The World's Safe Haven

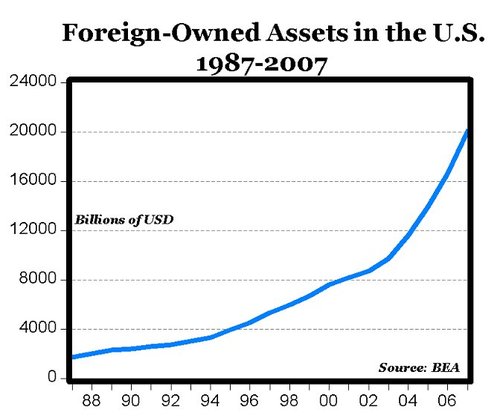

We have rising oil prices and falling housing prices. Mortgages are defaulting and stocks have been falling of late. The dollar is in the tank. But at the end of the day, the world still sees the US as the safest and most productive place to invest its money:

Its odd to me that from time to time we go through periods of angst (e.g. the late 1980s panic that the Japanese were "buying up America") about this effect, but we should instead be assured by this vote of confidence from the rest of the world. One might argue that folks are simply buying US assets today because they are cheap, and certainly the dollar's fall makes US assets relatively less expensive. But assets are cheap in Russia and Nigeria and Venezuela too, and you don't see the world rushing to invest a few trillion dollars in those locales.

Postscript: This foreign ownership of US assets also makes the world a more stable place. I am always stunned when people argue that Chinese ownership of a trillion dollars of US debt securities gives them power over us. Huh? Since when does holding someone's debt give you power? I don't think Countrywide Mortgage is feeling too powerful today. The fact is that holding our debt and owning US assets gives China (and other nations) a huge shared interest in our stbility and continued prosperity.

I agree, I see it as good news.

The various Latin Debt crisises have shown that China has no sway over the US by holding our paper. What are they going to do? Foreclose? If they stop buying our paper, the dollar totally tanks and they end up with widespread unemployment (because the US won't be buying their stuff anymore) and social unrest.

America, the first empire that let anyone buy-in, whether big (trophy buildings, stakes in banks) or small (immigrating and starting a business). It's practically self-perpetuating.

How about some of those money not being "foreign assets" ?

This is not the oldest trick in the book, but it works as well, I am told: if you have high taxes in your country, you register a company in some place with lower taxes, let's say Ireland or Luxembourg. You sell your product to that company at the minimum profit that would not make the IRS go berserk, sell it further at market price, then bring the money back in as "foreign investment". It works even with buying: buy from the "foreign company" at almost the the market price, sell in your country for a tiny profit, and save the profit tax differences. The result is that the tax heaven gets a stellar GDP and trade surplus and your country a stellar trade deficit. In the meantime, you can afford to pander to local resentments and support politicians that ask for higher taxes on corporate income etc.

Elambend: "America, the first empire that let anyone buy-in, whether big (trophy buildings, stakes in banks)"

Yeah, except that it's not just foreigners buying in. American investment overseas has risen almost exactly at the same rate shown in the graph above. It's the globalization of economic enterprise, and both American and foreign consumers have benefitted enormously.

Once again the Libertarian philosophy is incapable of grinding things out to a more realistic conclusion; i.e. in this case because Russia and Nigeria don't seem to be attracting the same relative levels of outside investment this is proof that the US is de facto solid and stable financially. Of course, these ratholes don't attract any foreign investment because, in my opinion anyway, a sensible investor would be terrified of investing in a place where mobocracy prevails.

Listen, my wife worked for an international merchant banker who has offices in Russia and these people are up to their necks in corrupt business practices and to survive one has to have extraordinary interpersonal skills as well as a comprehensive understanding of what these people are about.

Please, Warren don't try to scam us with the assertion that people are not buying in the US because they can get really good bargains but rather because we are so sound financially. It's because of our laws which do a better job of protecting investors then do the Russians and the Nigerians.

Also your comment about China investors not reallly having any control...huh? Isn't that what investment is all about; ie control? Why don't we just sell off everything and see what kind of boiling pot we're in? E.G If the board of directors for GM was all Chinese, Russia, Brazilian, or Iranian would it make any difference? Come on, of course it would.

The old comment "When you owe the bank $100, they own you. When you owe the bank $10,000,000,000, you own them." seems to apply here. If the Chinese dump their dollars, they will only kill their customers. This debt is the best control we have over them as it keeps their people working and tired, so they won't complain. It also fills their rice bowls...

tom