Some More Thoughts on Greece -- When European Charity Runs Out, All That is Left is Inflation

People keep talking about reducing Greek debt to a sustainable level, but part of the problem is that there is not such level. Even at zero. The problem is that Greece is running a government deficit even before any debt service, so if creditors were to waive all of its debt, it would still need to be borrowing new money tomorrow. Debt forgiveness is not enough -- what the Greeks need is for Europe to write off all its debt, and then (having lost all their money on the old debt) start lending new money immediately. Note also that any bailout agreement reached this month will just put everyone back in the exact same place a few months from now.

This situation cannot be expected to change any time soon, for a variety of reasons from demographics (Greece has the oldest population in Europe, and a relatively rich pension system) to ideology (the current pseudo-Marxist government will never implement the reforms needed to turn the economy around, even if they promise to do so under duress).

With structural solutions unlikely, Greece has only the options of charity and inflation. Greece still seems to be hoping for charity, which they make harder by spewing derision at the same folks whom they are begging for alms. Europe, certainly Germany, is in no mood to be charitable any longer, but may still do so depending on their calculation about which action -- bailout or exit -- has the worse long-term consequences for keeping Portugal, Spain, and Italy both in the Euro and continuing to pay their debts.

Lacking charity, the only thing left is inflation. Some folks think I am advocating that option. I am not. The best possible hope for Greece is to slash its economic regulation, privatize business, and cut back on the public sector -- but that is not going to happen with the current government. Or maybe any government.

I say inflation is the only option because that is what balances the budget and "solves" debt problems when politicians are unable or unwilling to make any hard choices. It is sort of the default. If they can't balance the budget or figure out how to pay off debt, then inflation does it for them by reducing the value of pensions and outstanding debts**. This is what will happen with a Grexit -- a massive bout of devaluation and inflation what will greatly reduce the value of any IOU, whether it be a pension or a bank deposit.

Eventually, the one good thing that comes from inflation and devaluation is that the country becomes really cheap to outsiders. Tourists will flock in and olive oil will sell well internationally as the new drachma loses its value, creating value for people holding stronger currencies and potentially forming the basis for some sort of economic revival. My wife and I decided a few months back to postpone the Greek vacation we wanted this year -- too much turmoil is still possible -- and wait for it to be a bargain in 2016 or 2017.

**Postscript: This is exactly why the Euro is both immensely seductive and a dangerous trap for countries like Greece. Seductive, because it could pursue any sort of destructive banana republic fiscal policy it wished and still have a strong currency. A trap because it can no longer print money and inflate away its debt problems.

Totally agree, pastry chefs retiring at 50. Give me a break. The Grexit is really the only option since they elect pro taxers, but don't want to pay taxes themselves.

http://www.cbsnews.com/news/europe-balks-at-greeces-retire-at-50-rules/

Greece is a very visible demonstration of what happens when finance decouples from production and labor. (I am entitled to money for sitting here, you can't possibly sell what you have due to regulations, ...).

Albeit extreme, Greece is the logical outcome of public socialists financed by private capitalists.

Eventually, the private capitalists get pissed off at the immensely irresponsible socialists, and the socialists run out of (other people’s) money.

The ominous outcome here is the fact that the Greek government is now so insolvent it cannot possibly repay what it already owes, and it also will not change, which means they will run out of even more money. Greece is about to become a 3d world country, more so then they already are.

The really really ominous outcome here is the US is not far away from a Greece-like situation; the only reason we are even mildly “safe” is the dollar is still the worlds reserve currency, and we can print our own money (Greece can’t print Euros).

Eventually, we will run out of our own money, as we are in process of doing (Socialist Insecurity insolvency, massive debt overhang, declining productivity and economic growth), and a tipping point in our extremely large country with extremely large obligations could come fairly quickly.

The US economy isn’t nearly as decrepit as Greece’s, but we are trending toward lower growth and productivity, and simultaneous skyrocketing financial obligations. That is a deadly combination.

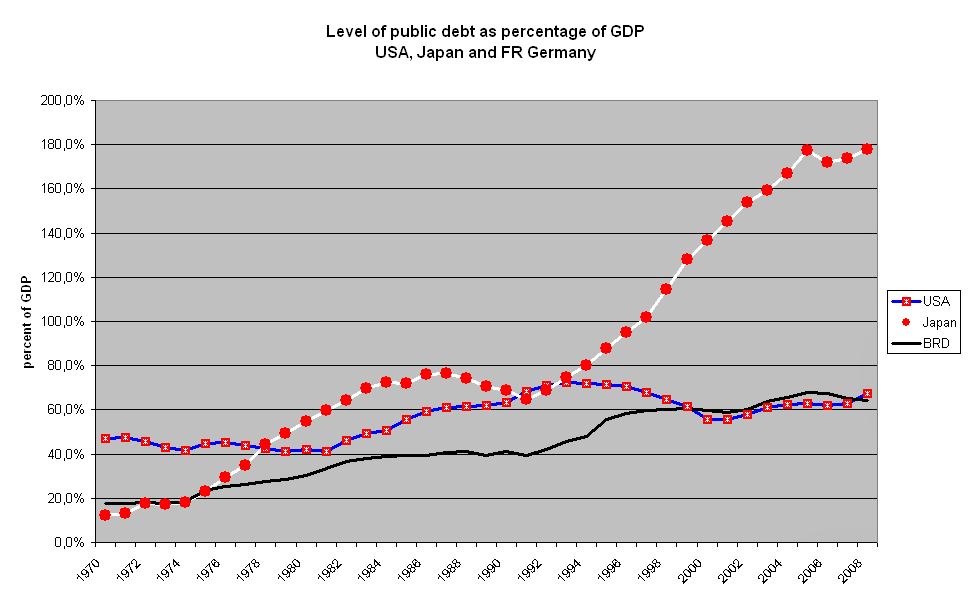

Depends on the time frame for being "not far away", but Japan has managed to stumble along and stagnate for a couple of decades while ever increasing debt loads.

All the while, their population is about 10 years ahead of us on aging, and continues to age rapidly without any possible rebound (we have the echo boom and immigration).

http://www.indexmundi.com/japan/age_structure.html

http://www.indexmundi.com/united_states/age_structure.html

But, it looks like we run into a brick wall in 20 years, unless both: 1) taxes go up and 2) spending / promises are dropped (we often see #1, only to expand rather than reverse spending)...

http://www.heritage.org/federalbudget/entitlements-historical-tax-levels?nomobile

We may have less time, given the uncertainty over what the unfunded liability is ($97T, or $144T?)...

http://usdebtclock.org/index.html

http://www.zerohedge.com/article/245-trillion-us-national-debt-144-trillion-unfunded-liabilities-2015

It won't be like Greece, unless we have another blow up like 2008, or major war, as all the financial levers are / have been used up to near capacity.

"I say inflation is the only option because that is what balances the

budget and "solves" debt problems when politicians are unable or

unwilling to make any hard choices."

I'm not certain I understand that statement. In 1975, the Mexican government deflated the value of the Peso by 50% (from 7.5 to 15 per U.S. Dollar). Many of the Mexicans had loans but the loans were calculated in dollars, not Pesos. Their debt suddenly doubled. How will this be different in Greece? The loans are in Euros.

"I say inflation is the only option because that is what balances the

budget and "solves" debt problems when politicians are unable or

unwilling to make any hard choices."

True, but that would require Greece to have it's own currency. You have talked before about them getting out of the Euro, but how do they do that?

Can they do it?

Do they still have the plant and equipment needed?

If they don't, where do they get the funds at this point to acquire the plant and equipment?

Do they have the necessary supplies to even start?

The cost of printing enough currency fast enough to matter would have to be fairly substantial. They have been kicking the can down the road for a very long time, and Now the piper must be paid. I actually don't think that they can do it. I don't think that they have the resources to print enough currency fast enough to keep the existing government from collapsing.

Inflation is never good for the people, only the government that is printing all the excess money will benefit. It doesn't matter if it is Greece, Mexico or even the US.

Japan is even worse off demographically – they have no replacement rate, and a generous elderly safety net which is entirely unsustainable. That doesn’t hit the fan for another decade or so, but that will pose immense problems (and already is). A major source for the funding of this calamity is Japanese banks, who are all rabid purchasers of JGBs, so when Japan’s finances start to become untenable, the banks will be sitting on a pile of garbage.

All of this stuff is coming home to roost now, and Greece (and Puerto Rico) is a small preview of larger coming attractions.

They can do it, the question is how.

One way already in effect by default (sorry) is that once the money runs out this weekend, Greece is planning on printing IOUs, which in the absence of Euros will become a parallel currency on its own. That leads to local currency transition.

The next step is to roll out the New Drachma, and simultaneous massive devaluation (50%+ I’m reading), followed immediately by re-denomination of Greek liabilities in the new currency.

All of this is academic though, and no one really knows how this will play out, or how to unwind the monetary union.

If there is a question about how it can be done then there is, by definition, uncertainty about whether it can be successfully done at all..

Who in their right minds would take IOUs from the current Greek government?

They will have no choice.

That they have no other choice than to try, does not mean that it can actually be done.

We may find out very, very shortly

http://www.bloomberg.com/news/articles/2015-07-08/eu-tells-tsipras-the-party-s-over-as-euro-exit-door-swings-open

Grexit has always envisioned the return of printable money in the form of the Greek Drachma but printing paper money and coin would be terribly expensive, so another economy enriching scheme is to make the official currency the US Dollar. You can't print money but you can become the money laundering center of the world for the Dollar. Drug cartels, oil shieks, Afghan poppy growers, Russian mobsters, ISIS, Diamond smugglers and human slave traffickers need seemingly-legitimate businesses through which to dispose of dollars in exchange for other economic considerations and a love-hate relationship will flourish between these criminals and the criminals that already control Greece. The first new businesses in Greece, however, will be the US Dollar counterfeiters. How do we know this? Because 15 years ago, socialist countries in South and Central America, including Ecuador and Guatemala, did this very thing

The US dollar will provide the currency stability required and it will stymie E. U. efforts to get their Euro back because Greece financial institutions will have to exchange Euros for Dollars on day one of the Grexit. Euro horders will be able to get real money instead of drachmas.

"Or maybe any government." That's the key point.

Without "charity" (forced transfers from citizens of other countries), government workers past and present lose. Either they get paid in deflated Drachmas, or they they get paid fewer Euros than they expect. In the first case, bystanders suffer from inflation. In the second case, bystanders suffer from taxation. But, given Greek history of tax collection, bystanders are less hurt by the latter -- by preservation of the Euro.

Yes. The timelines for the individual countries are all different, and can change to the extent that they address their debt (deficit spending) and unfunded liabilities (promises of future expenditures).

One of the links above shows exactly what you talk about for Japan's demographics. They are 10 years ahead of us in aging population, but they have a partially inverted pyramid, whereas we have almost a rectangular block under the boomers block. Also, Japan is very restrictive on immigration, we are practically wide open in comparison (the per capita burden is mitigated).

It will not be a direct consequence of all this financial mess that will be our undoing. It will be indirect, and triggered from one (or more, simultaneous) other larger national economies being hit by these same issues, particularly since there is little room to maneuver here in the US after pulling all the financial levers following 2008.

It will be a time when expansionist authoritarian regimes will want to make their move. But that is for another thread.

Our media and politics focus so much on social issues, and that will all become irrelevant if this comes to pass, as who knows what kind of government will emerge on the other side.

So, arguing that it matters very much that we need to cut back the size and scope of government, just to reign in current and future spending, just to create a buffer for the financial shocks to come.

To summarize Krugman - austerity causes drops in gnp, living standards, recesions and is overall a bad thing for a country's economy. Therefore the government should increase spending especially during recessions to stimulate the economy.

All is grand and good - until you run out of other peoples money.

A consequence that never enters Krugman's equation.

Japan's advantage is that they still have an economy based on industrial production and technical innovation. The only things Greece seems to have in abundance are sunny weather and history, both infuriatingly difficult to export.

Its my understanding that they *can't* inflate without leaving the Euro.

From what I've been reading, if they print more Euros, that amount gets tacked on to their debt to the EU central bank - meaning that it negates the 'benefits' of inflating away debt while leaving all the negatives.

Well, Krugman only pushes *half* of what is Keynsian policy. The other half (which no one ever does) is to *cut back* government spending during booms, to create a surplus.

Its *that* surplus that the spending during busts is supposed to come from.

We'll never know if that will work because no government has any ability to *voluntarily* throttle down spending. Its "we're in a boom, spend the extra tax income" and then "oh no! we're in a bust, we need to spend even *more* to save our phoney-baloney jobs gentlemen".

Exactly. This is why the recent totalitarian turns our government has taken are so disturbing.

More info:

http://blogs.wsj.com/briefly/2015/07/07/what-would-grexit-look-like-the-short-answer/

"More info:"

There is nothing at all in that as to how the actual mechanics of Grexit could or would work.

Can Greece print enough of it's new independent currency fast enough to keep the banks and government from collapsing?

They would need billions of new bank notes practically overnight.

Unless they have secretly been printing new Drachmas for months, I think it will end up being too little too late.

I believe most of their troublesome debt is in Euros and the creditors are outside of Greece. Inflation would do nothing for that.

He is presuming Greece first exits the Euro, then inflates the drachma.

Indeed, they cannot. "Grexit" means dropping the Euro. Then they can inflate.

That does nothing to help with the debt that is denominated in Euros and held outside of Greece. Those debts have to be paid in Euro's, not drachmas.

How do you collect a debt that is due from a sovereign government that is unwilling to pay it? This will only happen if you get your own government to use force to collect, and in the case of Greece, this seems unlikely and impractical.

First, you might get a court order to seize Greek government-owned assets that are within reach of your country's courts - if any - but in the USA the State Department often blocks such actions, and I would be very surprised if it isn't even more difficult in Europe.

Second, you might look for bank accounts and investments squirreled away by Greek officials in safer countries - but you can only claim those against a Greek government debt if you can - and are allowed to - prove that these are stolen government funds. That will be opposed by every crooked politician and bureaucrat in every country, although they won't come out and say why.

Third, you could ask your army to invade and seize the olive crop, or whatever statuary the British missed when they looted the Parthenon nearly two centuries ago. That seems pretty unlikely...