A Health Care Parable

This was simply amazing to me. For years, I and others have said that putting more health care spending under insurance plans was going exactly the wrong direction, both from an individual choice as well as a system cost perspective. By eliminating the need or incentive to shop by the consumer of services, prices almost inevitably rise.

Here is a fabulous smoking gun example from my windshield repair today. I happen to have free windshield replacement in my insurance policy. I called the insurance company and said I had an auto glass claim. I was transferred to Safelite Auto Glass, who apparently (very intelligently) have a contract to process claims for my insurance company. They said I could use any provider, but would I like them to call out someone for me -- if I used their choice, the insurance company would guarantee the work.

Well, what did I care -- I wasn't paying for it -- so I had them make an appointment for me. Unsurprisingly, it was with Safelite Auto Glass.

I must add here that Safelite did an exceptional job, the guy who showed up at my workplace was friendly and competent. No complaints at all about the service or workmanship.

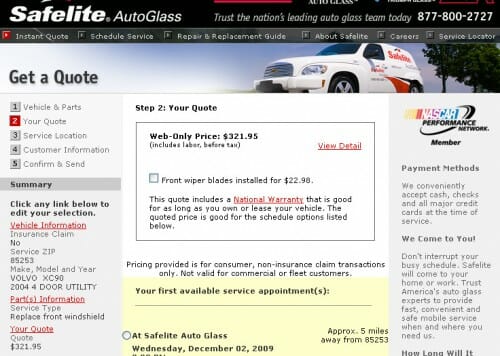

Anyway, I got a bill for which I owed zero dollars, which I suppose is heading right this minute for the insurance company. Before I show it to you, I was curious what I would have paid for this service if it hadn't been insured and I shopped around. I got just one quote - from the Safelite Auto Glass web site. This is a bit unrealistic because for a purchase this large, I would have gotten several quotes. But this was the only quote I needed. The charge to me if I bought the new glass service with my own money without insurance was$321.05 (click to enlarge).

And this was the bill I signed for the insurance company:

For a total of $710.40. Same service. Same car. Same customer. Same part. Probably the same repair guy. 2.2x higher price.

Now, I suppose I might be willing to believe there is some invoice pricing game here and the insurance company may get a discount over invoice, similar to car sales, though I am not sure what their incentive would be for this game -- it should be the opposite. In fact, we can be nearly positive they are marking up the price to insurance companies given a) the web quote says right up front it is not good for insurance work and b) I have already shown how glass companies give enormous consumer kickbacks for insurance work.

If I had cared, I would have eschewed the offer on the call to have them set up the appointment and shopped around for the best kickback. All a cross subsidy from those who don't use the insurance to those who do use the insurance. Talk about a terrible incentive.

I think the conclusion is pretty strong. Anything we shift to insurance from having individuals pay out of pocket gets substantially more expensive. And this doesn't even address my changing willingness to live with a small windshield crack and avoid this purchase altogether when I am paying the bills vs. when I am not.

"I happen to have free windshield replacement in my insurance policy."

Can't believe a free market advocate like you made this slip of the keyboard. I think you have no deductible windshield replacement.

Tag: There ain't no free lunch.

In Memphis, I got a new windshield for my Subaru Legacy for $225 at Jack Morris Auto Glass. I do not have glass coverage for my cars; it seems like an unneeded expense. This is my first glass replacement in 35 years of car ownership.

---------------------------------

A small percentage of physicians have been lobbying unsuccessfully for years for the return of an out-of-pocket health care system coupled with catastrophic health insurance. Gross receipts for health care providers would fall, but overhead expenses also would fall because we wouldn't have to deal with all the insurers. There's also a medical benefit to this system: studies have shown that when a person pays for care and for medicines, he is more likely to follow his physician's orders, more likely to take the medicines as directed, and more likely to get better, faster. A small co-payment doesn't provide this benefit.

So why does this happen? Certainly Allstate (or whoever) can go to the Safelite web site, do a fake quote and see the price that they charge the public. Then, go back to Safelite at the end of their contract and negotiate a rate that is lower than the standard public rate.

Being a reader of this site, you can surmise that my first question is, "What government regulation causes this to happen?" Which isn't to say that it couldn't just be bad business decisions, but it seems odd in the case of auto insurance, which strikes me as incredibly competitive and cost-conscious.

So, off I go to the internet. I didn't want to make this a project for the night, so this is probably just a starting point for more research, but there seem to be state requirements that say that an insurance company cannot limit where you get your car repaired. In fact, they mostly can't even recommend a shop to get it repaired at unless you ask for it.

Well of course that leads shops to charge whatever they want, so it appears as though states started creating rules and guidelines for what insurers are required to pay shops. Government setting prices... what could go wrong?

In your case, Coyote, I would imagine that the payment rules for glass replacement are out of sync with reality, and glass shops can charge insurance companies much more than the market price. Thus, your insurance company doesn't have much incentive to bargain down a standard price (and heck, it might even be illegal for them to do so), since so many of their customers are coming from non-affiliated glass shops that can charge a much higher rate to the insurance company and offer incentives to customers.

All of this should be part of the discussion with health insurance, as I'm guessing many of the same issues are in play.

Thanks for your post... it motivated me to learn a little something I didn't know. You might also guess that I've never had a major wreck with my car, so really haven't had to deal with this stuff directly.

So when I pay out of pocket for health procedures, I pay way more than ins. for a procedure, but when it's a windshield repair, ins. pays way more than I would?

I see sandman's logic about it possibly being illegal to charge less because of price setting by the government (for ex., the guy who did my windshield mentioned something about how all insurance policies in PA must cover glass replacement by law). But I'd disagree that "your insurance company doesn’t have much incentive to bargain down a standard price ". I think they absolutely do, just like my health insurance company does.

So what's really going on then? Are auto insurance companies stuck with these laws? Does the health insurance industry just have better lobbyists?

Coyote,

Your insurance company is not paying Safelite the amount shown on your invoice. That invoice is for your benefit and your insurance company's benefit. When I was fifteen I fixed small engines and lawnmowers for extra cash. My uncle was a mechanic for a trucking company. He took me down to the parts store that he delt with and set me up with a charge account that he vouched for. This is when I learned about the world of multi copy invoices. Say I bought a pull rope spring. The white copy of the invoice that I give to my customer says that I paid $6.00, the yellow copy that I kept says that I paid $3.50, which is what I actually paid. I charge the customer $6.00 and make $2.50 from just the part alone before I charge my labor.

The medical industry works the same way. Medicaid has had more of an effect on costs than any other factor. Say your Doctor needs to make $25.00 on each patient to keep his door open so he sets his office visit fee at $35.00. Along comes Medicaid and with it a large number of patients covered by it. Say Medicaid only reimburses 33%. To make that $25.00 the Doctor has to charge $75.00 per visit. So he has to change his office visit rate to $75.00 and the guy who comes in without insurance has to pay the $75.00. Back in the 80's there were Doctors who would charge the guy without insurance $35.00 and charge Medicaid $75.00. Remember them, they were the ones in the news on trial for Medicaid fraud?

I would think that the insurance companies have one motive for seeking the lowest cost provider. Profit.

If they make more money by steering you to Safelite, or spend less with some sort of performance guarantee contract - "If you have less than 1% complaint record for the claim period, you get a bonus of $XXX .."

Insurance companies are competitive, well sort of, and having 'no problem' glass repair is a selling point, no?

tom

Your windshield experience is an excellent post.

I had a similar experience with my doctor. I requested a copy of the results from my recent physical, to which my Doctor's nurse said that was confidential. The only way they would mail me the results would be if I filled out a waiver.

I did so, and 2 weeks later I received results from the last 5 years, or about 50 pages of info. How nice of them, or so I thought.

Shortly after I received an explanation of benefits. My doctor had charged my insurance carrier $200! Never fear, the insurance company "negotiated" the rate down to $90, which they payed in full.

This is an outrageous charge, and way more than what I requested! But since the charge to me was $0, I had very little incentive to protest.

I just had a very simlar situation happen to me in IL. Safelite must have agreements with a few insurance providers. What a crock.

I am a regular contributor to the auto glass blog for TeleGlass. TeleGlass does business with consumers and insurance companies.

That windshield is pretty pricey. Depending on options (rain sensor, solar tinting, it can run higher than even the part quoted on the second invoice.

I digress... it's not uncommon for insurance prices to be higher than cash prices, but as mentioned previously, the pricing is probably much different. My guess is they're offering steep discounts over the amount on the invoice; perhaps even lower than their "cash" price.