A Few Other Thoughts on Gamestop (GME)

A few thoughts in follow-up to this post on GME and short-selling

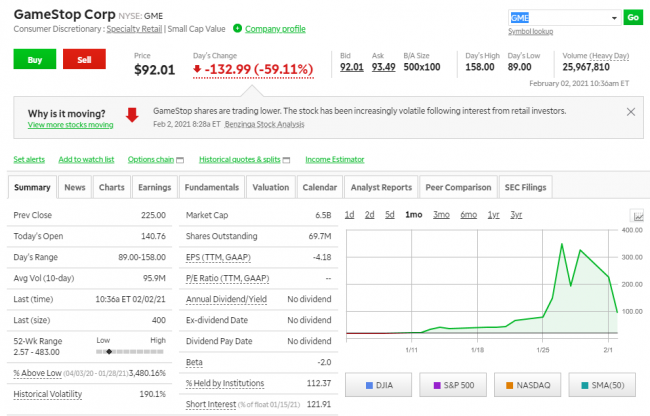

- The general celebratory air around the story of Gamestop (GME) is driven, I think, in large part because no one other than a few hedge funds who had naked unhedged short positions in GME. But recognize we are still only in the middle of this story. This is like reporting on the Titanic after the first lifeboats were away successfully but before the first drownings. There is no WAY that Gamestop is going to remain over $300, or even over $100. Gamestop has almost nothing you would want to own -- bricks and mortar retail locations that sell digital product -- and yet its valuation is higher than even the hottest of retailers. It is something like 6-8x the valuation on a price-to-revenue basis (so such thing as a PE as it loses a ton of money) of other similarly threatened retailers like Best Buy. Its valuation is even well above players like Home Depot, which unlike Gamestop a) makes a profit b) sells a bunch of stuff that can't be sold easily online and c) is growing rather than shrinking. Within 30 days or less GME will be back under $40 is my guess.

- This stock windfall is thus essentially a pyramid, no different than other attempts to corner a limited market, and will eventually fall to Earth. Those in and out early will win -- and those are the folks winning praise and love across the media. Those out late will lose out. Had I been in the stock, I would never ever have stayed in the stock past the market close on Friday

- Every professional investor and institution that does not have a lockup or some portfolio rule that keeps them in Gamestop is out. I would fire any professional that did not take the opportunity to unload this bankrupt dog worth $20 or less at a price over $300. So all that is left are redditors who are keeping the stock afloat by turning over more than the entire stock float every day, thus elevating it by some investor version of Boyles law.

- If the folks in the stock now are like the other redditors who got in early, they are very leveraged. This leverage allowed folks to claim huge gains with small investments, but in turn will leave small investors at the end with huge losses.

My prediction is that 30 days from now, we will look back on this story very differently. Perhaps I am just a member of the HBS-educated elite and can't see past my traditional views on investing, but I STILL don't think that highly leveraged momentum investments on near-bankrupt stocks in collusion with other investors of whom one knows nothing is a good approach for the typical small investor.

Update: Aaaaaand it only took 2 days. Do we still feel like this is a heroically great story for the everyman? We got to enjoy regular dudes making a fortune on the way up with highly-leveraged investments in a pyramid / pump-and-dump scheme. Do we get to see stories of people holding leveraged positions at $400?