Why First-Mover Advantage in a New Industry Isn't Always An Advantage

I have written in the context of both the new marijuana stocks (e.g. Tilray or Canopy) and Tesla in EV's that the market is putting a whole lot of value -- in some cases 90+% of their current market value -- on these companies being first movers in potentially large and lucrative new industries.

It is hard to predict early on where in an industry's value chain the profits will be, or if the industry will be profitable at all. Who will make money in marijuana -- the growers? the retailers? the folks that package the raw material into consumer products? The early marijuana entrants are focusing on cultivation, but in tobacco do the cultivators or the cigarette makers who buy from them make the most money? And as anyone at Myspace could tell you, being first is not always a guarantee of success, and in some ways can be a disadvantage. Second movers can avoid all the first-movers costly mistakes.

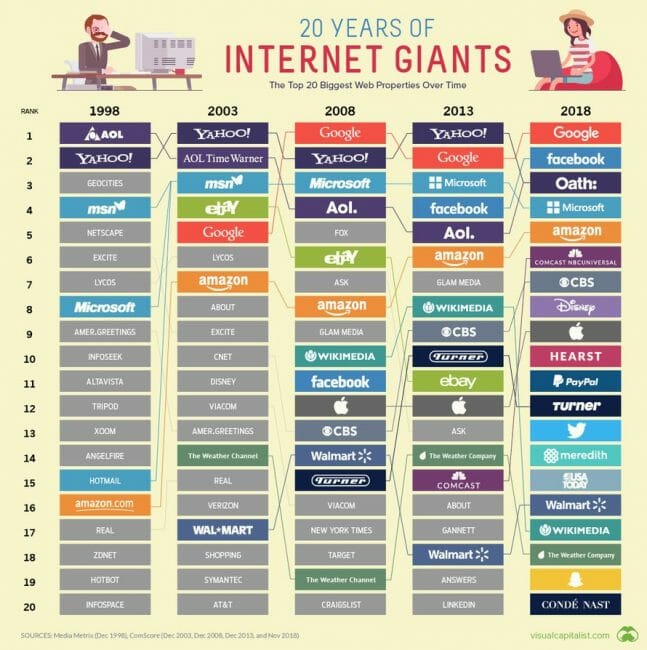

I though of all this seeing the infographic below on changing leaders in the Internet world. Almost all the top 20 companies in the first year are largely irrelevant today -- AOL and Yahoo are technically still in business but only because they have been bought up by Verizon in a group of other dogs they seem intent on collecting.