Better Measurement of State by State Prosperity

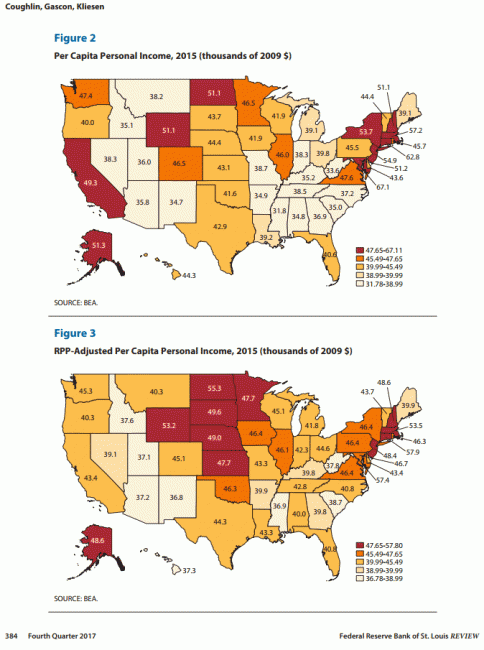

I have always been suspicious of metrics showing that people in, say, San Francisco are way richer than everyone else in the country. Sure, they have a larger number on their paycheck, but they also very likely have a larger number on their mortgage check. In a paper by Cletus C. Coughlin, Charles S. Gascon, and Kevin L. Kliesen, the authors publish this map of state per capita income, both before and after adjusting for local cost of living (Link via a long chain that started at Maggies Farm). As usual click to enlarge.

this is interesting, but also looks incomplete.

it does not appear to take taxes into account. income, sales, and property taxes can really swing affordability. i would bet that in CA, NY, and NJ, they exceed 10% of income.

I wonder what gets lost in these averages. California is in the top group in straight per capita ranking and mid pack in COLA adjusted per capita income rank. At the same time California has the highest poverty rate in the nation using the COLA adjusted income (just over 20%) and if you include near poverty folks also, the number jumps to 40%. In big states that have pockets of exceptionally high income, averages mask a lot of sins.

It'd be interesting to see it broken down by county, or "region" in addition to state. I live in Socal's Inland Empire which is far more affordable for the same income level vs. Silicon Valley or even Orange County / San Diego. For SV, you're paying $10K+/mo in rent for a 3br house if you can find it...

I'm a bit unclear as to the distinction being made. Yes, it adjusts for purchasing power, but aren't San Franciscans' mortgages so high precisely because they're all paid so much and have so much competition for a finite amount of real estate? That is, how would one filter out the chicken-and-the-egg effect there to see how rich they really are?

Isn't that the point? For San Fransiscans, the direction of the causation arrow doesn't matter as much as the fact that they have huge salaries and huge expenses. If I make 1 million a year, I look rich; if my living expenses to be near my job are $900k/yr, I'm not as rich as I look.

I got a job offer in San Diego years ago--could not afford to take it. I note that as housing has gone up in San Fran, blacks have fled the city. My friend in Mississippi has a nice house on several acres for $100,000 and low taxes.

My point, I suppose, is to question what we are trying to measure. They have a huge housing expense, but it's only huge in proportion to average salaries. Proportional to local salaries it's probably going to be more or less about the same ratio as local-salaries-to-housing-quantity everywhere. I suppose we're trying to measure everything else affecting prices besides market forces, such as San Francisco's zoning laws and NIMBYism preventing development, or their rent-control laws. I'm just not sure how well the comparison does it.

I guess I interpreted the adjustment as something simpler, which is that Californians are not as rich as they appear simply based on salaries, because their cost-of-living is much higher. A deeper question is what causes the cost-of-living problem, which may be what you are thinking.

Incidentally, it would be profoundly wrong to say that salaries-to-housing is about the same everywhere. It might be true if you account for the mix of buyers; in the Midwest or South, 75% of people may be able to afford a house but in LA or SF it's closer to 25%. Maybe if you compare the ratio of the top quartile average income to house prices for LA/SF and the average of all incomes to house prices in other places, maybe it would work out?

Well, that sense of salary-to-housing is a matter of what percentage of the housing sale price is the land versus what is the cost of the building. In the South or Midwest the land is likely a very small percentage of the cost of the property. In places like San Francisco, the land-- the location-- is most of it, and it's the cost of the materials, and to a lesser extent the labor, that constitutes the smallest percentage of the cost. That's going to change the dynamic confusingly, and I'm not sure how one would go about correcting for the skew.

Another thing which will mess things up is the extent to which rich people want to live there-- because they're going to be getting a large percentage of their income from investments, which of course don't require physical proximity to any particular place.

So I can afford to have my family live in San Diego, I have to work in Dallas Tx.

http://conversableeconomist.blogspot.com/2017/11/regional-price-parities-comparing-cost.html

The point is a general one. Getting a higher salary in California or New York, and then needing to pay more for housing and perhaps other costs of living as well, can easily eat up that higher salary. In fact, the Bureau of Economic Analysis now calculates Regional Price Parities, which adjust for higher or lower levels of housing, goods, and services across areas. Comparisons are available at the state level, the metropolitan-area level, and for non-metro areas within states.

They're obviously getting value out of those taxes so it's a wash. Maybe even more than they put in! /s

My point is that the higher salary and the high cost of living are related. Higher cost of living doesn't "eat up" the higher salaries, higher salaries cause a higher cost of living due to the greatly increased levels of competition for a limited good, housing. The obvious solution would be to build more housing, but for various reasons, mentioned above, San Francisco won't.

It seems obvious that more units would help. I'm not sure how much though. IMHO affordable housing is what was built 40 years ago. At this point the Bay Area is so far behind demand that I find a hard time imagining housing becoming affordable for another generation, especially for those trying to make a living in the service industry.

As for costs, I think I'm picking up that you may think that all costs are proportional. Is that correct? To some extent they are. The point of the study is that they're not all proportional. Just because you make $200k in Palo Alto doesn't mean that your cost of living is only twice that of Nashville where you may only make $100k.

http://conversableeconomist.blogspot.com/2017/11/regional-price-parities-comparing-cost.html

"Where are the US states color-coded according to per capita GDP with an adjustment for Regional Price Parities: that is, it’s a measure of income adjusted for what it actually costs to buy housing and other goods"

Thanks. I wonder the same thing. I poked around a bit but couldn't find a good breakdown of metro areas that would give some insight into that.

I've heard others point out that California is really 2 states: The wealthy coast + Mississippi.

I think greater costs of living are caused by downward imbalances in the supply of some things, which are restricted by various and sundry external influences, such as the zoning laws or rent-control laws here. True, real estate isn't the only cost, but it bleeds through into other costs. People providing services to SF residents have to live somewhere, after all, and have to be able to pay their rent, so the price charged for their services rises accordingly.

Real estate also seems to me to be the one thing with a strong non-inherent component to its price, which is theoretically unlimited. That's the part that seems connected to how much free cash flow the service provider gets from the job. When the non-inherent component, the desireability of the location, is low in value, because people have little desire to be there for reasons other than proximity to their job, the cost of rent is going to be a lot closer to proportional to the cost of the building, not chiefly to the relatively minor value of the building's land-- that is, its location-- and therefore the arbitrage is available to the service provider to get considerably more for the job than they pay in rent.

To a large extent, housing prices are far more related to zoning than the income of the potential residents. The real estate costs so much in many places is because of the rigmarole that goes along with it. They have to provide so many "affordable" units in their buildings. They have to set aside X% of the property as a "green zone" or other environmentally "friendly" purposes. Environmental and other government mandated actions can be as high as 25% of more of the cost plus add in all the cost of taking years to get built what elsewhere would be done in a few months. In SF itself, they can't build over so many stories tall. Neighbors can nix any changes you want to make on your own property. Rent control is a big driver of housing costs.

https://www.city-journal.org/html/playgrounds-elites-15494.html?utm_source=City+Journal+Update&utm_campaign=a57b472418-EMAIL_CAMPAIGN_2017_11_26&utm_medium=email&utm_term=0_6c08930f2b-a57b472418-109406777

Regulatory policies that seek to limit lower-density housing have led to escalating home prices in areas such as San Francisco, Los Angeles, and Portland. In these areas, housing costs (adjusted for income) are roughly two to three times higher than in places like Dallas, Atlanta, Charlotte, and Raleigh.

Thank you. That's more than well put .

Huh, who'da thunk that California, liberal progressive mecca, would have the WORST income inequality.....

A lot of state taxes do not go to benefit those paying taxes.