Business Advice: Getting Loans in the Current Environment

I originally started this blog as an advice column for small business, and though I have diverged pretty far from that most of the time, I still like to share some of the things I have learned.

The last year have been difficult for a growing business that needs capital to survive. A lot of our growth is on leased land in the form of leasehold improvements that revert to the landowner when the long-term lease expires. This has always made getting funding difficult -- as bankers want to slap a lien on something -- but of late it has been impossible.

The one exception has been in equipment financing -- I get almost more calls from lenders looking to do equipment financing than I do from companies selling printer supplies. So I began thinking about how I might be able to redevelop a campground using as much equipment financing as possible.

One large expense in any construction project is rental equipment. But on this job we have bought a bunch of equipment - up to and including large construction equipment. We equipment-financed the machinery, the payments on the loans are less than the rental charges we would have had, and we hopefully can sell the equipment at the end of the job if we have no place to redeploy it.

But we still were facing a large expense for buildings. I asked my equipment finance guy - will you finance a modular building? "Sure," he says. So we started rethinking the whole design using factory-built buildings. We combined three modules to make the store and office:

The entry / gatehouse was entirely factory built:

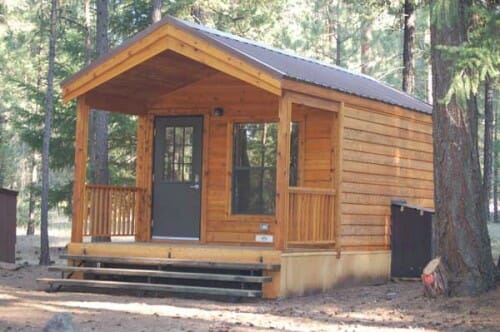

In another location at Burney Falls, California, we equipment financed 24 cabins by, you guessed it, having them factory built rather than built on-site. They came out pretty well:

I was really amazed at how well they came out. Modular has really come a long way. And since in many locales they are permitted different, some of the paperwork and approvals and inspections were streamlined as well.

Coyote:

The problem we have run into with equipment finance companies is prepayment. They typically do not stop the interest meter if we prepay. We have to pay off the total of all the payments rather than deducting the "unearned" interest.

Have you any experience with this type of provision?

Doh! Never mind. I followed the link included in the article and answered my own question. My caffeine uptake must be slow this morning.

Glad you've discovered a "secret" - that many (including us) have been using for years.

At times they've been a bit more expensive, but in today's market such financing is generally much easier to find.

As to prepayment, Tom, that's typical (at least IMO).

I'm wondering why your equipment-financing guy would finance modular buildings? Do you get to keep the modular buildings when your lease expires or are they considered leasehold improvements that you have to leave behind (which is what I would expect)?

Are these the ones Maricopa County bitched at you about?

I love Burney Falls and the whole Lassen area. You just converted a reader to a customer (well, next year anyway).