More Lame Economic Analysis

Kevin Drum and the left think falling savings rates are all ... wait for it you are going to be shocked with surprise ... Reagan's fault. OK, you are not surprised, since in left-world everything that is not Bush's fault is either Reagan's, Wal-mart's or Exxon's.

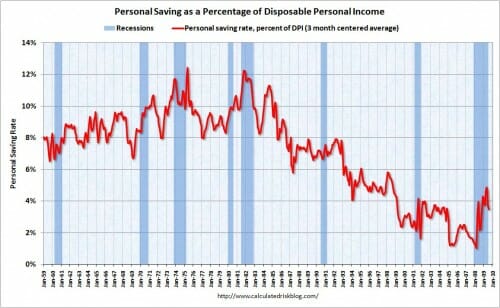

Paul Krugman looks at this chart of the personal savings rate in the United States and concludes that Reaganomics is the most likely reason that it fell off a cliff....

But I'd point to two other things that Krugman mentions: financial deregulation and stagnant median wages. Those seem like much more likely villains to me. Starting in the late 70s, middle class wages flattened out, which meant there was only one way for most people to support the increasing prosperity they had long been accustomed to: borrowing. At the same time, financial deregulation unleashed an industry that marketed itself ever more aggressively on all fronts: credit cards, debit cards, payday loans, day trading, funky home mortgage loans, and more. It was a match made in hell: a culture that suddenly glorified debt; an easy money policy from the Fed that made it available; a predatory financial industry that promoted it; and middle-class workers who dived in to the deep end without ever quite knowing why they were doing it.So, yeah, Reagan did it. Sort of. But he had plenty of help.

This is a great variation of the classic "I know what caused bad trend X -- everything I was against before I learned about bad trend X." The following was my response in the comments:

- The chart on the left starts out at 8%. Drum picked a recession peak as his starting point, a clever trick, but it appears that when Bush 1 left office the number was still about 8%. The largest fall seems to be in the Clinton years. For which, by the way, I don't "blame" Clinton any more than Reagan, certainly not without any real evidence or understanding of the mechanism involved.

- Drum's "consumers are all stupid pawns of electronics retailers and credit card companies" wears thin at some point. It's funny how everyone thinks this is true... of everyone else, but not himself.

- Let me posit an alternative. The 1980s and 1990s saw huge percentage increases in asset values, both equities and homes. This began just about at the time the savings rate dipped. I would posit that consumers, in their mental calculation of savings, included paper gains on these assets. These paper gains are not, to my knowledge, included in savings rate numbers (you can be sure that is true because, if they were, savings rates would have dropped in late 2008). Thus consumers saved less money from their paycheck (which is measured, so it showed a drop in savings rate) while they considered themselves still to be saving as much or more as previously, because they were counting paper profits on assets as savings. The big decreases coincide with the 80's bull market, the 90's bull market / internet bubble, and this decades housing bubble.

My explanation in number three will look even better if we see an increase in savings rate over the coming years as consumer expectations about asset value changes are made less exuberant by the recent burst bubble. A fascinating chart would be to plot savings rate against some measure of consumer expectations of future asset price increases. I bet they would correlate pretty well.

Don't forget that this measure of savings excludes 401k contributions and mortgage principal payments according to the regular amortization schedule.

Root cause: Nixon's decision to close the gold window followed by the Fed's refusal to keep liquidity in line with the demand for dollars.

Coyote got mast of it, but a few random things:

True, 401ks are not included in (most) “traditional†savings measures, however they haven’t been around long enough (not for the demographic generation covered in this analysis) to comprise a large proportion of savings. That’s a relatively recent addition to the retirement arsenal.

Drum points to Krugman who points (incorrectly) at mortgage deregulation as a major driver in household indebtedness. I will buy that component if and only if you add in the other prior or contemporaneous government regulations which drove the exact same thing – increased home ownership and indebtedness. Among those factors: Home Mortgage Disclosure Act (1975), Equal Credit Opportunity Act (1974), Fair Housing Act (1968), Community Reinvestment Act (1977). Krugman conveniently ignores these enormous regulations, because they don’t fit his political agenda, and Drum is too stupid to know about them and therefore account for their effects here as well.

The really weird thing about Krugman is not just his political hackiness, but his seemingly feigned ignorance of the existence of such things. He supposedly knows economics (I personally doubt this, but haven’t had much time to investigate), so he definitely should have awareness of unintended consequences, spinoff/downstream effects, opportunity costs, and related concepts, but his writing is so completely uninformed by any of these things. I’m starting to wonder if he is purely a “top down†(in AI terms) economist, that is, he’s really skilled at reciting economic concepts (Keynesianism lends itself especially well to this type of fake analysis), but he doesn’t actually understand what they mean.

And yes, Coyote, #3 is exactly what I was thinking, a form of rational expectations/future value computation for how much consumers can afford over time, applied to mortgages (Milton Friedman’s permanent income hypothesis).

In fact, that very study has been done:

The Impact of Deregulation and Financial Innovation On Consumers: The Case of the Mortgage Market (Forthcoming, Journal of Finance)

A few conclusions, via Amity Schlaes:

More: Blame Barney Frank If a Pool Isn’t in Your Future

Couple of thoughts:

If 401k's are not included(and I've read conflicting accounts on this)then the savings rates are in actuality higher.

If these stats take into account primarily savings and money market accounts, you have to remember that interest paid was up around 10% circa 1981. It would be interesting to compare those graphs to another graph of inflation rates.

I agree with txjim,

But there is one other factor.

1: Credit markets have evolved considerably even since 1980. It used to be that people would have to save for everything. If you wanted a new house in the 50's you needed to save all $6000, wanted a car, you needed to pay the full amount there too. Now since we have developed credit markets, we don't have to have tons of cash sitting around because we can just borrow it when needed. Even with rainy day funds - 20 years ago I would have needed to save 6 months income in order to survive a layoff. Now with unemployment and credit, I need to save nothing. In fact - I just gained quite a few grand in debt because of being laid off.

2: Getting off the gold standard is not quite the reason offshored jobs lost savings and have a huge trade deficit. The real reason is that we went off the gold standard and told the world to use the $ instead. This was great for us at first because people in other countries were willing to give us goods for pieces of paper because they needed those pieces of paper to trade with each other so they did not spend them again in the US. We basically got free goods. The demand for the $ also raised it's value 20 - 40% higher then it should have been which allowed us to get natural resources from other countries for a nice discount.

However, because the $ was overvalued it became cost prohibitive to produce anything in this country, so companies started manufacturing overseas. Even if we became 100% more efficient, it would not help us, because foreign countries needing $ would just bid up the value of the $ until their currency needs could be met, which would offset any productivity gains.

Eventually some countries ended up with a surplus of $ or needed a place to store them for future use or just to show solvency (I am a good trading partner - look I have all these reserve $). So these countries stored them in treasuries - but later started trying to get better yields by investing in other bonds and currency investment instruments. for instance they would invest in packed home debt offerings and packaged credit card debt offerings, this drove down our interest rates, and gave us such a pool of easy credit that we stopped savings in addition to the natural decline due to advanced credit markets.

If you look at other first world countries they don't import nearly as much as we do, and they actually produce many of the toys and furniture and clothe in house so to speak, but then these countries do not have the "advantage" of having the world currency.

Fortunately this system is about to collapse and something else will replace the $. It will mean pain for us for many years, much like the Japanese stagnation of the 1990's but when we get out we will be stronger, our manufacturing will return, our savings rate will get better ...

here's a graphic showing 401k participation with time, it looks like it would have a perfect inverse correlation to declining savings rate.

http://img.coxnewsweb.com/C/09/15/07/image_7207159.jpg

Well, yes, I'm sure a lot of the graph can be justified with such savings substitution, 401k, assets, etc. But it is also quite rational for the savings rate to fall from that peak because in the run up to the early 80s economic conditions were quite poor in general, and in uncertain times it is only rational to save more. However, the reverse should also be true, as after 1981 the recessions were far less disruptive and therefore did not frighten the populous enough to reverse the savings rate reduction.

There is a basic assumption that saving dollars is a good thing as oppose to buying things.

Since I first voted for Reagan in 1980 my assets have increased. I went from renting and one so-so car, a wife, two kids and the clothes on our backs to owning homes, cars, and all kinds of modern day things.

I've raised my kids, putting one kid through college, the other didn't want to go. My wife and I have travels to 46 states, climbed mountains in the Rockies, backpacked on the Appalachian Trail, the Adirondacks, the Unitas, Michigan, West Virginia, Virginia. Went snrokelling at Catalina Island, Key West, Jamaica, skied in the Rockies, Poconos, and Western Pennsylvania. Ridden my bicycle in Leadville CO, in South Dakota along side a herd of buffaloes (there was a fence between us), across the George Washington bridge and along the Hudson river, through the streets of Las Vegas, on the Pacific Coast highway, through the streets of Key West, the back roads of Gila Bend Arizona, farm lands of OH, PA, WI, KS, the hills of KY and WVA, rode across the state of Florida, rode along the shores of Lake Superior and watched the sun rise on the Upper Peninsula of Michigan, and through the Naval Academy in Annapolis MD.

I've been to Yellowstone, Yosemite, Grand Canyon, the Great Salt Lake, and Arches National Park. Para Sailing and jet skiing in the Gulf of Mexico, white water rafting on the Youghiogheny River.

I've helped out family members, gave my sister-law and family a place to stay and food to eat so they could move from West Virginia to Ohio and establish themselves. I've help my kids get started in their adult life. I've given to my church, supported our food bank.

I've received two college degrees and working on a third, all these things I have done since Reagan first took office.

My point is that I may have not accumulated as much money as I could have, but I have lived my life, bought things and did things that made it interesting. I've accumulated much more than money. Enjoy life, live it, my dad spent all his life working and saving, but I like my life more than his.

As I get older I have slowed down and my current plan is to eliminate all debt and accumulate money, but I wanted to live life while I could.

The prime interest rate in 1981 was 20.5%. Of course people are going to save a lot more during that time. CD's were drawing almost 10% in the early 80s. It was a lot better deal than the market at the time. I wish people would look at data instead of their political blinders.

It should be also pointed out that Medicare and Social Security rates went up sharply over these years. In 1959 the nominal rate was 2.5 percent, in 1972 it was 5.2 percent, by 1984 it was 6.7 percent and since 1990 it has been 7.65 percent.

In addition, since the employer has to pay the same rate, which means lost wages or higher end prices, the nominal rate has gone from 5 percent to 15.3 percent in 50 years.

Of course average real wages were rising until 1974, so let's look at that period.

In 1974 the nominal rate was 5.85 percent, which correlates to an 11.3 percent tax if one takes into account the employer portion of the tax. So since 1974 there is an automatic 5 percent loss in nominal savings rate that affects the bottom 85 percent of wage earners.

In case you wonder about the figures, here is a link:

http://www.taxpolicycenter.org/taxfacts/displayafact.cfm?Docid=227

All this is a sad commentary on the way we have raised our children. A responsible parent (and our government leaders!) would teach his kids to study, work hard, save, invest wisely, and only buy things they can readily afford. Outside influences bombard people with the notion that all the good things in life are theirs for the asking. The government chimes in with schemes to further encourage spending beyond one's means.

I am a retiree who lives well within my means. I don't see why I should subsidize those who do not. Until we educate young people on the wisdom of sensible money management, and ween them from the idea that they are entitled to freebies, these problems will never end.

of *course* krugman's analysis is wrong. krugman's the guy who wrote it. in any economic analysis, there comes a point in which the author has to choose between making his point with A)pure economic reasons or B)blaming a politician, especially one who's a member of the party the economist actively hates. there's never ever any doubt which road krugman's gonna take. it's why he writes for the 'times'. it's why the MSM treats him with such reverence. it's why they gave him a nobel prize: "ideological purity".

Someone should overlay that chart with an inverted chart of the S&P 500, and set the intersection of the two somewhere around 1980.

Boom from mid '82 to mid '83, bust from mid '83 to mid '84, boom from mid '84 to mid '87, bust from mid '87 to end of '87....

Of course correlation isn't perfect, but to rule out causation in the absence of another explanation of the squiggles for the same time is absurd.

I'm not saving because I know that I'm gonna recieve Social Security...after all, I paid into it and am entitled to getting mine. Screw my kids and the children of others -- once I'm eligible and go on the dole, I want taxes raised on the younger generation to pay our way. [/sarc]

Well, yes, I’m sure a lot of the graph can be justified with such savings substitution, 401k, assets, etc. But it is also quite rational for the savings rate to fall from that peak because in the run up to the early 80s economic conditions were quite poor in general, and in uncertain times it is only rational to save more. However, the reverse should also be true, as after 1981 the recessions were far less disruptive and therefore did not frighten the populous enough to reverse the savings rate reduction.

It should be also pointed out that Medicare and Social Security rates went up sharply over these years. In 1959 the nominal rate was 2.5 percent, in 1972 it was 5.2 percent, by 1984 it was 6.7 percent and since 1990 it has been 7.65 percent.

In addition, since the employer has to pay the same rate, which means lost wages or higher end prices, the nominal rate has gone from 5 percent to 15.3 percent in 50 years.

Of course average real wages were rising until 1974, so let’s look at that period.

In 1974 the nominal rate was 5.85 percent, which correlates to an 11.3 percent tax if one takes into account the employer portion of the tax. So since 1974 there is an automatic 5 percent loss in nominal savings rate that affects the bottom 85 percent of wage earners.

In case you wonder about the figures, here is a link:

http://www.taxpolicycenter.org/taxfacts/displayafact.cfm?Docid=227

sure

this is sic