When Bad Things Happen to Well-Intentioned Legislation

My Forbes article is up for this week, and discusses 10 reasons why legislation frequently fails. A buffet of Austrian economics, Bastiat, and public choice theory that I wrote for the high school economics class I teach each year.

Here is an example:

3. Overriding Price Signals

The importance of prices is frequently underestimated. Prices are the primary means by which literally billions of people (most of whom will never meet or even know of each others' existence) coordinate their actions, without any top-down planning. With rising oil prices, for example, consumers around the world are telling oil companies: "Go find more!"

For a business person, prices (of raw materials, labor, their products, and competitive products) are his or her primary navigation system, like the compass of an explorer or the GPS of a ship. And just as disaster could well result from corrupting the readings of the explorer's compass while he is trekking across the Amazon, so too economic damage can result from government overriding price signals in the market. Messing with the pricing mechanisms of markets turns the economy into a hall of mirrors that is almost impossible to navigate. For example:

- In the best case, corrupting market prices tends to result in gluts or shortages of individual products. For example, price floors on labor (minimum wages) have created a huge glut of young and unskilled workers unable to find work. On the other side, in the 1970s, caps on oil prices resulted in huge shortages in the US and those famous lines at gas stations. These shortages and gas lines were repeated several times in the 1970's, but never have returned since the price caps were phased out.

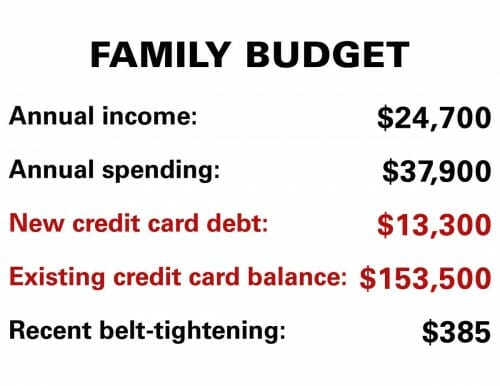

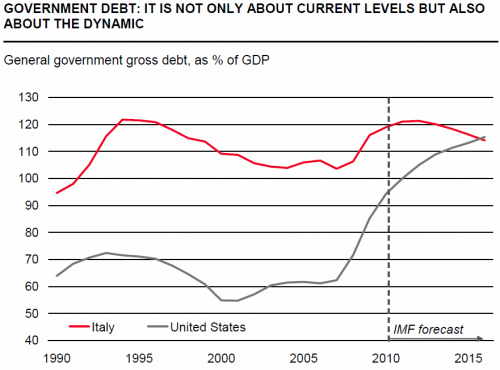

- In the worst case, overriding market price mechanisms can create enormous problems for the entire economy. For example, it is quite likely that the artificially low interest rates promoted by the Federal Reserve over the last decade and higher housing prices driven by a myriad of US laws, organizations, and tax subsidies helped to drive the recent housing and financial bubble and subsequent crash. Many will counter that it was the exuberance of private bankers that drove the bubble, but many bankers were like ship captains who drove their ships onto the rocks because their GPS signal had been altered