Austerity

Democrats are labeling any plans that would cut or even flatten Federal spending as the "austerity" option. They use the word austerity to imply an unusual and radical reduction in spending which evokes proposed plans in places like Greece that has all the government workers marching in the street.

But Greece is trying to find a way to move to a fiscal regime they have never even experienced, not in any of our lifetimes and maybe never. In contrast, the US merely needs to move to a place it was way back in about 2006. Yes, that's right, "austerity" is returning to the level of government spending we had five years ago. And we all remember what a blighted time that was, a veritable Mad Max desolation relieved only by Obama arriving like the Postman from the David Brin novel (or the execrable Costner movie, if you prefer).

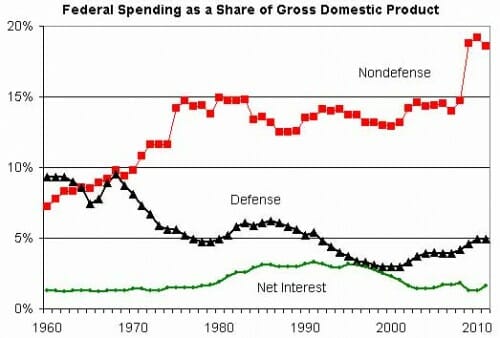

Behind this graph, there’s a deep explanation of why we’re in the pickle we’re in.

Note the decline in defense spending during the Clinton years. We did get a “peace dividend” after the Berlin Wall fell. But for a dominant segment of the Republican party, 9/11 was a God-sent excuse to get us back to “normal”. How many wars are we in now – I’ve lost count. Thank you, “Deficits Don’t Matter” Dick Cheney. As I write – but not listen – Obama tries to defend this.

After Iraqi-WMD was exposed as a fraud, to mask his weakness, Bush let domestic spending expand to curry favor.

Interest expense % has been low because of the machinations of the Fed, starting with Greenspan. Can this last?

Once the Democrats got power they blew up the spending side. This has been deliberate. They want to create socialism through the Internal Revenue Code as necessary compensation. But if they have their way, we’ll have something quite different.

Important point: the nondefense 2009 % should be lower, and the nondefense 2010 % should be higher. Shithead government accounting treats about $300B in direct TARP investment as an expense in 2009, and treats the payback in 2010 as revenue. It meaningfully affects the trendline.

My conclusion: There’s nothing wrong with our government except for what’s wrong with our two political parties.

That totals up to 25%? And I am not super-psyched to count saving some bankers million dollar bonus as a worthy non-defense goal, so I'd be all for a lot of austerity in that space. I guess we'd be fine with about 40% of the spending and 40% of the laws on record.

So basically, undo the payoffs to those that got Obama elected.

Actually, Greece's first steps on the road to the current mess were in the 1980's. The lavish retirement benefits were started by the current prime minister's father.

So Conservatives are better managers of the economy?

Gil, I get the feeling you said "Conservatives" and meant "Republicans"

me, I share your (I presume tongue in cheek) pondering of a "mere" 25 percent. Two, no, three idea threads come to mind.

First, 1/4 of what? GDP includes a lot more than products. If a huge chunk is services, "homeworkers", etc, then I think the 1/4 idea hides the actual significance. What impact does gov't consumption have if its focus differs significantly from the spread represented by GDP? How does that difference skew predictions based upon the assertion of "mereness"?

Second, I marvel at the incredibly productive result of current free enterprise. It can support a 25% drain and still provide an awesome standard of living for the many which surpasses that of even the few rich of the past.

Third, At what percentage does gov't kill the golden egg producing goose? At what percentage does it so encourage parasitism, so limit enterprise, so create dishonesty (think tax code, evasion as well as avoidance, underground economy)that the goose begins to fade?

Roy's got the idea. And its not just the spending side of the equation. Government laws and regulations put downward pressure on the GDP itself. These onerous laws and resulting regulations retard the pace of business expansion and may actually kill it in some industries.

It isn't just a matter of rolling back spending to 2006 levels although that is an important component. We most repel Obamacare and the Dodd/Frank financial reform law. We need to put a harness on the EPA and NLRB and fire Obama's troublesome czars. As long as we're doing some heavy lifting why not reform the income tax code. At a minimum we need to get our business tax rates in line with other countries.

I wonder where I put my musket, bullet and gunpowder?

Agree with tax reform. Simplify, use a single flat rate on any monetary transaction (say, 1% of any exchange of money for services or goods for both consumers and companies), abolish all other taxes. Done.

I listened to a discussion on local radio about how some folks would like to add a $20 special temporary tax on car tabs to finance a shortfall in the local transit budget. The typical arguments you'd expected, but I had the frontrow seat to watch four empty busses clog the road in front of me. The temporary tax is euphemistically called "congestion relief". Cough.

The linkage of federal government spending to gross domestic product is a tragedy. Graphs of federal spending over time should be adjusted for inflation and population, not for GDP. Linking federal spending to GDP implies that the federal government should expand whenever businesses and workers become more productive.

Ironically, increased government is the main reason why productivity hasn't been rising as fast as one might expect in the computer age. I believe that over the past twenty years, federal, state, and local governments have reduced business productivity gains by at least 50%. Businesses are making better use of automation and computers, but then they have to divert more and more human and computer assets to more government-required reports, more mandated payroll deductions, more tax forms, etc.