Sustainability Is Baked Right Into the Heart of Capitalism

A while back I was having a back and forth on Twitter with a Tesla supporter. They had said that Tesla was the poster child of sustainability, I presume because since Teslas are electric that they are presumed to use less energy and produce fewer emissions. I learned a long time ago not to try to have discussions with Tesla supporters on energy consumption -- even if the fan in question understands that electricity is not magic pixie dust summoned for free out of nowhere, they seldom understand issues with geographic variability of electrical generation sources or the difference between electrical sources for the average vs. marginal incremental load.

So I just said the company can't be very sustainable because it spends far more than it earns, ie it consumes more valuable resources than it produces (a ratio made even worse if one factors in all the taxpayer subsidies the company consumes as revenue). The person I was tweeting with replied that this fact had nothing to do with environmental sustainability.

I would argue that financial stability has everything to do with environmental sustainability (though I will admit that this comparison is a bit hard since environmentalists seem to bend over backwards to NOT define "sustainability" very precisely). In fact, I think that sustainability is baked right into the heart of capitalism.

The reason for this comes back to the magic of prices. Of all the amazing, wondrous things we celebrate in the world, prices may be the most overlooked. Just think of it: with no governing structure or top down ruling board, a single number encapsulates everything most everyone in the world knows about a particular product: both its utility and relative scarcity, both now and as anticipated in the future. It is a consensus derived voluntarily between millions of people who never meet with each other and likely never communicate with each other.

It is amazing to me that people who talk so much about their concern for scarcity tend to be the same folks who ignore prices and even eschew markets and capitalism. But in prices we have a number that gives us a single metric telling us the world's consensus on the current and future scarcity of any commodity.

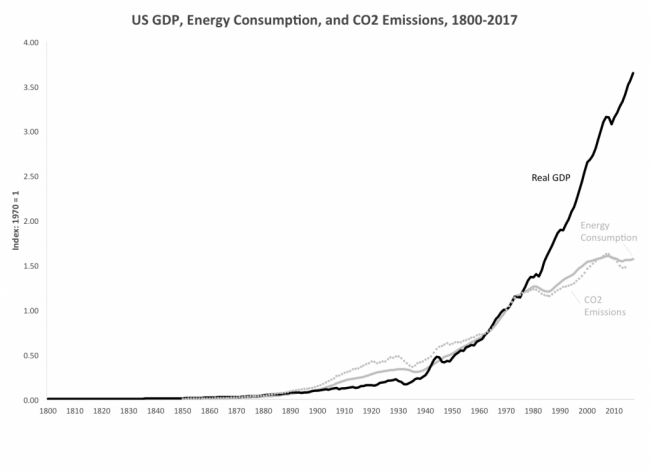

We do know that prices can miss some things. Perhaps most relevant today, they can fail to include the cost of emissions (ground, water, air) associated with that commodities extraction, refining and processing, and use. But compared to the effort of trying to create some alternate structure for managing product scarcity, this is a relatively simple problem to fix (simple technically, but not necessarily politically). Estimates of these pollution costs can be added as a tax (e.g. a carbon tax on fossil fuels to take into account climate effects of CO2 emissions) and prices will continue to work their magic but with these new factors added.

Along these lines, Andres McAffee writes about some research work by environmental scientist Jesse Ausubel. He writes in Reason:

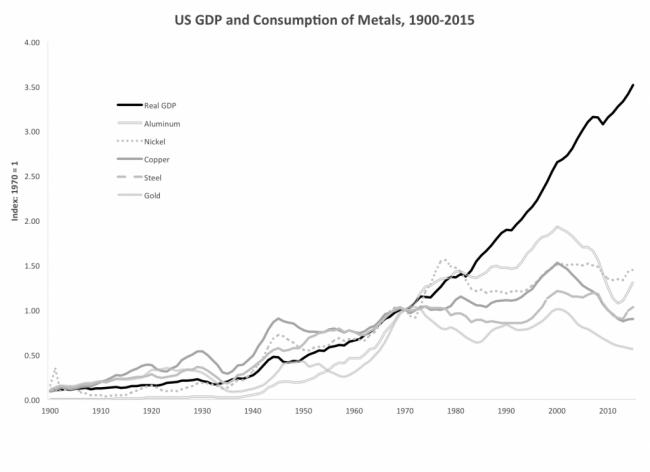

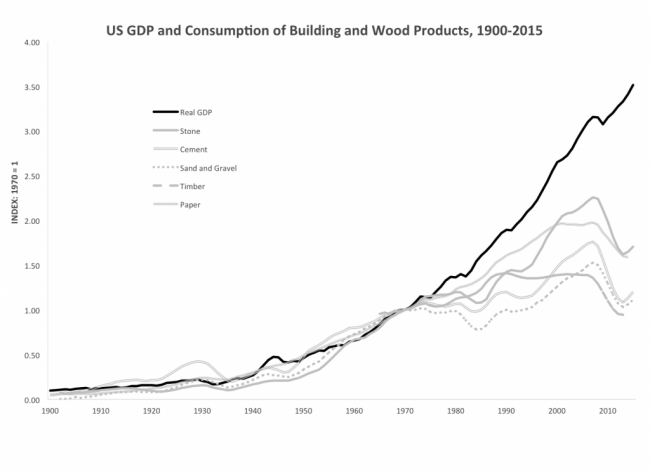

In 2015, Ausubel published an essay titled "The Return of Nature: How Technology Liberates the Environment." He had found substantial evidence not only that Americans were consuming fewer resources per capita but also that they were consuming less in total of some of the most important building blocks of an economy: things such as steel, copper, fertilizer, timber, and paper. Total annual U.S. consumption of all of these had been increasing rapidly prior to 1970. But since then, consumption had reached a peak and then declined.

This was unexpected, to put it mildly. "The reversal in use of some of the materials so surprised me that [a few colleagues] and I undertook a detailed study of the use of 100 commodities in the United States from 1900 to 2010," Ausubel wrote. "We found that 36 have peaked in absolute use…Another 53 commodities have peaked relative to the size of the economy, though not yet absolutely. Most of them now seem poised to fall."

The charts are great and I encourage you to read the whole thing:

Postscript: Going back briefly to Tesla, if the company consistently spends more money that it takes in, then it means the resources it employs could be used elsewhere more productively. Talented people who design cars could be using those talents more productively at another car company. Or defined differently, talented people who are passionate about saving the environment could have more impact working on something else that helps the environment. Scarce (and environmentally suspect) cobalt and other Lithium ion battery resources could be used to more impact in other applications (many of which also may be to transition the world's energy economy from fossil fuels but do it better or faster).