In Medias Res

You certainly don't have to spend very long convincing me that a significant government action can be distortive of markets, so I won't argue too much with Kevin Drum that the capital gains tax changes maybe played a contributing factor to the housing bubble (though it is hilarious that the left considers tax reductions as the only distortive government actions).

However, thinking back on events, its a little hard for me to ascribe the lion's share of the bubble to capital gains tax changes, as opposed to, say, the mortgage interest deduction or Federal Reserve interest rate policies or local zoning controls.

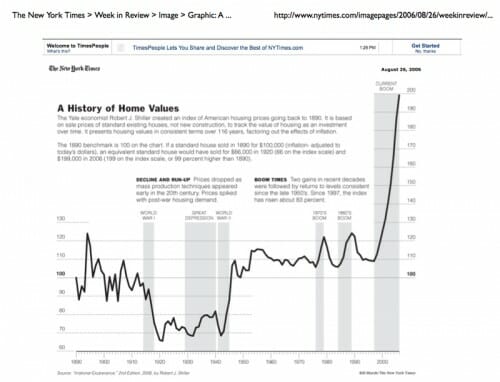

I probably wouldn't have bothered blogging on this, but I found the chart Drum uses from the NY Times to be hilarious:

Do you see the problem? I will help by simplifying the chart:

Its a pretty heroic assumption to say that Event B caused Trend A.

Update: Russel Roberts thinks the Times is right, but that they are using the wrong data to prove it. 1997 looks much more like the critical inflection point if you look at prices rather than sales (chart via Roberts, from a different NY Times article, click to enlarge)

Event B = the evil Bush-Hitler, cause of ALL problems in the world.

An excellent example of fallacies in data analysis. Could I used that graphic in a class I'm teaching?

I noticed that before I even scrolled down to your own chart.

The trend seems to continue along its path for a few years after the event in question.

If its good enough for global warming.....

the increase in sales before the change was caused by evil wall st profiteers buying up cheap houses from little old ladies and working class americans in anticipation of the change that the fats cats lobbied for. duh.

It looks to me like there was a jump after the new code passed. Exactly like you would expect, a little bump right after the change, then a subsequent flatter period returning to the trend. Just like any other equilibrium situation where you remove an obstacle.

The confusing thing to me is what mode is being suggested for the tax change to create a bubble? I don't assume that people really move more or less frequently because of the tax code, but if a change made it more profitable to sell a house, wouldn't this have had a negative effect on home ownership? Someone might be motivated to sell their house and rent for a windfall, but I can't imagine buying a house i couldn't afford because of a tax code change that might make it's sale more profitable 10yrs down the road. am i missing something?

Not to mention the fact that the change affects "profits" over 500k, isn't median house price less then half that? really, what % of transactions would this even affect?

It seems there is a lot more wrong with his chart usage.

Yeah. That was a stretch.

Cafe Hayek has a good follow up to the Times article.

The change in home values, starting around 1997, is striking.

And, for you serious finance/public policy geeks, let’s not forget the relentless government assault on lending standards.

Kevin Dumb has no idea what he's talking about (as usual).

Sales do not equal prices, aren't we talking about a bubble in prices?? Yeah, the chart proves nothing.

I don't know when this changed, but until not that long ago housing capital gains were treated very specially:

1) As long as you bought a higher priced home than your previous one (with 18 months), the capital gains simply rolled into the new purchase and the tax was deferred. This was a policy very focused towards causing rising home prices - moreso than lowering CG rates no.

2) When you reached a certain age (58?) - you got one sale free, so you could sell a home that you had rolled a lifetime of capital gains into, with no cap gains. Then you could buy down into your retirement home.

In other words, homes were better than 401K's - not only was tax deferred on the gains, but you could avoid it entirely at a certain point.

if you are looking for what changed in 1997 and drove an inflection point in pricing, id have a grad look at bill clinton's "community reinvestment act" which was introduced in 1995 and then modified to ease lending standards several times. he mandated $1 trillion in under market rate loans to sub prime borrowers. low rates drive higher prices all else equal.

this, fueled by greenspan's irresponsibly low interest rates drove the real estate (and lending bubble).

oh, and two more observations:

prices did not exceed the 1990 high until 1999 when clinton really opened the spigot on CRA.

and if you are looking at a reason for a real estate uptick from 1997 onward, keep in mind: it was the dot boom. the stock market (until march 2000) was ripping. unemployment was incredibly low. wages were strong. leaving that out of an equation seems a bit of a stretch.

then, when the bubble burst, everyone fled to real estate as the new assets class they were excited about. i heard load of equities brokers complaining that they kept getting calls to liquidate funds to buy RE. as the economy dropped away, a huge influx of unqualified buyers and very low interest rates kept prices going up.

greenspan thought this was a marvelous example of effective government management and denied a housing bubble existed until well after he was out of office.

i am consistently surprised by the high regard in which many seem to hold greenspan. history will revile him as the one who was asleep at the switch and let bubbles feed bubbles until they very nearly took the whole country down.

Any discussion of housing prices in the US which does not grapple with the huge differences between housing markets is not worth bothering with.

Check the data at http://www.demographia.com/.

See also Krugman's discussion of the difference between "Flatland" and "the Zoned Zone" at

select.nytimes.com/2006/01/02/opinion/02krugman.html?_r=1