The Dumbest Tax -- Business Small Equipment Property Tax

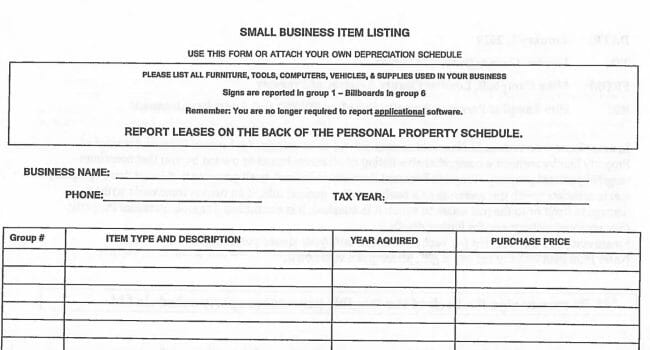

There are a lot of reasons a tax can be dumb. It can be too damn high. It can create incentives for counter-productive behavior. But I want to propose another category of stupid taxes -- taxes that cost WAY more to do the paperwork than the tax actually collects. For this category I propose the dumbest tax award to the property tax many counties charge on business small equipment and moveable property. Here is one page from a sample county return we have to fill out.

This is just one page of many -- assets have to be reported in multiple classes -- but you get the idea. Every single business asset down to trivial things like office and cleaning supplies, screwdrivers, etc all have to be individually listed with year acquired and purchase price. We have nearly 150 locations across the county and waste a staggering amount of time staying on top of this.

AND, the real punch line is it raises about zero dollars in tax. Take something we have a lot of, a hand push mower. Let's say we bought a good one at $500 about 3 years ago. The property tax process generally discounts this -- the taxable value might be $200 or less today. Then they might charge a half percent annual tax, which would bring in a whopping $1. So tracking this mower and entering it on this form every year probably costs me more in labor and software we have to license than the tax itself. I would be willing to pay a higher amount of tax if when they sent the forms they said, "Fill out these forms by March 1 or you can alternatively pay $500 and be done with it."

I understand they want to be able to tax the crap out of the Exxon refinery, but there really needs to be some minimum cutoff. Florida did this years ago and it is great -- there is a card that you sign to certify your total personal property is under some number and you avoid the process altogether.

PS, we are tired of the old asset management software we have -- if someone out there knows a package that works well for this kind of thing, email me at the link above.