Run Away!

Megan McArdle said a few days ago:

My reasoning for thinking of this as a depression, rather than a recession: roughly, that we don't understand how to get in or out of it.

I have no doubt that unwinding serious problems with mortgage loans and the housing bubble would have pushed us into some kind of recession. But one can easily argue that the bank failures in the 1980s and the housing market in places like Texas were far worse in the 1980's than they were in late 2008. In fact, there is a fair amount of evidence that current mortgage and foreclosure problems are mainly limited to 4 states (Arizona, California, Nevada, Florida).

If one argues that we now have something worse than a run-of-the-mill recession (which I am still dragging my feet on admitting), then I think I know the cause: economic hypochondria. Yes, we may have a cold, but we have convinced ourselves it's cancer.

It all began with one man: the US Treasury Secretary. Who decided in October to scream to all the world that the US and all its financial institutions were facinig systemic disaster.

FDR did at least one thing I thought fairly clever. One day, he declared a bank holiday, and told the country he was going to inspect all the banks. And a few days later, a few were closed and the rest opened up, suddenly certified by the US Government as healthy. He did exactly the opposite of Paulson - he faked it. No way he really knew if all the other banks were healthy, but he saw a crisis of confidence and he bluffed. The same way, in fact, Jeff Skilling bluffed (and went to jail for) when he faced a liquidity crisis and the leaders of Bear Stearns and many others have this year as well. But Paulson screamed to the world "liquidity crisis" and we may not know much about how to get in and out of them, but we do know that such a statement is usually a self-fulfilling prophesy.

Once Paulson struck the match, everyone else had a reason to contribute to the fire. Obama loved it, because a financial crisis could be laid at the door of Republicans. The media loved it, because they always like to headline pending disasters and it supported their guy Obama. Banks learned to love it, as they soon found that if the country bought the "disaster" story, they might get free government handouts. And then GM and others saw an opening to stampeded the government into more handouts. In one of the great ironies of all time, the looming depression became the greatest gravy train of all time, spawning what literally will be the largest pork-fest in all of history.

So what do the rest of us think? Well, we might still have our jobs, but it sure seemed like we might lose them soon. Just watch the news. And our company joined right into the panic. I have cut expenses and jobs like crazy in anticipation of a drop in revenue I haven't even seen yet!

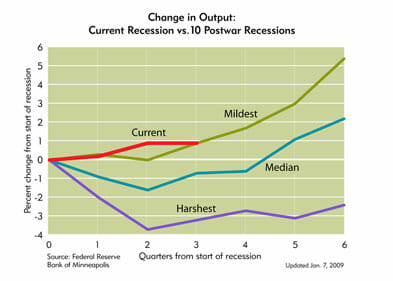

Can I prove that this is anything more than just a libertarian fantasy-rant? Not really. The only potential proof I can offer is as follows. If my story is correct, then we should see layoffs occurring faster than actual drops in output. We should see job cuts in anticipation of, rather than as a result of, falling demand. To which I offer these two charts, via Alex Tabarrok:

Postscript: To be fair, economists who look at this stuff much more deeply were calling out deep problems long before Paulson screamed fire in a crowded movie house (example). I am not say we would not have had a recession, but the speed and depth of the drop may well have been affected by his mismanagement.

Postscript: To be fair, economists who look at this stuff much more deeply were calling out deep problems long before Paulson screamed fire in a crowded movie house (example). I am not say we would not have had a recession, but the speed and depth of the drop may well have been affected by his mismanagement.

Great point. There was a chance to prevent much of this if the Republican nominee had more brains than John McCain. Paulson's "sky is falling" proclamation was a great opportunity for the Republican nominee to triangulate away from Bush and Obama at the same time by proclaiming himself the "anti-bailout" candidate. He could have carried the election on that basis and spared us much of the pain the country will now go through paying for trillions of bailouts and new new government entitlements.

I must agree, this is mostly fantasy, but it is dangerous fantasy. Why? Well, because people (and not only people without influence, also people who have a lot of money at hand) buy into it and go the safe road, meaning they cut spending and they cut consumption. This is what the company I work for experiences at the moment. People could down on consumption and so do companies. This results in a reduction of production which means less demand for our goods.

So, as you said, a self-fullfilling prophecy. Perhaps Keynes was closer to the real thing, than he himself imagined, not in economic terms, but in psychologic terms.

Though, I think the industry can rest a while with a dump and an increse in first order investing. At least, we can.

"We have tried spending money. We are spending more than we have ever spent before and it does not work ... After eight years of this Administration we have just as much unemployment as when we started ... And an enormous debt to boot!"

-Henry Morgenthau, Treasury Secretary under FDR, after 8 years of FDR's "New Deal"

I presume you are discounting Michigan,Tennessee, and the nationwide issues with manufactured homes financed by conseco (more than 60%) because their foreclosure problems were endemic and pre-existing?

Otherwise I agree with you.

This is mostly a manufactured crisis; and has consisted primarily of self fulfilling prophecies, and the entirely predictable results of poor risk evaluation, questionable accounting practices, and entities responding appropriately to perverse incentive.

I work for a company that make components for automobiles.

Everyone at work seems to think the bailout of GM will help us. But it won't. Our demand has been dropping rapidly not because GM may be going under, but because people aren't buying cars. Giving GM money isn't going to make people buy more cars.

People need financing to buy cats. Like you stated, if banks are scared to give out loans, they won't.

Once again, coyote, you're spot on.

History should show that Henry Paulson a.k.a. Chicken Little created this crisis. Or is it Munchausen's syndrome? (not sure of the spelling on that).

Too bad none of our elected representatives had the stones to tell him no.

There is a lot of debt in the private sector to unwind before things can get started in earnest again. That has to be considered.

Thank you for laying much of the blame for this debacle on Chicken Little Paulson. No, the underlying problems were not his fault. But, the stock market would never have fallen 40% if he hadn't run around screaming, "The economy's falling; the economy's falling." Then, to make matters worse, he claimed that a 700 billion dollar money infusion was needed immediately to prevent an even worse crisis. The man is both a fool and a liar.

Well, to my mind, the D's in Congrefs were screaming and shouting about the "worst economy in history" and so on up until Nov 5, when they all of a sudden decided that things weren't so bad.

They upped the ante, and claimed it was "Crisis". Paulson helped, but he was waaaay late in the game they set in motion.

They built this mess, word by word. Now they have the pleasure if trying to fix it.

Talk about your 'self fulfilling prophecies'. Ugh.

tom

Interesting. I just finished an article to be published on another site talking about how PEOPLE have made this more than what it is. There has been very little talk of how the normal movements of the economy have always brought ups and downs. Hard working people are being affected and it makes people feel like they should act but looking at it solely as an economic condition, I don't think it's as bad as many say. Good post!

In every economic slowdown I have experienced over the last 50 years companies have used the cover of recession to pare back on their overhead by cutting their workforces so that their leverage will be increased as the recession abates and their managements will benefit from the appearance of exceptional profitability in the recovery. Before it became commonplace, it made those managements that did pare back look much better than those who stuck by their workers, at least in the shortrun. But then the shortrun is what we foolishly pay these clowns for. We are the stupid ones for rewarding shortsightedness with our stock purchases. They are just reacting to the stimulus.

I'm sincerely hoping that, to the extent that psychology impacts the actual well-being of the economy, that the media's Obama worship will cause them to call the economy a lot better than it is. Then, people will act as if the economy is recovering, and the self-fulfilling prophecy will work the other way too.

There was more going on than Paulson and Bernanke announcing a crisis that created a crisis...I was picking up pieces of information on blogs more than a year ago from Wallstreet insiders who knew that CDOs and SIVs were failing. And, since these instruments were leveraged ten, twenty, and thirty times over that there was going to be hell to pay for it. Later, China dropped off the map as it had been fueling much of the commodities boom importing raw materials for manufacturing. Why? What did the Chineses know long before our stock market crashed. Banks starting tightening lending standards in 2007. As a RE investor who had been in the market for fifteen years, I could no longer find financing. The banks were already reading the handwriting on the wall in 2007. They too knew that the housing bubble was bursting and that hundreds of billions in bad loans had been written. To sum these anecdotal factors up, I would say that many in the business including Paulson and Bernanke knew that the pain was coming more than a year or more ago. I think what culminated last fall was the storm having finally arrived and that it surprised everyone in its intensity and depth...So, I don't blame them at all for creating a crisis...The history has yet to be written but I think we will see things like the cheap money at the Fed and Japan led to a worldwide housing and commodities bubble. That lax oversight in Congress, and things like the community reinvestment act precipited the now famous sub-prime loans. That Wallstreet barons of the last few years eclipsed the excesses of 1929 in overselling the market to a naive public. That many countries were living off the consumption of Americans and that they would even lend us the money to overconsume in cheap manufactured goods as well as BMWs and the like...I suspect that the world economy is a lot more resilient than the 1930s and that we have the benefit of history and the study of these types of crises to help guide us through. It is bad and will continue to be bad but I think the turnaround will come and sooner than most think. But we will have a year or two before we see the end or worse the "end of the beginning" as Churchill once said. And, we will remain tempered and somewhat chastened for decades...

Where was McKinsey? Hmmm? You gonna answer me? Where was the day one hyptothesis and the fact based apporach and the obligation to dissent? Where was it on Enron and the dotcoms?

we have resently saw alot of coyote tracks and we are trying to see one we think they went down some hills and we are going to follow them.