of introspection happening in the public world is about zero, and my bet is that Obama is going to propose more of the same tonight in his speech.

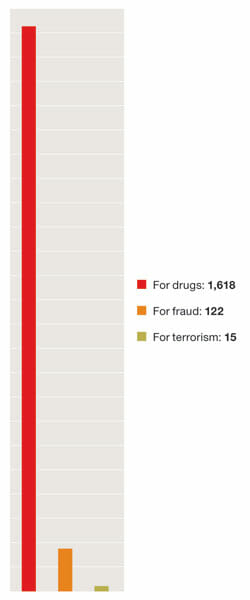

In fact, the Department of Energy (the source of the loan) and the FBI have today sent armed agents into Solyndra looking for evidence of fraud. While Zero Hedge argues that fraud would be bad for Obama, in fact I think it would probably be the best possible outcome and one he is hoping for. If he can say, "wow, you and I both got tricked here by some evil folks we are going to put in jail" it deflects attention from the fact that he put a half billion dollars of taxpayer money into a business plan that never made a lick of sense.

Another me-too solar manufacturer with a factory in California of all places was never going to compete in a global commodity market. This company's plan was always to sell dollars for 50 cents and to make it up on volume. I don't see how any investor thought this was going to work. My guess is that the private investors didn't know much about solar and invested because it had a certain hip-ness to it, or less charitably, they knew it never made sense but hoped that Uncle Sam, once it was already in for a half billion, would keep more money flowing or perhaps agree to buy out their production at above market prices.

There may have indeed been fraud, but as in the case of Pets.com, it is perfectly possible no real internal fraud existed and they ran through a ton of money against a stupid business plan that should never have been funded. Obama would greatly prefer to call it fraud rather than his own failure of judgement. As an aside, Fannie and Freddie are pursuing exactly the same course in suing banks, arguing that they were defrauded by the banks in buying mortgages, a fairly laughable proposition in the great scheme of things when one considers Fannie and Freddie were at the forefront of the industry in driving down lending standards and promoting the expansion of the mortgage market.