Understanding "Mix": Is Flattening in Income Growth Due in Part to Geographic Cost of Living Differences and Migration Within the US?

For 20 years, before I liberated myself from corporate America, I spent a hell of a lot of time doing business and market analysis (e.g. why are profits declining in Division X). I was pretty good at it. If I had to boil down everything I learned in those years to one lesson, it would be this: Pay attention to changes in the mix.

What do I mean by "changes in the mix"? Here is an example. A company has two products. One has a 20% margin, and the other has a 30% margin, and both margins have been improving over time because of a series of cost reduction investments. But overall, company margins are falling. The likely reason: the mix is shifting. The company is selling a higher proportion of the lower margin product.

Here is a real world example: When I was at AlliedSignal (now Honeywell) aviation, they had exactly this problem. They were operating in a razor and blades business -- ie they practically gave the new parts away to Boeing and Airbus to put on their planes, because they made all their money selling aftermarket replacements at a premium (at the time, government rules made it almost impossible to buy anything but the original manufacturer's part, so they could charge almost anything for a replacement, especially given that an airline likely had a $50 million plane sitting dormant until the part was replaced). I routinely would tell managers in the company that essentially our business made money from unreliability -- the less reliable our parts, the more money we made. Because newer technology, competition, and pressure form airlines was forcing us to greatly improve our reliability (at the same time we were giving stuff to Boeing at ever greater losses), all our newer products on newer planes were less profitable than the old stuff. As planes aged and dropped out of the fleet, our product mix was getting less and less profitable.

This same effect can be seen in many economic and political issues. Take for example an argument my mother-in-law and I had years and years ago. She said that Texas (where I was living at the time) had crap schools that were much worse that those in Massachusetts, her argument for the blue political model. She observed that average educational outcomes were much better in MA than TX (which was and still is true). I observed on the other hand that this was in part a result of mix. Texas had better outcomes than MA when one looked at Hispanics alone, and better outcomes for non-Hispanics alone, but got killed on the mix given that Hispanics typically have lower educational outcomes than non-Hispanics everywhere in the US, and Texas had far more Hispanics than MA.

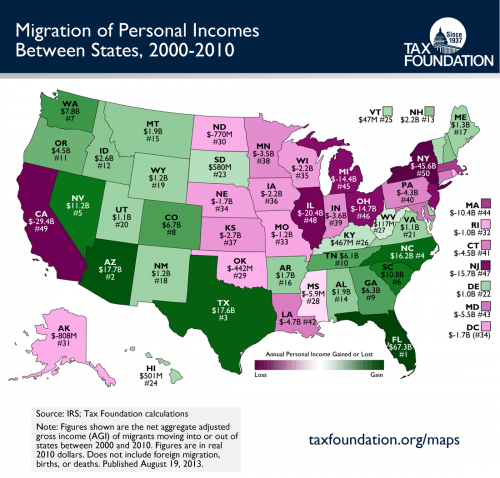

All of this is a long introduction to some thinking I have been doing on all the "Average is Over" discussion talking about the flattening of growth in median wages. I begin with this chart:

There is a lot of interstate migration going on. And much of it seems to be out of what I think of as higher cost states like CA, IL, and NY and into lower cost states like AZ, TX, FL, and NC. One of the facts of life about the CPI and other inflation adjustments of income numbers is that the US essentially maintains one average CPI. Further, median income numbers and poverty numbers tend to assume one single average cost of living number. But everyone understands that the income required to maintain lifestyle X on the east side of Manhattan is very different than the income required to maintain lifestyle X in Dallas or Knoxville or Jackson, MS.

Could it be that even with a flat average median wage, that demographic shifts to lower cost-of-living states actually result in individuals being better off and living better?

For some items one buys, of course, there is no improvement by moving. For example, my guess is that an iPhone with a monthly service plan costs about the same anywhere you go in the US. But if you take something like housing, the differences can be enormous.

Let's compare San Francisco and Houston. At first glance, San Francisco seems far wealthier. The median income in San Francisco is $78,840 while the median income in Houston in $55,910. Moving from a median wage job in San Francisco to a media wage job in Houston seems to represent a huge step down. If you and a bunch of your friends made this move, the US median income number would drop. It would look like people were worse off.

But something else happens when you take this nominal pay cut to move to Houston. You also can suddenly afford a much nicer, larger house, even at the lower nominal pay. In San Francisco, your admittedly higher nominal pay would only afford you the ability to buy only 14% of the homes on the market. And the median home, which you could not afford, has only about 1000 square feet of space. In Houston, on the other hand, your lower nominal pay would allow you to buy 56% of the homes. And that median home, which you can now afford, will have on average 1858 square feet of space.

So while the national median income numbers dropped when you moved to Houston, you actually can afford a much nicer home with perhaps twice as much space. Thus, it strikes me that there are important things happening in the mix that are not being taken into account when we say that the "average is over".

Of course, while this effect is certainly real, I have no idea how much it affects the overall numbers, ie is it a small effect or a large effect. Fortunately my son is studying economics in college. If he ever goes to grad school, I will add this to my list of research suggestions for him.

Postscript: This exact same discussion could apply to US poverty statistics. We have one poverty line income number whether you live in Manhattan or Tuscaloosa. I have always wondered how much poverty statistics would change if you created some kind of purchasing power parity test rather than a fixed income test.

Dan:

Something similar is behind the supposed rise in income inequality; people in their 50s have much more unequally incomes and people in their 50s make up a much larger proportion of the adult population than they did 30 years ago.

October 15, 2013, 9:35 amOldNHMan:

This is something I have tried to express to a number of folks during discussions about incomes and cost of living. I have even used the California/Texas comparison to show how median income is not a good indicator of 'wealth' of a given area unless you also include the cost of living. We need a better way to express this comparison and one I've always used has been the "median income/cost-of-living" ratio which gives us a better idea of the actual 'wealth' of an area. The big problem is coming up with relatively up-to-date data on both and making sure to compare apples to apples. For instance the cost of living should include the costs of the same products, services, homes, and the total tax burden (state and local taxes only). This gives us an across the board metric to use for comparisons. It isn't perfect but it's a whole lot better than using just median income.

October 15, 2013, 11:00 amwintercow20:

Well, to add datum to your conjecture, I took a $30,000 pay cut when I moved first from NYC to Danville, Kentucky - and was easily better off (had a COuntry Club membership to boot)! Then after some life changes, took another "big" pay cut of another $30,000 by moving from the Peoples Republic of Western Massachusetts over to Rochester, NY. Again, easily better off despite this part of the world experiencing very high property tax rates. Rochester is easily one of the most easy to live in places in America.

October 15, 2013, 11:21 ammorgan.c.frank:

this gets tricky as there is a lot of subjective value here.

if i offered you a house twice the size of your existing one at half the price, would you jump at the opportunity to move to darfur even if you earned the same wage you do now?

square footage is not the only thing that matters when assessing value. local culture, amenities, schools, weather, people, and on and on matter.

it's a very interesting point about people moving to lower cost areas, but it sort of finesses the question of "did they want to?"

did they move to houston because they were excited to have a bigger home and lower taxes or because they could no longer afford to live where they wanted to?

it seems to me that the essence of the "better off" calculation lies there.

October 15, 2013, 12:00 pmmorgan.c.frank:

that's not entirely true though.

if you buy a ford focus and pay $30k or a porsche 911 and pay $80k the latter may seem less affordable, but most also agree that it's better. cost of living is only half the measure when looking at happiness. quality of living is the other. clearly, people value living in san francisco more than in houston. you can tell by the massive price difference.

you can't look at just price, you have to look at what you get for it as well.

some people may prefer houston. that's fantastic for them and they get a great deal. others may prefer to pay up and live in SF, and, given the relative prices, this groups seems to be the majority.

the market is not setting these relative costs arbitrarily.

expensive cites are expensive because so many people want to live there.

October 15, 2013, 12:05 pmborepatch:

I actually think that it's even more exaggerated than this. We moved from a Boston suburb to an Atlanta suburb three years ago. Not only did we get twice as much house for half as much money, but our annual property taxed dropped from $11k/yr to $3k/year. If you tracked after tax income, the gap will be even larger than you point out.

And OBTW, the schools here are as good as those in the Massachusetts town that we left.

October 15, 2013, 12:51 pmmharris717:

I've speculated that this argument works across time as well. Income inequality is higher now than 50 years ago, but the inequality of "income above subsistence level" may be the same across time.

October 15, 2013, 12:52 pmSTW:

Mark Twain had a discussion along these lines in "A Connecticut Yankee in King Arthur's Court" in 1889. Apparently this book hasn't been required reading for enough people in the intervening years.

October 15, 2013, 1:29 pmTJIC:

> Could it be that even with a flat average median wage, that demographic shifts to lower cost-of-living states actually result in individuals being better off and living better?

My fiance and I are relocating from MA to NH.

We're trying to convince good friends to make the move at the same time.

They were skeptical until this last weekend, when we drove them up to a cute little town 20 minutes outside of Manchester.

They could sell their 3 bedroom house on 1/10th of an acre just outside of Boston and move to a new construction 5 bed, 5 bath house on 20 acres, two doors down from a bookstore.

...and pay off their mortgage.

...and have $10k left over.

They're now researching nearby Catholic schools and moving companies.

October 15, 2013, 2:00 pmJoshua Vanderberg:

I pay about 2x as much for housing and probably about 4x as much in property and other taxes, than I would if I lived in a rural area.

Yes, I value being within a short train ride of downtown Chicago. I value the amenities that Chicago has to offer, but I am starting to realize that over the next 20 years, this will probably cost me about $500k(more if there were investments that had a positive return) in retirement/college savings.

I really have to wonder if it's worth it. Especially since I do not have to chose between work and location. I could work from a Houston suburb and take in the same salary.

October 15, 2013, 2:01 pmSteve Merryman:

The buying power of each dollar changes within each state as well. I

October 15, 2013, 2:03 pmlive in eastern Washington state, and the cost of living here is much

lower than on the west side. I live on 10 acres of land near the Idaho border. I could have never afforded the same in the Seattle area. Although living far from the cultural hub does come with a cost - much less traffic.

Matthew Slyfield:

"Although living far from the cultural hub does come with a cost - much less traffic."

Less traffic is a cost?

October 15, 2013, 3:23 pmSteve Merryman:

I was being ironic.

October 15, 2013, 3:33 pmmarque2:

I experienced this moving to Iowa from California. At the time I was earning about 60K per year, and my family were all living in a one bedroom apartment, and couldn't afford to do much of anything. We moved to Iowa, and got 68K per year, but were able to purchase a 3000 square foot house, with a quarter acre of land. This house cost about 1/3 to 1/4 depending on how you count it compared to California. Groceries were also about 1/3 less as well (eggs for example were 80 cents per dozen compared to 2.25 per dozen in CA at the time). Even though the schools are 10x better than CA, we still sent our daughter to private school and could afford to do so! Interestingly we moved back to CA and I was earning 97K per year, We felt outright poor again. - Now we have a home there that is 350K, but I couldn't find another contract job, so I live in Texas while the family lives in CA still, similar homes here in Texas to the one we got in CA go for 120K. If I could convince the family to move here, we would be doing outrageously better, even though my salary here is a bit less than my last job in CA. Power is another issue. We pay 26 cents per kwh in CA, it is only 13 cents in Texas. Gas in CA is about $3.80 per gallon (regular) it is $3.00 even on average here in Texas.

States like Iowa, Texas, Tennessee do all have lower salaries by about 20% than CA, but your expenses go down by 1/3. And also you tend to end up in a lower tax bracket as well, so you get to keep more of what you earn. Double bonus. Only downside, since the homes are so low in value, that you don't always reach the standard deduction threshold to write off the interest - that interest write off is a bene for the expensive states.

October 15, 2013, 5:36 pmmarque2:

A bit of Fe is good for the body, Too much is deadly :-)

October 15, 2013, 5:38 pmOldNHMan:

My folks made the move from CT to NH 9 years ago. After selling their home in CT they bought an equivalent home in NH (same size on a slightly larger lot) for a fourth of what they got for their old place. Their property taxes were also lower and they didn't have to pay sales or state income taxes any more. While some things are more expensive here than in CT and MA, they are the exception rather than the rule.

October 15, 2013, 5:40 pmmarque2:

My move to Iowa a few years back from California - we may not have been close to a world class museum, have a world class symphony or have a ballet theater. First run broadway shows were also not available. But we never went to these things anyway. Only thing we missed was the food. The schools outside of CA are better, everything is cheaper - as in you can afford a house 4 times the size because your heating and cooling costs are half as much per unit as well.

The difference is not as great as you might think, because every state has their own set of advantages, and innate beauty.

October 15, 2013, 5:41 pmOldNHMan:

You are comparing Red Delicious apples (Ford Fusion) with Macintosh apples (Porsche 911). If the same things are compared - the cost of that same Ford Fusion in San Francisco and Houston - then you have a reasonable metric, just as I laid out in my comment above. I wrote " the cost of living should include the costs of the same products,

services, homes, and the total tax burden (state and local taxes only)." What part of that did you not understand?

My ratio isn't perfect but it's a darn sight better than just median income as it compares common items. A Ford and Porsche may both be cars, but they aren't what I would consider common items. When you compare Ford to Ford and Porsche to Porsche, then you're comparing the cost of common items. When you compare a 1500sqft home on a 1/10th of an acre in Houston and in San Francisco, you are comparing the cost of common items. To compare disparate items (Ford vs Porsche) means the cost comparison has no meaning.

October 15, 2013, 5:54 pmmorgan.c.frank:

marque-

the difference is personal and varies by individual. this makes aggregates very difficult to use here to explain any individual case.

but we can say one thing for sure:

some markets are far more expensive than others. if the cheaper ones were better in the opinion of most people, then they would be moving in droves.

the fact that this is not happening and that the price gap is actually rising seems to say a great deal about just what the integral of personal preferences is.

October 16, 2013, 6:00 ammorgan.c.frank:

old nh-

you are still missing this.

the issue is that comparing an apartment in sf to one in houston is NOT apples to apples.

the weather, culture, access to shopping, nightlife, restaurants, parks, views, beaches, surrounding areas, etc are all different. so are the job and educational opportunities.

your metric misses this.

you are leaving out the fact that prices vary for a reason.

"When you compare a 1500sqft home on a 1/10th of an acre in Houston and

in San Francisco, you are comparing the cost of common items."

is completely false.

they are NOT common items.

if i offered you a house the same size as your current one at half the price in darfur, would you say "hey, what a great deal"? i doubt that very much.

i suspect you would not call them common terms at all.

so, to use your own phrase, what part of that did you not understand?

you are trying to use only half the equation (cost) and leaving out the other half (what you get for it) leaving out the fact that markets differ in price for a reason, and that reason is based on what people value.

October 16, 2013, 6:06 ammarque2:

People are leaving CA and NY in droves. In CA in particular the middle class is leaving with the ultra rich and poor immigrants staying behind. They are moving to Nevada, Arizona and Texas.

Housing prices are going up in CA as elsewhere because of the bottoming out of the recession and new laws effectively banning non-high density housing.

Yes it is a personal thing and folks are voting with their feet. I am working in Dallas now while the family stays in CA because there are few jobs in my field there any more - they have been moving out. Dallas is pretty nice. If it works out we will probably move here.

The reality is that people don't care as much about personal preference as you think - people follow jobs and evaluate whether they can live comfortably on those jobs.

October 16, 2013, 6:10 ammorgan.c.frank:

i think that is incorrect.

people do care a great deal about where they live.

why else would the nice places be so expensive? why, within even the same city, are some neighborhoods expensive and others less so?

people often do not have a choice. if you lose a job and get a new one elsewhere or your existing job does not pay enough to live where you prefer, you move.

sure, loving where you live is not the only factor in people's choices. jobs, family, taxes, etc all matter too.

but the notion that this means that people do not care about where they live flies in the face of all the market price inforamtion we have,.

October 16, 2013, 9:47 amOldNHMan:

Actually, I think we're basically saying the same thing. However, if you are not comparing the costs of similar items then any 'price' comparison you have is meaningless. If you compare the price regular gasoline in one city versus the price of diesel in another in another, the price comparison is misleading.

Most cost of living comparisons match like items. Even the feddle gummint uses that metric. As I said, it isn't perfect but it does give a better idea of what it costs to live in one area versus another. If you start making disparate comparisons then it's a waste of time to figure out the cost of living..

Earlier you made a reference to Darfur in regards to comparisons. That's a straw man. I want to compare the cost of living in San Francisco to the one in Houston. Darfur is meaningless and you know it. I'm not going to include intangibles that will be difficult to quantify without a lot of time and research.

Cost of living comparisons usually don't include happiness or the number of dog parks or bike paths. Those are quality of life factors and I am NOT including those. Those are a separate issue yet you want to include them. I do not as that isn't the purpose of the comparison. I would look at quality of life as well, but I wouldn't include it in the comparison. I want to know how much it will cost me to live in one place versus another - the cost of housing, food, utilities, transportation, taxes, fees, insurance, health care, and so on. It doesn't matter if one place has a superior quality of life if I can't afford to live there, does it?

October 16, 2013, 3:56 pmJoe:

The "mix" that you're talking about is called Simpson's paradox and is unfortunately not well known among the general public. Wikipedia has a good article on it:

http://en.wikipedia.org/wiki/Simpson%27s_paradox

October 16, 2013, 4:04 pmrst1317:

another factor when it comes to amenities?

http://burghdiaspora.blogspot.com/2013/10/demise-of-global-city.html

"Postscript: To put a fine point on the post, I disagree with the analysis that migration patterns indicate economic divergence. I see economic convergence. Talent can have all of New York City in Philadelphia. Go ahead and move back to Des Moines, Iowa instead of sticking it out in sinking Chicago."

October 17, 2013, 9:51 amrst1317:

Yes, the market reflects values. But it reflects a whole heck of a lot of values including how much someone values a specific property give all their other choices. Unfortunately in a lot of areas the choices are more limited than they naturally would be.

If someone has something very specific they _really_ like to do, they will have some limited choices. If you highly value surfing, where you can live and do that all the time is quite limited. It's not just limited to a few places like Southern California but even more finite than that. You're going to want to live in Santa Monica instead of Pasadena or Huntington Beach instead of Corona or even Yorba Linda.

We see that, as Morgan points out, played in cities with certain neighborhoods having higher prices than others with similar housing stock. People are willing to spend $375k for a pre-WWII house in Linden Hills in Minneapolis ( btw, that's below median price for that neighborhood ) yet a nearly identical house a nearly identical distance from downtown in the same city, MPLS, may only go for $250k in Waite Park or $165 in Victory. Heck In McKinley you may be able to by the same size house for $60k. These neighborhoods have diverging histories especially after WWII.

October 17, 2013, 10:24 amrst1317:

For someone like me who is overly picky about their culture, their music, their beer, the ability to walk or bike to the store, I can live in new 2 bedroom 1,000 sq foot loft in downtown Des Moines or $1,100 / month or 3 schnazy new 3 bdrm in East Village above Zombie Burger for $1,450. I get a quite a few less bands coming through than I would Minneapolis but I still get a few ( I pay some attention to touring bands, especially thianks to modern "hey they're on tour" apps that track this stuff for me ). In fact, sometimes they get shows Minneapolis doesn't ( Black Flag, The London Souls, etc ). I still have pupaserias, ethnic grocery stores, lil' Ecuadoran, Ethiopian and Korean restaurants to eat at. I still have quite a few local craft brews to choose from and nearly all of the same big craft brews that are available in MPLS. I watch all of my fartsy artsy tv shows and movies via the internet these days. But if I want to venture to a theater I do have a couple choices, too. I still have coffee shops within walking distance that roast their own beans or other fancy-pants things like spice shops and cupcake shops.

It's all there. I'm not saying it's 100% the same. But I gain a lot in some things ( same type apt. for 1/2 the cost ) that offset some of the others ( NE MPLS alone - let alone the rest of MPLS - probably has as many choices as Des Moines ).

And if I wasn't such a stuck up prick and hit Wal-Mart for grociers and goods + wanted to eat out at Ruby Tuesdays and PF Changs a couple nights a week, etc, etc. I could have all of that in West Des Moines for $180k for what I'd be paying $300k for in Plymouth. I'd have all those same things that I otherwise do.

October 17, 2013, 10:59 amrst1317:

"clearly, people value living in san francisco more than in houston. you can tell by the massive price difference."

The city of Houston has 2 1/2 times more people living in it than San Francisco. Seems like a whole hell of a lot of people value Houston over San Francisco.

October 17, 2013, 11:04 ammarque2:

I was unfortunate to live in Cedar Rapids, but we went to West Des Moines at least twice a year - went to Costco the Zoo, and the Mall behind Costco in West Des moines. It was like a modern mall you would find in California. Des Moines area has all the features of a decent sized city, but with half the crime and houses that cost 1/3 as much.

Costco just built a store in Coralville, so we would probably go only half as often if we were still there today. But we would still go and my girls would prefer the Amusement park to the Zoo as well.

Now if only we could sell our house in Cedar Rapids and get our money back on it :-) (Its doing OK as a rental)

October 17, 2013, 8:29 pmjimcraq:

I see a way to solve this problem: we have to stop people from moving to those low income states, or even better, get them to move to high income states.

October 18, 2013, 7:39 amskhpcola:

+1, and that doesn't include the deleterious market effects of restrictive land-use policies and stifling regulatory regimes in SF and other blue-state dystopias. Every locale has zoning, but elitist progressives are infamous for using zoning as a class-warfare bludgeon.

October 18, 2013, 10:34 ambigmaq1980:

Thanks for pointing that out.

This post by Coyote was thoughtful and insightful. It is a model that I think would be applicable in many debates we are having in this country.

October 19, 2013, 6:31 pm